The financial landscape in London has undergone a transformative shift in the last decade. No longer solely dominated by traditional banking institutions, the city has embraced a new era of financial technology, positioning itself at the forefront of global fintech innovation.

With its unique blend of financial heritage, regulatory support, and technological advancement, London has become a world-leading fintech hub, drawing investment, talent, and ambitious startups from across the globe.

From mobile banking and digital wallets to AI-powered investment platforms and open banking APIs, fintech companies in London are redefining how individuals and businesses manage their finances.

These companies are not just reshaping financial services; they are setting new standards in accessibility, efficiency, and customer experience.

This article explores the top 10 fintech companies in London in 2025, shedding light on the innovative firms leading the charge. Whether you’re an investor, entrepreneur, or tech enthusiast, understanding who these players are and what they offer is key to grasping the future of finance in one of the world’s most dynamic cities.

Why Is London a Global Hub for Fintech Companies?

London’s global status as a financial powerhouse didn’t happen overnight. It is the result of a blend of factors that have made the city a magnet for fintech growth.

To begin with, the regulatory environment is welcoming yet robust. The Financial Conduct Authority (FCA) and initiatives such as the Regulatory Sandbox allow startups to test innovations in a controlled setting. This flexibility encourages startups to experiment and scale quickly.

Then there’s the city’s strategic position as a gateway between the US and European markets. Its time zone, multicultural talent pool, and deep capital markets make it ideal for fintech operations that require international reach.

In addition, major global financial institutions are headquartered in London. This proximity to legacy financial systems enables collaboration and innovation. It’s no surprise then that London continues to lead the pack in Europe’s fintech race.

What Makes a Fintech Company Stand Out in London?

In a bustling ecosystem like London, differentiation is key. The top fintech companies distinguish themselves through innovation, scalability, customer satisfaction, and regulatory adherence.

These firms often provide simplified and user-friendly financial services, whether it’s through digital-only banking, faster payment systems, or AI-powered investment platforms. Customer experience remains at the core of what they offer.

Moreover, scalability is a sign of long-term success. Startups that manage to scale their operations across borders, languages, and regulations earn a place among the most respected in the industry.

The ability to secure funding is another crucial factor. Many top firms attract substantial Series A to Series D rounds, showcasing their potential to disrupt financial markets.

Lastly, companies that invest in data security and compliance win user trust an invaluable asset in the financial technology space.

Which Are the Top 10 Fintech Companies in London in 2025?

1. Revolut – “Finance Reimagined in a Single App”

Revolut has transformed from a simple currency exchange tool into a comprehensive global financial platform. With over 30 million users in 2025, it offers personal and business accounts, international transfers, crypto trading, stock investing, and even travel insurance all from a single app.

Revolut’s seamless UI and rapid feature rollouts have made it a go-to digital finance solution for a tech-savvy generation. The platform also integrates budgeting, spending analytics, and vault savings features, making it a powerful all-in-one digital banking alternative.

Primary Focus

Multi-service digital banking platform with global capabilities.

Ideal For

Frequent travellers, digital nomads, and users seeking financial flexibility.

Pricing: Free basic plan; Paid plans from £3.99/month to £45/month

- Website: www.revolut.com

- Phone: +44 20 3322 8352

- Address: 7 Westferry Circus, London E14 4HD

- Email: support@revolut.com

Review: ★★★★☆

“Best financial tool for travelling and saving across currencies. Took care of all my global transfers seamlessly.”

2. Monzo – “Banking Made Human”

Monzo is one of the UK’s most beloved digital-only banks, renowned for its customer-first approach and clean app interface. It offers everything from current accounts and overdrafts to joint accounts and savings pots.

Users love its instant spending notifications, monthly insights, and fee-free usage abroad. Monzo also supports business accounts and is continually expanding into lending and investment products. With transparency at its core, Monzo is redefining the relationship between banks and customers.

Speciality Area

Transparent mobile banking for everyday users.

Best Suited To

Young professionals and digital-first customers.

