With London property values among the highest in the UK, securing your home with reliable insurance is not just a smart move. it’s essential. Home insurance provides financial protection for both the structure of your home and the belongings inside it.

Whether you’re living in a converted flat in Kensington or a semi-detached house in Croydon, having the right homeowner insurance can be the difference between peace of mind and financial uncertainty. This article outlines the best-rated homeowner insurance companies in London, offering insight into what makes them stand out and how to choose the right policy for your needs.

What Makes a Home Insurance Provider Stand Out in London?

Choosing the right insurance provider requires more than just comparing prices. In a diverse and high-risk city like London, it’s vital to understand what separates top-tier insurers from the rest.

Reliable Customer Service

In the event of an emergency be it flooding, theft, or accidental damage the last thing a homeowner needs is poor customer support. A standout provider offers clear, efficient communication channels, including 24/7 claims assistance and dedicated helplines. Customer reviews often highlight how a company responds under pressure, making service quality a key differentiator.

Comprehensive Coverage Packages

A reputable insurer provides a well-rounded package that includes buildings and contents cover as a minimum. Many of London’s leading providers go further by offering optional extras such as accidental damage, home emergency assistance, and legal cover. Flexibility to customise these elements makes policies more tailored to individual homeowner needs.

Transparent and Fair Pricing

Competitive premiums are important, but the overall value of the policy depends on clear terms and fair excess fees. Trustworthy providers are upfront about exclusions and limits, reducing the risk of unpleasant surprises when making a claim. Top insurers balance cost with coverage quality, ensuring clients pay only for what they need.

Why Is Comparing Insurance Providers Crucial for Londoners?

The wide range of housing styles and varying neighbourhood risks in London means a one-size-fits-all insurance policy doesn’t exist. Comparing multiple providers gives homeowners the best shot at a policy that fits both their property and budget.

Policy Flexibility Across Providers

One insurer may focus on high-value properties, while another specialises in affordable coverage for flats or first-time buyers. By comparing quotes, Londoners can find a provider whose coverage matches their exact property profile and lifestyle.

Price Variability Based on Location

From Westminster to Walthamstow, London postcodes affect insurance rates significantly. Providers assess crime rates, flood risk, and building age, making premium comparisons vital for understanding where value lies.

Access to Special Offers and Bundles

Some insurers reward loyalty or provide incentives such as multi-policy discounts when bundling with car insurance. Comparing providers can uncover these hidden perks, often resulting in notable savings over time.

What are the Top 10 Homeowner Insurance Companies in London?

1. Aviva – “Home Insurance that Grows With You”

Aviva stands out as one of the UK’s most established and trusted insurance providers, offering a strong presence both online and in-person. Their home insurance policies are flexible and cater to a wide variety of needs from basic contents protection to extensive buildings and accidental damage cover.

Londoners particularly appreciate Aviva’s digital convenience: everything from quotes to claims can be managed through their sleek mobile app. The company also offers generous discounts for bundling policies, making it an attractive option for those who already insure vehicles or travel with Aviva.

In terms of coverage, they’re known for not only protecting property but also valuables such as jewellery, electronics, and art. Their services cater to both homeowners and landlords, making Aviva a versatile player in the insurance market.

Coverage Focus

Comprehensive cover including high-value items, alternative accommodation, and flood protection.

Ideal Choice For

Digitally inclined homeowners who want a reliable, all-inclusive insurance provider.

Pricing: Starting from £150/year (based on average buildings and contents cover)

- Website: www.aviva.co.uk

- Phone: 0345 030 7078

- Address: St Helen’s, 1 Undershaft, London EC3P 3DQ

- Email: contactus@aviva.com

Review: ★★★★☆ “Aviva made my claim process seamless after a burst pipe incident. Their app was incredibly helpful.”

2. Direct Line – “Cutting Out the Middleman”

Direct Line has built its reputation by doing just that eliminating brokers and connecting directly with customers. This allows the company to keep its prices competitive without compromising on coverage quality.

Its home insurance offerings are straightforward, with clearly defined terms and minimal fine print. Direct Line policies include essentials such as fire, theft, and storm damage, while also giving customers the flexibility to add extras like accidental damage or legal expenses. London homeowners appreciate their UK-based call centres and fast claims resolution times, especially in times of crisis.

Direct Line’s commitment to transparent pricing and reliable service makes it a solid choice for homeowners who don’t want to overpay for unnecessary extras.

