The FTSE 100 Index, representing the top 100 companies listed on the London Stock Exchange (LSE), offers a snapshot of the UK’s corporate strength and financial resilience. These companies are not only domestic powerhouses but also global giants shaping industries such as finance, energy, healthcare, and consumer goods.

This blog explores the top 10 FTSE 100 companies in London in 2025 and analyses why they matter from their market impact to their economic footprint in the UK and beyond.

What Is the FTSE 100 Index in London-Based Corporations?

Understanding the Index

The FTSE 100 Index, established in 1984, tracks the performance of the 100 largest companies listed on the LSE by market capitalisation. It acts as a barometer for the overall health of the UK economy and signals investor sentiment toward British corporations.

Role in Financial Markets

For investors, the FTSE 100 serves as a benchmark for UK equity performance. For companies, being included in the index signals market prestige, liquidity, and investor trust. Institutions and funds often track the index, making its movements closely tied to the fortunes of global markets.What Makes These British Multinational Companies Stand Out?

Emphasis on Innovation

Many of the FTSE 100 leaders invest significantly in research and development. AstraZeneca and GSK have transformed patient care with pharmaceutical breakthroughs, while RELX pioneers data science solutions across various sectors.

Global Market Penetration

Unilever, HSBC, and Diageo generate a significant portion of their revenue outside the UK, demonstrating their ability to scale internationally while maintaining a strong base in London.

Sustainability and ESG Initiatives

Shell, BP, and Unilever are among the firms integrating Environmental, Social, and Governance (ESG) practices into their long-term strategies. Their efforts to reduce emissions, improve governance, and support ethical practices enhance their appeal to modern investors.

Which Are the Top 10 FTSE 100 Companies in London?

1. Shell plc – “Powering Progress Through Energy Transformation”

Shell plc consistently holds a top-tier position in the FTSE 100, reflecting its broad global footprint and evolving energy portfolio. Founded in 1907 and headquartered in London, Shell has evolved from a traditional oil and gas corporation into a global energy group focused on clean and sustainable technologies.

With operations spanning more than 70 nations, Shell manages a fully integrated energy supply chain, from resource extraction to end-user distribution. In recent years, the company has aggressively invested in renewable energy, including offshore wind farms, hydrogen, and electric vehicle (EV) charging networks.

Its long-term vision to become a net-zero emissions business by 2050 is already underway, with substantial progress visible in Europe and Asia. Shell is seen as a hybrid energy leader: balancing profitability in hydrocarbons while building the future of energy.

Focus Area

Championing clean energy and environmental transition

Ideal For

Investors seeking sustainable energy portfolios with legacy market strength

- Website: www.shell.com

- Phone: +44 20 7934 1234

- Address: Shell Centre, London SE1 7NA, UK

- Email: info@shell.com

Review: ★★★★☆

“Shell’s renewable push feels both strategic and sincere they’re evolving with the times.”

2. AstraZeneca plc – “Innovating Life-Changing Medicines”

AstraZeneca has solidified its position as one of the most valuable pharmaceutical companies in the world, with a core base in Cambridge and a major footprint in London.

The company specialises in treatments for oncology, cardiovascular diseases, respiratory conditions, and immunology. AstraZeneca is known for fast-tracking innovation from its COVID-19 vaccine to its breakthrough cancer immunotherapies. In 2025, the company is running over 160 clinical trials across multiple continents, many in partnership with cutting-edge biotech firms.

With a strong R&D pipeline and a commitment to equitable access to healthcare, AstraZeneca exemplifies how pharmaceutical innovation can be commercially viable and socially impactful.

Core Expertise

Revolutionising treatment through advanced biopharmaceutical innovation

Recommended For

Ethical and long-term healthcare-focused investors

- Website: www.astrazeneca.com

- Phone: +44 20 3749 5000

- Address: 1 Francis Crick Ave, Cambridge CB2 0AA, UK

- Email: info@astrazeneca.com

Review: ★★★★★

“AstraZeneca keeps breaking new ground in medical science definitely a top pick for anyone serious about biotech.”