Pricing: Free basic account; Plus £5/month; Premium £15/month

- Website: www.monzo.com

- Phone: +44 20 3872 0620

- Address: Broadwalk House, 5 Appold St, London EC2A 2AG

- Email: help@monzo.com

Review: ★★★★★

“Monzo helped me budget like never before. The app is clear, friendly, and way ahead of traditional banks.”

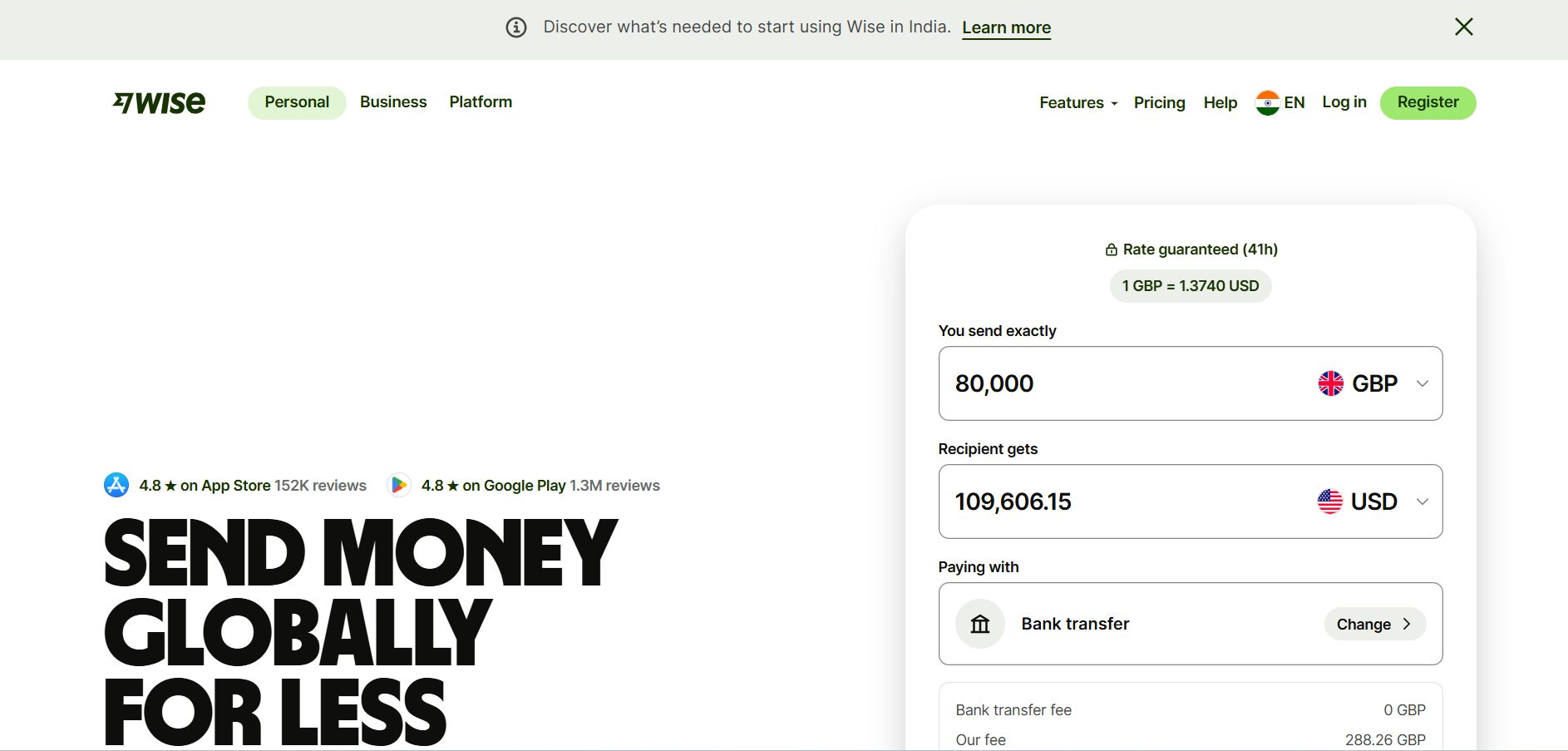

3. Wise – “Money Without Borders”

Formerly TransferWise, Wise remains the top choice for international money transfers. It’s known for its transparent fees, mid-market exchange rates, and speed. Wise Business supports invoicing, batch payments, and multi-currency accounts. Their borderless account lets users hold and convert 50+ currencies instantly.