Core Advantage

No-broker pricing structure that saves money without cutting corners.

Recommended For

Homeowners who want dependable coverage without complex conditions or broker fees.

Pricing: From £160/year

- Website: www.directline.com

- Phone: 0345 246 3564

- Address: Churchill Court, Westmoreland Rd, Bromley BR1 1DP

- Email: customer.service@directline.com

Review: ★★★★☆ “Easy to set up and no confusing jargon. Got a decent quote for my Hackney flat.”

3. Hiscox – “Luxury Cover for High-Value Homes”

Hiscox specialises in high-net-worth insurance and is a premium choice for those with unique or valuable properties. Unlike standard insurers, Hiscox doesn’t rely on one-size-fits-all policies.

Instead, they work with clients to develop bespoke coverage plans that include everything from antiques and art to customised architecture. Their home insurance is particularly suited to Londoners with heritage homes, listed properties, or luxury apartments.

With optional cover for home offices, renovations, and worldwide contents protection, Hiscox is designed for maximum flexibility. They also offer access to personal advisors who help manage claims, assess values, and ensure that even the smallest details are covered.

Key Offering

Bespoke policies that include rare or high-value items, personal advisors, and specialist property protection.

Most Suitable For

Luxury homeowners or property investors who require tailored protection with expert advice.

Pricing: From £450/year

- Website: www.hiscox.co.uk

- Phone: 0800 247 1902

- Address: 1 Great St Helen’s, London EC3A 6HX

- Email: enquiries@hiscox.co.uk

Review: ★★★★★ “Their premium is higher, but I feel completely secure knowing my art and home are protected.”

4. AXA UK – “Smart Protection, Trusted Worldwide”

AXA is a household name across the globe, and its UK division offers some of the most competitive and flexible homeowner insurance packages in London. The company provides easy-to-understand policies that come with clear coverage limits and straightforward excess terms.

AXA’s digital services are excellent, allowing customers to make claims or access documents online with minimal fuss. What sets AXA apart is its attention to optional extras such as garden equipment cover, personal legal support, and protection against tenant damage. Their plans suit both new homeowners and those upgrading from basic insurance, and they also cater well to landlords.

Coverage Highlight

Internationally backed security with customisable add-ons and user-friendly claims management.

Best Suited To

Homeowners wanting a global brand’s reassurance combined with local London expertise.

Pricing: Starting at £145/year

- Website: www.axa.co.uk

- Phone: 0330 024 1235

- Address: 20 Gracechurch St, London EC3V 0BG

- Email: help@axa-insurance.co.uk

Review: ★★★★☆ “Everything was explained clearly, and the policy fit my Victorian home’s needs perfectly.”

5. Admiral – “Bundle and Save Big”

Admiral is widely recognised for its value-driven approach, especially when bundling policies. The company offers generous multi-product discounts for customers combining home, car, or pet insurance. Its home insurance options cover both buildings and contents, and the claims process is straightforward, often resolved within a few working days.

Admiral also caters to renters, landlords, and high value property owners, offering flexible upgrades like accidental damage and outside-the-home cover for valuables. London homeowners who already use Admiral for other insurance products find the home cover seamless to integrate.

Service Focus

Value-packed policies that reward loyalty and simplify management of multiple insurance types.

Recommended Homeowners

Those with multiple insurance needs who want to consolidate services and save on premiums.

Pricing: From £130/year when bundled

- Website: www.admiral.com

- Phone: 0333 220 2003

- Address: Tŷ Admiral, David St, Cardiff CF10 2EH

- Email: customerqueries@admiralgroup.co.uk

Review: ★★★★☆ “Great value when I combined it with my car insurance. Saved over £70 this year.”

6. LV= (Liverpool Victoria) – “Coverage That Cares”

LV= is one of the UK’s most respected mutual insurance companies, renowned for combining fair pricing with standout customer support. Their home insurance options include solid buildings and contents cover with clear, jargon-free policies.

London homeowners appreciate LV= for its no-nonsense approach, quick claims processing, and compassionate handling of urgent issues like storm or flood damage.

They offer optional upgrades including accidental damage, home emergency cover, and alternative accommodation in case your home becomes uninhabitable. LV= has a particularly loyal base among older homeowners and families who value consistent service and clear terms without hidden surprises.