3. HSBC Holdings plc – “Banking for a Changing World”

With its global headquarters in Canary Wharf, London, HSBC stands out as one of the most globally integrated banking institutions in the world. Serving over 40 million customers, the bank operates in retail banking, investment services, wealth management, and corporate finance.

HSBC has pivoted strongly toward digitalisation, offering AI-powered financial tools and mobile-first banking services. It’s also a global leader in green finance, committing billions toward low-carbon projects.

The bank has increasingly focused its strategic growth on Asia-Pacific markets, especially China and Singapore, while retaining a strong operational presence in the UK. In 2025, HSBC is considered a reliable yet innovative financial institution that continues to deliver under economic uncertainty.

Area of Excellence

Integrating sustainable banking with cross-border services

Best Suited For

Global clients, institutional investors, and ESG-focused portfolios

- Website: www.hsbc.com

- Phone: +44 20 7991 8888

- Address: 8 Canada Square, London E14 5HQ, UK

- Email: contact@hsbc.co.uk

Review: ★★★★☆

“Great global access and ESG commitment though traditional, HSBC remains forward-thinking.”

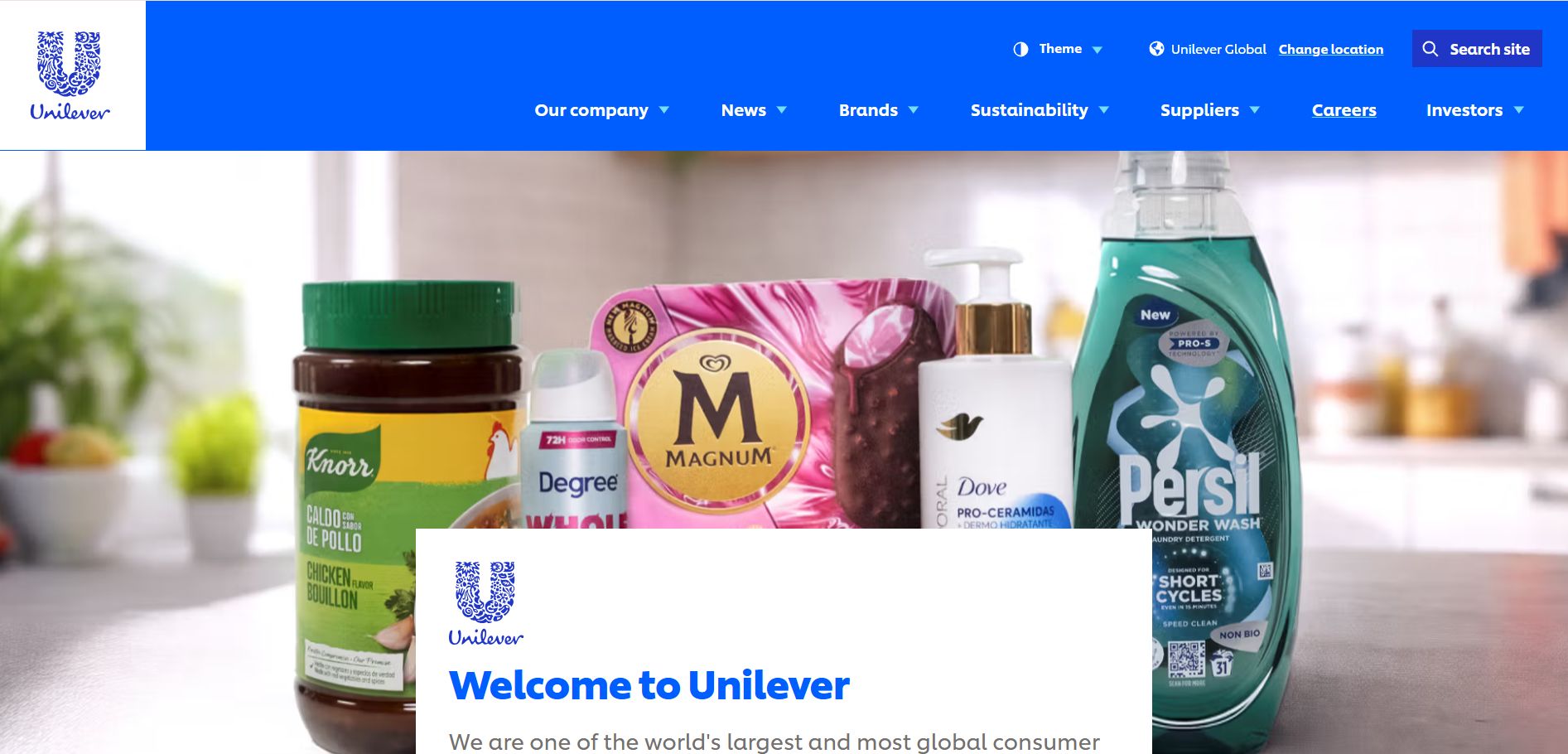

4. Unilever plc – “Everyday Brands for Every Home”

Unilever is a true consumer goods titan, owning over 400 well-known brands sold in more than 190 countries. Headquartered in London, Unilever produces everything from personal care and household products to food and beverages.

Some of its most iconic and best-selling brands include Dove, Ben & Jerry’s, Lifebuoy, and Hellmann’s, reaching millions of households globally. In 2025, Unilever is focusing heavily on sustainable packaging, plant-based ingredients, and net-zero emissions across supply chains.

The company is also enhancing digital marketing strategies and e-commerce reach to meet evolving consumer behaviours. Thanks to its resilience, consistent revenue, and ESG leadership, Unilever is one of the most reliable and socially conscious choices on the FTSE 100.

Notable Strength

Purpose-led innovation in fast-moving consumer goods

Recommended For

Investors seeking a stable, globally diversified portfolio with ethical appeal

- Website: www.unilever.com

- Phone: +44 20 7822 5252

- Address: 100 Victoria Embankment, London EC4Y 0DY, UK

- Email: corporate.enquiries@unilever.com

Review: ★★★★★