It’s perfect for freelancers, global businesses, and anyone regularly sending money abroad. With its focus on simplicity and fairness, Wise continues to dominate cross-border payments.

Key Strength

Efficient global money transfer and multi-currency management.

Recommended For

Freelancers, expats, and small international businesses.

Pricing: Pay per transaction – 0.35% to 1.5% depending on route

- Website: www.wise.com

- Phone: +44 20 3966 0999

- Address: Tea Building, 56 Shoreditch High St, London E1 6JJ

- Email: support@wise.com

Review: ★★★★☆

“I’ve saved hundreds compared to bank transfers. Fast, fair, and reliable every time I send money.”

4. Starling Bank – “A Bank Built for the Digital Age”

Starling Bank is a full-fledged UK bank offering award-winning mobile banking. Its personal and business accounts come with features like real-time notifications, budgeting tools, and interest-bearing current accounts.

Starling is known for its strong financial products, including overdrafts, loans, and joint accounts. It’s also one of the few fintechs with a full UK banking licence, ensuring FSCS protection. With superior customer service and a clean UX, Starling is a top challenger bank.

Core Feature

Full-service mobile banking with a traditional banking licence.

Perfect For

SMEs and users wanting modern features with full UK regulation.

Pricing: Free for personal and business accounts

- Website: www.starlingbank.com

- Phone: +44 20 7930 4450

- Address: 2 Finsbury Avenue, London EC2M 2PP

- Email: help@starlingbank.com

Review: ★★★★★

“Starling makes my personal and business finances effortless. Customer service is responsive and top-notch.”

5. OakNorth – “Smarter Lending for the Real Economy”

OakNorth specialises in data-driven business lending for SMEs that are often overlooked by traditional banks. It uses advanced credit models to offer customised loans faster and with more flexibility. The platform’s analytical edge comes from its proprietary OS, which assesses borrower risk with precision.

OakNorth is bridging a vital gap in the UK’s business financing ecosystem and has built a strong reputation among entrepreneurs and mid-sized firms.

Distinctive Edge

Smart lending tech tailored for growing businesses.

Targeted Users

Scale-ups and SMEs seeking growth capital.

Pricing: Custom quotes per loan; rates vary

- Website: www.oaknorth.com

- Phone: +44 20 8012 2000

- Address: 57 Broadwick St, Soho, London W1F 9QS

- Email: contact@oaknorth.com

Review: ★★★★☆

“OakNorth believed in our business when no one else would. The funding process was smart and fast.”

6. Zopa – “Better Borrowing, Smarter Saving”

Zopa started as a peer-to-peer lending pioneer and has now evolved into a fully regulated digital bank. It offers personal loans, credit cards, and high-yield savings accounts, all powered by intelligent data use.

Zopa’s platform appeals to users who want more from their money with fewer hoops to jump through. Its credit card offers features like real-time tracking, repayment suggestions, and flexible borrowing options.

Unique Proposition

Modern banking with a credit-focused foundation.

Most Useful For

Borrowers and savers looking for value and clarity.

Pricing: Varies by loan/product; Credit card has no annual fee

- Website: www.zopa.com

- Phone: +44 20 7580 6060

- Address: Cottons Centre, Tooley St, London SE1 2QG

- Email: contactus@zopa.com

Review: ★★★★☆

“The Zopa credit card helped me rebuild my score while earning cashback. Easy to manage and reliable.”

7. Checkout.com – “Powering Payments for the World”

Checkout.com is one of London’s top fintech unicorns, offering advanced payment processing solutions for businesses. Its platform supports global transactions with high success rates, fraud prevention, and robust APIs.

Used by brands like Netflix and Farfetch, Checkout.com helps enterprise clients handle multi-currency and high-volume payment flows. Its real-time data and modular system make it a flexible solution for global commerce.

Niche Focus

Enterprise-grade digital payment infrastructure.