Notable Strength

Customer-first culture with excellent claim response and communication.

Suited Audience

Older homeowners or families looking for a dependable, stress-free insurance provider.

Pricing: Approx. £140/year (depending on cover and location)

- Website: www.lv.com

- Phone: 0800 032 2799

- Address: County Gates, Bournemouth BH1 2NF

- Email: customerservices@lv.com

Review: ★★★★☆ “Had to call them after a garden wall collapse—very compassionate and fast.”

7. Policy Expert – “Simple Insurance for the Digital Age”

Policy Expert has made waves in the UK insurance industry with its intuitive digital platform and competitive pricing. Ideal for London homeowners who prefer managing everything online, it offers easy quotes, renewals, and claims all without unnecessary paperwork.

Policy Expert’s insurance packages cover all essentials like buildings and contents, and can be extended with extras such as accidental damage, home emergency, and legal expenses.

Its streamlined model keeps costs low while still delivering responsive customer service via online chat or phone. The platform is a favourite among younger or first-time buyers looking for straightforward, affordable home insurance in the capital.

Main Focus

Digital-first policy management for tech-savvy customers.

Best Match

Young professionals and first-time buyers seeking value and ease of use.

Pricing: From £110/year

- Website: www.policyexpert.co.uk

- Phone: 0330 0600 600

- Address: 352-356 Fulham Rd, London SW10 9UH

- Email: support@policyexpert.co.uk

Review: ★★★★☆ “Great value. Did everything online in under 15 minutes. Ideal for my first home.”

8. Saga – “Secure Living for Over-50s”

Saga is a specialist insurance provider focused on serving the over-50s market, offering comprehensive homeowner policies designed with retirees in mind. The cover includes buildings and contents insurance, accidental damage as standard, and higher coverage limits than most mainstream providers.

Policyholders benefit from UK-based phone support, priority services for vulnerable customers, and flexible payment options. Saga has carved out a niche in the London market with clients who own long-held properties and want a provider that understands their evolving needs. Their clear communication and considerate service are what sets them apart in this age-specific insurance sector.

Premium Feature

Age-optimised policies with enhanced cover limits and personal service.

Tailored Audience

Retired or semi-retired homeowners seeking high-quality, low-hassle insurance.

Pricing: Typically from £175/year

- Website: www.saga.co.uk

- Phone: 0800 056 9102

- Address: Enbrook Park, Folkestone CT20 3SE

- Email: customerservices@saga.co.uk

Review: ★★★★☆ “Saga treated me with respect and explained the cover clearly. A top-tier experience.”