“Unilever’s mission-driven products feel good to use and even better to invest in.”

5. BP plc – “Reimagining Energy for People and Planet”

BP is transforming from one of the largest fossil fuel firms into a modern energy solutions provider. Based in London, BP has been shedding oil assets and increasing investment in renewable energy, including wind, solar, and bioenergy.

In 2025, the company is a key player in global hydrogen infrastructure and EV charging rollouts. Its net-zero roadmap aims to cut operational emissions and promote greener cities. BP’s balance between providing returns and reimagining energy markets has made it a top FTSE performer with renewed investor confidence.

Primary Focus

Driving innovation in clean energy and carbon neutrality

Ideal Investment For

Those balancing legacy energy exposure with future-focused growth

- Website: www.bp.com

- Phone: +44 20 7496 4000

- Address: 1 St James’s Square, London SW1Y 4PD, UK

- Email: corporateinfo@bp.com

Review: ★★★★☆

“BP’s vision for a cleaner world is refreshing it’s no longer just oil.”

6. GSK plc – “Science-Led Global Healthcare”

GSK, with its headquarters in Brentford, London, has repositioned itself as a science-first healthcare company. With a focus on vaccines, specialty medicines, and infectious disease treatments, GSK continues to grow its pharmaceutical pipeline.

In 2025, the company is spearheading innovations in mRNA technology, immune therapies, and antibiotic resistance. GSK’s spin-off of its consumer health unit Haleon has allowed it to double down on its pharma division, resulting in more targeted investments and higher revenue growth. The firm’s work with global health organisations also enhances its humanitarian appeal.

Key Expertise

Innovative pharmaceuticals and public health breakthroughs

Good For

Investors wanting exposure to resilient healthcare firms with ethical impact

- Website: www.gsk.com

- Phone: +44 20 8047 5000

- Address: 980 Great West Rd, Brentford TW8 9GS, UK

- Email: generalenquiries@gsk.com

Review: ★★★★☆

“Steady, science-backed, and socially impactful GSK keeps climbing steadily.”

7. Diageo plc – “Celebrating Life, Every Day, Everywhere”

Diageo is the UK’s leading premium alcohol company with an extensive global portfolio. Headquartered in London, the firm produces renowned brands such as Johnnie Walker, Guinness, and Baileys. In 2025, Diageo is focusing on premiumisation, digital-first sales strategies, and market expansion across Asia and Africa.