Optimised For

Large-scale eCommerce and SaaS platforms.

Pricing: Custom quotes based on business volume

- Website: www.checkout.com

- Phone: +44 20 3514 2888

- Address: Wenlock Works, 1A Shepherdess Walk, London N1 7QE

- Email: sales@checkout.com

Review: ★★★★★

“As a SaaS business, our payment flow improved drastically with Checkout. Analytics and uptime are excellent.”

8. Curve – “All Your Cards in One Smart Wallet”

Curve simplifies financial life by combining all your debit and credit cards into one card and app. Users can switch the payment source even after a transaction with the “Go Back in Time” feature.

Curve also offers cashback, real-time insights, and travel benefits. It’s a favourite among users managing multiple accounts or currencies. Its sleek design and fintech ingenuity make it one of the most innovative card platforms in the UK.

Main Offering

Unified financial control with innovative card technology.

Best Matched For

Tech-savvy spenders and cashback hunters.

Pricing: Free plan; Curve X £4.99/month; Curve Black £9.99/month

- Website: www.curve.com

- Phone: +44 20 3966 4879

- Address: 15-19 Bloomsbury Way, London WC1A 2BA

- Email: support@curve.com

Review: ★★★★☆

“Curve made my wallet obsolete. It’s smarter, safer, and surprisingly fun to use.”

9. PrimaryBid – “Giving Retail Investors a Fair Share”

PrimaryBid opens the door for retail investors to participate in IPOs and public company share issues. This fintech is bringing democratisation to capital markets, allowing individual investors to access the same opportunities as institutions.

It has partnered with the London Stock Exchange and several FTSE companies to offer easy-to-use digital share access with transparent pricing.

Primary Benefit

Equity access for everyday investors in capital markets.

Best Audience

Retail investors looking for pre-market opportunities.

Pricing: Free to use; No commission on investments

- Website: www.primarybid.com

- Phone: +44 20 3026 4750

- Address: 21 Grosvenor Pl, London SW1X 7HF

- Email: contact@primarybid.com

Review: ★★★★☆

“Finally, an app that gives retail investors a real shot at IPOs. Simple and no hidden fees.”

10. Thought Machine – “Modern Banking from the Inside Out”

Thought Machine is a deep-tech fintech company developing next-gen core banking systems. Its cloud-native platform, Vault, enables banks to launch flexible and scalable digital financial products.

Instead of patching old infrastructure, Thought Machine helps banks rebuild from scratch with automation, smart contracts, and custom product logic. It’s used by global giants including Lloyds Bank and Standard Chartered.

Technical Prowess

Next-gen infrastructure for legacy banking systems.

Industry Fit

Traditional banks and financial institutions undergoing digital transformation.

Pricing: Enterprise pricing on request

- Website: www.thoughtmachine.net

- Phone: +44 20 8132 8130

- Address: 1-3 Worship St, London EC2A 2AB

- Email: info@thoughtmachine.net

Review: ★★★★★

“A true tech company in finance—Vault has completely transformed our bank’s product speed and capability.”

How Do Fintech Startups Differ from Traditional Banks?

Fintech startups are inherently more agile and customer-focused than traditional financial institutions. They operate with lighter infrastructure, which means fewer overhead costs and faster decision-making.

Whereas legacy banks often rely on outdated core banking systems, fintechs use cloud-native platforms, open banking APIs, and AI for more personalised services. The result is quicker product rollouts and better customer satisfaction.

Traditional banks, on the other hand, are bogged down by bureaucracy and legacy compliance frameworks, making change a slow process. Fintechs challenge that model by offering what banks can’t: speed, innovation, and simplicity.

How Do Fintech Companies Secure Customer Data?

Customer trust hinges on data security. Fintech firms in London adhere to stringent FCA and GDPR regulations, ensuring customer data is securely handled.

They often implement the following:

- Two-Factor Authentication (2FA) for user access

- End-to-End Encryption on transactions

- Real-time fraud monitoring systems

- Secure cloud hosting with high redundancy

The use of biometric login, zero-knowledge proofs, and blockchain is also growing in sophistication, especially among leading companies like Revolut and Starling Bank.