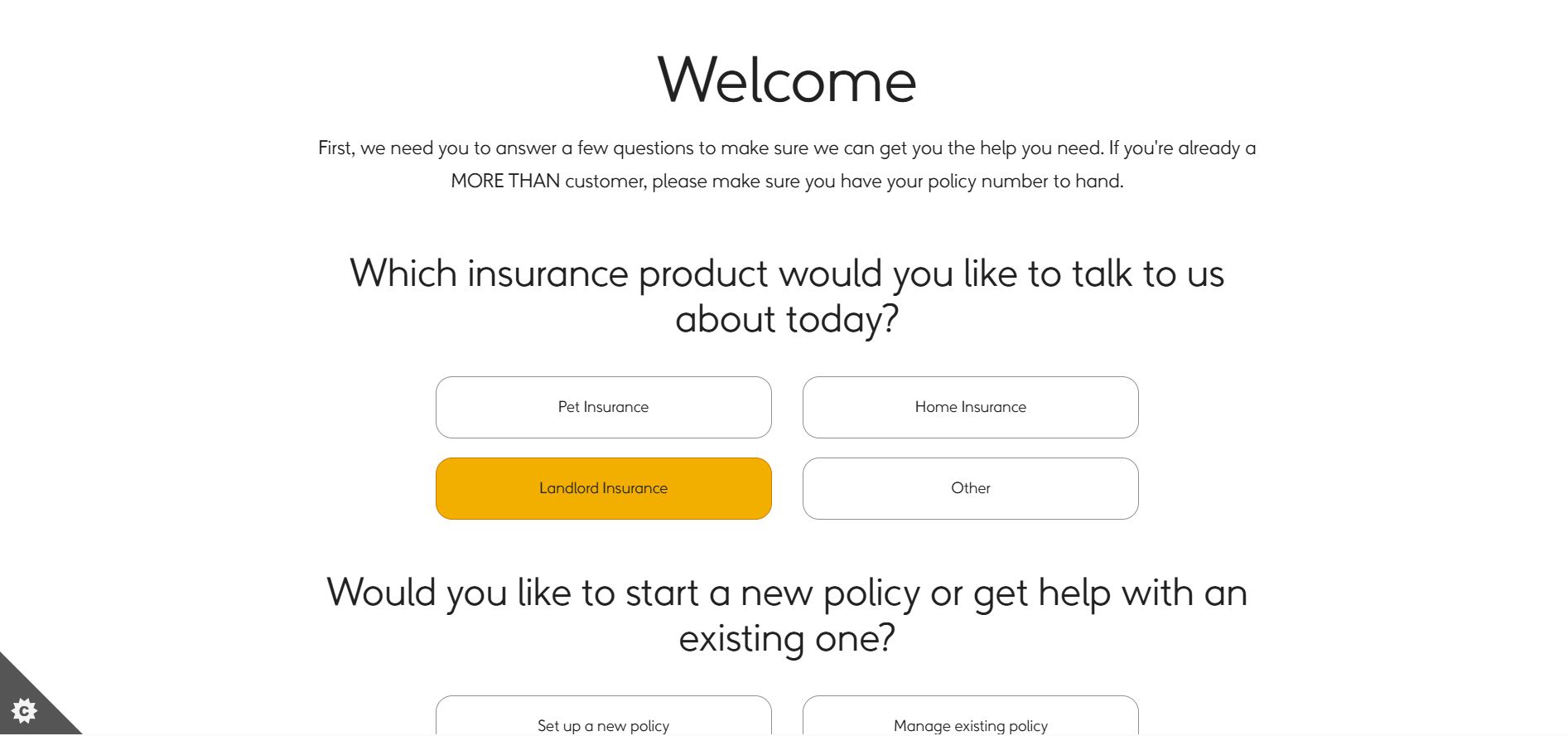

9. More Than – “Customisable Cover Made Easy”

More Than prides itself on flexible insurance that allows homeowners to tailor policies to their exact needs. Whether you want basic cover or a comprehensive plan with all the extras, More Than lets you build it. London residents find this especially valuable when dealing with high-value belongings, home offices, or garden buildings.

You can include optional cover for bicycles, freezer contents, and home emergency assistance, all through an intuitive quote builder. The provider is backed by RSA Insurance, giving customers confidence in both financial strength and claims reliability.

Unique Offering

Flexible, modular plans tailored to individual lifestyles and property types.

Ideal For

Homeowners wanting total control over what they pay for and how much coverage they get.

Pricing: Starts at £120/year

- Website: www.morethan.com

- Phone: 0330 100 2639

- Address: St Mark’s Court, Chart Way, Horsham RH12 1XL

- Email: support@morethan.com

Review: ★★★★☆ “I could adjust nearly every detail of my plan. Great for someone like me with a complex layout.”

10. Churchill – “Reliable Insurance from a Trusted Name”

Churchill is a well-known UK insurance brand synonymous with trust, consistency, and no-fuss service. Their home insurance policies are simple yet effective, covering both buildings and contents with options to add legal expenses, personal possessions, and emergency call-outs.

Churchill appeals to homeowners who want a recognised name with a long track record of reliability. The insurer also provides handy online tools that allow users to make changes to their policy or file claims without calling. In a fast-moving city like London, Churchill’s focus on dependability and transparency makes it a go-to choice for traditionalists.

Defining Benefit

Trusted reputation built on dependable, no-surprise service.

Perfect Fit

Long-term homeowners who want peace of mind and brand-backed reassurance.

Pricing: Average £135/year

- Website: www.churchill.com

- Phone: 0800 032 4829

- Address: Churchill Court, Bromley BR1 1DP

- Email: help@churchill.com

Review: ★★★★☆ “Straightforward and dependable. No frills, but they got the job done when I needed help.”

What Coverage Options Should You Expect From a London Home Insurance Policy?

Understanding what’s typically included in a homeowner insurance policy helps in choosing the right provider.

Buildings Insurance for Structural Protection

Buildings insurance covers the cost of rebuilding your home in the event of serious damage. This includes walls, roof, floors, windows, and permanent fittings like bathrooms or kitchens. In London, where older homes are common, this is especially vital.