The company has also embraced low-alcohol and zero-proof product lines to meet growing wellness trends. Its strong brand equity, marketing strength, and commitment to water conservation and responsible drinking make it an exceptional performer in the consumer discretionary sector.

Market Edge

Global leader in high-end spirits and digital beverage experiences

Ideal For

Those seeking stable dividend growth and luxury brand value

- Website: www.diageo.com

- Phone: +44 20 8978 6000

- Address: 16 Great Marlborough St, London W1F 7HS, UK

- Email: info@diageo.com

Review: ★★★★★

“Iconic brands, strong returns, and a future-proof portfolio Diageo delivers.”

8. Rio Tinto plc – “Essential Materials for Human Progress”

Rio Tinto, a dual-listed mining group, is one of the largest producers of essential minerals globally. With headquarters in London and Melbourne, it supplies aluminium, iron ore, copper, and lithium critical materials for construction and green technologies. In 2025, Rio Tinto is heavily investing in sustainable mining practices, such as electric haul trucks and biodiversity projects.

Rio Tinto has deepened its collaboration with Indigenous communities and enhanced its commitment to sourcing materials ethically and transparently. Despite industry challenges, Rio Tinto maintains strong margins and is well-positioned for the shift toward renewable-powered infrastructure.

Industry Niche

Ethical sourcing and green mining innovation

Perfect For

Commodities-focused portfolios with ESG filters

- Website: www.riotinto.com

- Phone: +44 20 7781 2000

- Address: 6 St James’s Square, London SW1Y 4AD, UK

- Email: enquiries@riotinto.com

Review: ★★★★☆

“Heavy industry with a conscience Rio Tinto is evolving with responsibility.”

9. British American Tobacco plc – “A Better Tomorrow™”

British American Tobacco is globally known as a major force in the tobacco industry, with a reputation that spans decades. Headquartered in London, the company has shifted towards “reduced-risk products,” investing in heated tobacco, e-cigarettes (Vuse), and oral nicotine pouches.

In 2025, its R&D division is working on synthetic nicotine and alternatives to traditional cigarettes. BAT continues to be a dividend powerhouse, offering reliable income to shareholders despite global tobacco restrictions. The company’s future hinges on its ability to innovate responsibly and transition consumer behaviour toward less harmful alternatives.

Specialty Area

Next-gen nicotine technologies and smoke-free transitions

Best Fit For

High-yield portfolios prepared for regulatory changes

- Website: www.bat.com

- Phone: +44 20 7845 1000

- Address: Globe House, 4 Temple Place, London WC2R 2PG, UK

- Email: info@bat.com

Review: ★★★☆☆

“A reliable income stock in a controversial space BAT is navigating its pivot carefully.”

10. RELX plc – “Advancing Knowledge Through Analytics”

RELX operates as a key player in data and analytics, quietly driving progress across legal, scientific, and healthcare industries within the FTSE 100 landscape. Based in London, the company serves law firms, scientific researchers, and medical institutions through products like LexisNexis and Elsevier.

RELX’s core strength lies in data integration, AI-based search tools, and a subscription-based model that ensures recurring revenue. In 2025, it is expanding its cybersecurity analytics offerings and legal tech platforms, enabling smarter decisions across sectors. Though not a household name, RELX is a consistent, tech-savvy growth stock.

Core Strength

Smart data analytics and legal-tech innovation

Great For

Tech-focused investors seeking recurring revenue stability

- Website: www.relx.com

- Phone: +44 20 7166 5500

- Address: 1-3 Strand, London WC2N 5JR, UK

- Email: contact@relx.com

Review: ★★★★☆

“Understated but vital RELX is a hidden gem for data-savvy investors.”

How Do These FTSE 100 Companies Impact the UK Economy?

Contribution to Employment

These companies employ hundreds of thousands across the UK, supporting both urban centres and regional economies. Their hiring spans technical, administrative, and leadership roles.