What Are the Most Common Business Models for Fintech Companies?

Fintechs in London typically operate on one or a combination of the following models:

| Business Model | Description | Examples |

| Freemium | Basic services are free; users pay for premium features | Revolut, Monzo |

| Transaction-Based | Charges are levied per transaction | Wise, Checkout.com |

| Subscription Model | Users pay a recurring fee for access to tools | Zopa, Curve |

| Lending & Interest | Earnings from lending money with interest | OakNorth, Zopa |

| B2B SaaS | Banks and businesses pay for backend platforms | Thought Machine |

These models provide both stability and flexibility in revenue generation, depending on customer needs and market shifts.

What Fintech Services Are Popular Among Londoners?

In a fast-paced city like London, convenience is king. The most in-demand services include:

- Mobile banking apps with real-time spending notifications

- Low-cost international money transfers

- Automated budgeting and saving tools

- Cryptocurrency trading platforms

- Instant loan approvals

Digital natives and younger professionals appreciate the accessibility and flexibility of these solutions, often integrating multiple fintech apps into their daily financial lives.

What Are the Key Trends Shaping London’s Fintech Scene in 2025?

Fintech is a constantly evolving industry, and 2025 has already introduced several important trends:

- Embedded Finance: Non-financial brands are offering financial services through fintech APIs.

- Green Fintech: Companies are aligning products with sustainability goals.

- Decentralised Finance (DeFi): Although still emerging, London is seeing more startups enter this space.

- AI-Driven Credit Scoring: Algorithms now assess creditworthiness more fairly and efficiently.

- Hyper-Personalisation: Leveraging AI and big data for uniquely tailored financial solutions.

These trends not only shape innovation but also draw more funding and international attention to London’s thriving ecosystem.

How Accessible Are Fintech Services to the Public?

One of the defining goals of fintech is financial inclusion. London-based fintechs are creating tools that make banking more accessible for all, including:

- People with no prior credit history

- Gig economy workers

- Students and first-time savers

- Those without fixed addresses or identification

Digital-only platforms remove the need for in-person visits and paperwork, reducing barriers traditionally present in banking.

What Role Does the UK Government Play in Supporting Fintech Growth?

The UK government actively champions fintech growth through policy support, grants, and initiatives. The Kalifa Review laid down a comprehensive roadmap that’s now being executed to improve access to capital, talent, and international markets.

Organisations like Innovate Finance, Tech Nation, and UK Export Finance help London-based fintechs scale globally. The recent creation of fintech “clusters” around universities also aids regional development.

The UK’s ambition is clear: to make London not just Europe’s, but the world’s fintech capital.

Conclusion

Fintech companies in London are not only shaping the future of finance they’re redefining what financial empowerment looks like.

They bring transparency, accessibility, and innovation to a sector that has long been monopolised by legacy institutions. With the ability to pivot quickly and focus on customer needs, these companies are setting global benchmarks.

Whether you’re a startup enthusiast, an investor, or someone looking for smarter financial tools, London’s fintech leaders offer insights, opportunities, and services that are simply too important to ignore.

FAQs About Fintech Companies in London

How do fintech companies get licensed in the UK?

They must register with the Financial Conduct Authority (FCA) and may need additional approvals based on services offered.

Are London-based fintechs safe for business banking?

Yes, several fintechs like Starling and Monzo offer regulated business accounts with FSCS protection up to £85,000.

Can I use multiple fintech services at once?

Absolutely. Many users combine services from different fintechs for budgeting, investing, and business payments.

Do fintech firms in London offer credit or loans?

Yes, companies like Zopa and OakNorth specialise in digital lending and offer personal and business loans.

How do fintechs help with international business?

Platforms like Wise and Checkout.com simplify cross-border payments and multi-currency operations.

What industries benefit most from fintech?

eCommerce, retail, healthcare, education, and SMEs benefit the most from fintech’s agility and innovation.

Are fintechs replacing traditional banks?

Not entirely. Many collaborate with banks, offering tech solutions while banks provide licenses and compliance frameworks.