Contents Insurance for Personal Belongings

This aspect protects the items inside your home—from furniture and electronics to clothing and valuables. Many insurers in London offer cover limits that can be increased based on your asset inventory, ideal for those with high-value possessions.

Optional Extras for Enhanced Protection

While not always included, optional extras can be essential in a bustling city. Accidental damage covers unintentional events such as spilling paint on carpets. Legal expenses insurance assists with disputes involving neighbours, landlords, or tradespeople. Home emergency cover provides quick fixes for broken boilers or burst pipes.

How Much Do Londoners Pay for Home Insurance on Average?

Pricing for homeowner insurance in London varies due to property type, location, and coverage level.

Flat in Central London

For a one-bedroom flat in areas like Islington or Camden, premiums typically range from £14 to £22 per month. These policies often focus on contents insurance, with optional buildings coverage if the flat is privately owned.

Terraced and Semi-Detached Homes

Three-bedroom properties in zones 3 to 5 may see premiums between £25 and £45 monthly. This reflects the larger square footage and higher rebuild costs, as well as increased contents value.

Period Homes and High-Value Properties

Victorian terraces or detached homes in areas like Richmond or Hampstead may attract premiums of £50 and above. Their age, bespoke architecture, and high rebuild costs significantly influence price.

New Build Apartments

New builds, often located in regeneration zones like Stratford or Battersea, can benefit from lower premiums—typically around £15 to £25—thanks to modern materials and built-in security systems.

What Should You Know Before Choosing a Home Insurance Provider?

Before committing to a policy, it’s important to take a closer look at some common terms and features.

Understanding Policy Exclusions

Not all damage is covered. Policies generally exclude wear and tear, damage from poor maintenance, and loss due to negligence. Carefully reading the exclusions helps homeowners avoid denied claims later.

The Role of Policy Excess

The excess is the amount you must contribute when making a claim. While a higher excess can lower your monthly premium, it may lead to a larger out-of-pocket cost if you need to file a claim.

Importance of Accurate Valuations

Underestimating the value of your home or contents can result in inadequate coverage. It’s essential to provide accurate rebuild costs and an honest inventory of personal belongings to ensure claims are fully honoured.

How Can You Save on Homeowner Insurance in London?

Even with rising living costs, there are still ways to secure good coverage at a reasonable price.

Use Price Comparison Sites

Websites like MoneySuperMarket, GoCompare, and Compare the Market enable users to compare quotes side by side, filtering by excess amount, coverage level, and policy extras. These tools often expose deals that aren’t directly available on insurer websites.

Opt for Annual Payments

Monthly instalments can incur interest, increasing the total cost. Paying annually typically reduces your premium and may also trigger eligibility for early-bird discounts.

Improve Home Security

Installing deadlocks, smart cameras, or monitored alarms can reduce perceived risk, often earning discounts on premiums. Many insurers recognise the value of proactive safety measures.

Conclusion

Homeowner insurance in London is a critical investment that offers protection, security, and peace of mind. Whether you’re insuring a Victorian semi in the suburbs or a studio flat in Shoreditch, finding the right insurer involves balancing cost, coverage, and customer service.

The companies featured in this guide have consistently delivered strong ratings and reliable policies for a variety of homeowners. By understanding your options and comparing providers, you can confidently protect your property in one of the world’s most valuable real estate markets.

FAQs About Homeowner Insurance Companies in London

What is covered under a standard home insurance policy in London?

A typical policy includes buildings and contents insurance, protecting your property structure and belongings from risks like fire, theft, and storm damage.

Can I cancel my policy before the term ends?

Yes, but early termination may involve cancellation fees. It’s important to check with the insurer before switching providers.

Does insurance cover theft even if there’s no forced entry?

Many insurers require proof of forced entry, but some may cover theft without it—if specific conditions are met in the policy.

How is the premium for London properties calculated?

Premiums depend on location, building type, property value, previous claims, and installed security systems.

Are landlord properties covered under regular home insurance?

No, landlords require separate landlord insurance, which includes rental-specific liabilities and coverage.

What’s the typical claim time for London insurers?

Most insurers process claims within 48 hours of notification. Final resolution can vary depending on claim complexity.

Is it better to use an insurance broker in London?

Brokers can help find niche policies for unusual properties but may charge a fee. Direct-to-consumer options are more common today.