Influence on GDP and Trade

The combined output of these firms contributes significantly to UK GDP. Many are also leading exporters, particularly in sectors such as pharmaceuticals, mining, and consumer goods.

Attracting Foreign Investment

Their global footprint and listing on the LSE attract international capital inflows, strengthening the UK’s position as a global financial hub.

What Sectors Dominate Among the Top 10 FTSE 100 Firms?

The following table shows the sectors represented by the top 10 FTSE 100 companies in July 2025:

| Sector | Represented Companies |

| Energy | Shell, BP |

| Pharmaceuticals | AstraZeneca, GSK |

| Financial Services | HSBC |

| Consumer Goods | Unilever, Diageo |

| Mining | Rio Tinto |

| Tobacco | British American Tobacco |

| Information | RELX |

Sectoral Strength

This diversity of sectors reflects a balanced index, where energy, healthcare, and consumer industries take the lead. The rise of digital and data-driven firms like RELX signals an ongoing shift toward technology-focused business models.

Are These Top Performing UK Stocks a Good Investment in 2025?

Long-Term Investment Potential

FTSE 100 leaders like Shell, Diageo, and AstraZeneca continue to offer strong dividend returns, making them attractive to income-focused investors. Their broad market exposure and strategic adaptability also help mitigate risks.

Current Market Sentiment

Investor sentiment in 2025 remains cautiously optimistic. While inflation and global market volatility present challenges, most top FTSE 100 companies are demonstrating resilience and growth.

What Challenges Are These Leading UK Businesses Facing?

Regulatory and ESG Pressures

Companies face increasing pressure from regulators and stakeholders to demonstrate transparency, ethical behaviour, and environmental stewardship. Compliance has become both a risk and a growth opportunity.

Technological Disruption

Traditional industries like mining and oil must continuously modernise operations using AI, automation, and data analytics. Failure to innovate could result in losing competitive advantage.

Economic and Political Uncertainty

Factors such as Brexit aftershocks, shifting trade alliances, and geopolitical tensions continue to influence currency value, labour movement, and overall business confidence.

What Is the Future Outlook for FTSE 100 Companies in London?

Embracing Green Growth

Energy firms like BP and Shell are investing billions into clean energy as they move toward net-zero goals. This pivot is likely to reshape the energy sector by 2030.

Digital Transformation

Companies across sectors from RELX to HSBC are adopting Artificial Intelligence and big data to streamline services, enhance customer experience, and improve operational efficiency.

Resilient and Global-Ready

FTSE 100 firms are increasingly diversified, digitised, and resilient to market shocks. Their global presence ensures access to new markets, even as domestic growth stabilises.

Conclusion

The top 10 FTSE 100 companies in London represent the peak of British corporate excellence. With diversified operations, strong market capitalisations, and an ongoing commitment to innovation and sustainability, these companies continue to define the UK’s financial and industrial landscape.

As we look ahead, the FTSE 100’s leading firms are well-positioned to tackle economic uncertainty, embrace technological advancements, and lead on the global stage.

FAQs About FTSE 100 Companies in London

What is the difference between FTSE 100 and FTSE 250?

The FTSE 100 includes the largest 100 companies on the LSE, while the FTSE 250 covers the next 250, offering more exposure to mid-sized UK businesses.

Do FTSE 100 companies always stay in the index?

No, the index is reviewed quarterly, and companies can be replaced based on changes in market capitalisation.

How often is the FTSE 100 reviewed?

It is reviewed every three months to ensure the top 100 companies are accurately represented based on market value.

Can retail investors invest in FTSE 100 firms?

Yes, through direct stock purchases, exchange-traded funds (ETFs), or index funds that mirror the FTSE 100’s performance.

Which sectors contribute most to FTSE 100 performance?

Energy, pharmaceuticals, and financial services are currently the most dominant sectors among the top 10 firms.

What is the dividend yield for FTSE 100 companies?

Dividend yields vary, but companies like Shell, BAT, and Diageo have traditionally offered high and stable dividends.

Are FTSE 100 companies affected by global events?

Yes, global market trends, geopolitical shifts, and international regulations all influence the performance of these multinational firms.