In the heart of London’s fast-paced business scene, managing company expenses efficiently isn’t just a back-office task. it’s a competitive advantage. As businesses expand, juggling travel costs, staff reimbursements, and corporate card spend becomes increasingly complex and risky. That’s where corporate expense management companies come in, offering smart, automated solutions that replace outdated spreadsheets with real-time control and visibility.

For London-based startups, SMEs, and large enterprises alike, choosing the right expense management platform can drive cost savings, improve HMRC compliance, and free up finance teams for more strategic work. From prepaid card systems to all-in-one travel and expense tools, these companies are transforming how businesses handle financial operations.

In this guide, we reveal the top 10 corporate expense management companies in London, based on platform features, ease of use, integrations, and real user reviews helping you make the best decision for your organisation’s needs.

Why Should London Businesses Prioritise Expense Management Solutions?

Effective financial control has become more critical than ever for companies operating in London’s dynamic economic environment. With rising operational costs and tighter compliance regulations, businesses must be proactive in managing their expenses to avoid overspending, fraud, or tax complications. Traditional methods of expense handling such as manual spreadsheets or paper-based systems are not only time-consuming but also prone to errors.

Corporate expense management solutions offer a streamlined approach by automating reporting, tracking, and reconciliation processes. For London-based companies, this means quicker approvals, real-time visibility into spending, and the ability to maintain financial compliance with HMRC and other governing bodies. Adopting the right platform can help organisations become more agile, reduce administrative overhead, and support smarter budgeting decisions.

What Key Features Should You Look For in Corporate Expense Management Companies?

When considering expense management tools, London businesses should focus on platforms that address both current and future operational needs. The best solutions go beyond basic expense tracking they act as comprehensive financial control systems.

One of the key features is automation. Platforms that automatically scan receipts, match them with card transactions, and categorise expenses by department or project help reduce errors and save time. Mobile functionality is another essential component, especially for teams that travel or work remotely. Employees should be able to submit expenses through an app, while finance teams approve them instantly.

Integration capabilities are equally important. The chosen platform should work seamlessly with your existing software stack whether it’s accounting software like Xero or Sage, or HR systems used for payroll and employee management. Additionally, robust reporting tools that provide insights into spending patterns and budget forecasts make a platform invaluable to decision-makers.

Finally, compliance support cannot be overlooked. A top-tier platform should offer features that help enforce company policy and maintain tax compliance through digital recordkeeping and secure cloud storage.

How Can Automated Expense Tracking Transform Financial Efficiency?

![]()

Manual expense reporting has long been a source of inefficiency and frustration for employees and finance teams alike. Errors in data entry, missing receipts, and delayed approvals contribute to administrative bottlenecks that drain valuable time and resources. Automated expense tracking changes this completely.

With automation, expenses can be recorded in real time. Receipts are captured through mobile apps using OCR (Optical Character Recognition), while smart categorisation ensures every transaction is logged accurately. Finance teams gain full visibility into all expenditures, from travel and entertainment to recurring subscriptions and office costs.

This level of insight empowers companies to identify spending trends, allocate budgets more effectively, and make proactive decisions. Approvals and reimbursements also become significantly faster, enhancing the employee experience and maintaining morale. Perhaps most importantly, automation greatly reduces the risk of fraudulent claims, as systems are programmed to flag out-of-policy transactions for review.

What Are the Top 10 Corporate Expense Management Companies in London?

1. Soldo – “Smarter Spend Control for Modern Businesses”

Soldo is a London-based corporate expense management company that focuses on proactive spending control rather than reactive reporting. The platform allows businesses to issue prepaid company cards with predefined budgets and spending rules. Every transaction is tracked in real time, giving finance teams immediate visibility into company expenditure.

Soldo reduces the need for reimbursements by empowering employees to spend within approved limits. Its dashboard enables detailed reporting and seamless integration with accounting software. The system also supports compliance through automated audit trails and digital receipt storage. Soldo is widely adopted by UK businesses seeking greater control over operational spending.

Core Focus

Real-time spend control using prepaid company cards.

Ideal Users

UK SMEs and scaling organisations.

- Website: https://www.soldo.com/

- Address: 119 Marylebone Road, London, NW15PU

- Email: Contact Form

Review: ★★★★☆

“Soldo gives us complete visibility and control over spending, which has significantly reduced finance admin time.”

2. Pleo – “Expense Management That Employees Actually Enjoy”

Pleo is a popular corporate expense management solution known for its strong user experience and automation capabilities. It provides smart company cards that automatically sync with expense reports. Employees can capture receipts instantly using the mobile app, reducing delays and missing documentation.

Finance teams benefit from automated categorisation and policy enforcement features. Pleo offers real-time insights into company spending across departments. The platform integrates easily with accounting systems used by UK businesses. Pleo is especially valued for simplifying expense processes without sacrificing financial control.

Key Strength

User-friendly expense automation.

Target Organisations

Startups and mid-sized UK businesses.

- Website: https://www.pleo.io/en

- Phone: +44 330 808 1006

- Address: 3rd floor, 11 St John St, London EC1M 4AA, United Kingdom

- Email: sales@pleo.io

Review: ★★★★★

“Pleo has completely removed the frustration from expense reporting for both staff and finance teams.”

3. SAP Concur – “Enterprise-Grade Expense and Travel Management”

SAP Concur is a globally recognised expense management platform used by large organisations in London. It combines expense, invoice, and travel management into a single enterprise-grade solution. The platform supports complex approval workflows and detailed financial reporting. SAP Concur is designed to handle high transaction volumes across multiple locations.

Its strong compliance framework helps businesses meet UK and international regulatory requirements. Integration with ERP systems makes it suitable for large finance departments. SAP Concur is best known for its depth, scalability, and reliability.

Strategic Advantage

Advanced compliance and reporting capabilities.

Best Fit

Large enterprises and multinational corporations.

- Website: https://www.concur.co.uk

- Phone: +44 20 8917 6659

- Address: Clockhouse Place Bedfont Road Feltham Middlesex TW14 8HD

- Email: Contact Form

Review: ★★★★☆

“A powerful solution for complex organisations, offering excellent visibility and control at scale.”

4. Thredd – “Powering Next-Generation Expense Card Solutions”

Thredd operates as a payments technology provider supporting expense management platforms. It enables businesses to issue and manage physical and virtual cards securely. The company provides the infrastructure that powers many modern expense solutions. Thredd focuses heavily on compliance, transaction security, and scalability.

Its technology supports real-time transaction authorisation and controls. London fintech firms rely on Thredd for reliable expense card processing. Thredd plays a crucial behind-the-scenes role in the expense management ecosystem.

Technical Expertise

Card issuing and payment infrastructure.

Primary Clients

Fintech and expense platform providers.

- Website: https://www.thredd.com/industries/expense-management

- Address: Kingsbourne House, 229-231 High Holborn, London, WC1V 7DA, England

- Email: Contact Form

Review: ★★★★☆

“Highly reliable infrastructure with strong compliance and payment stability.”

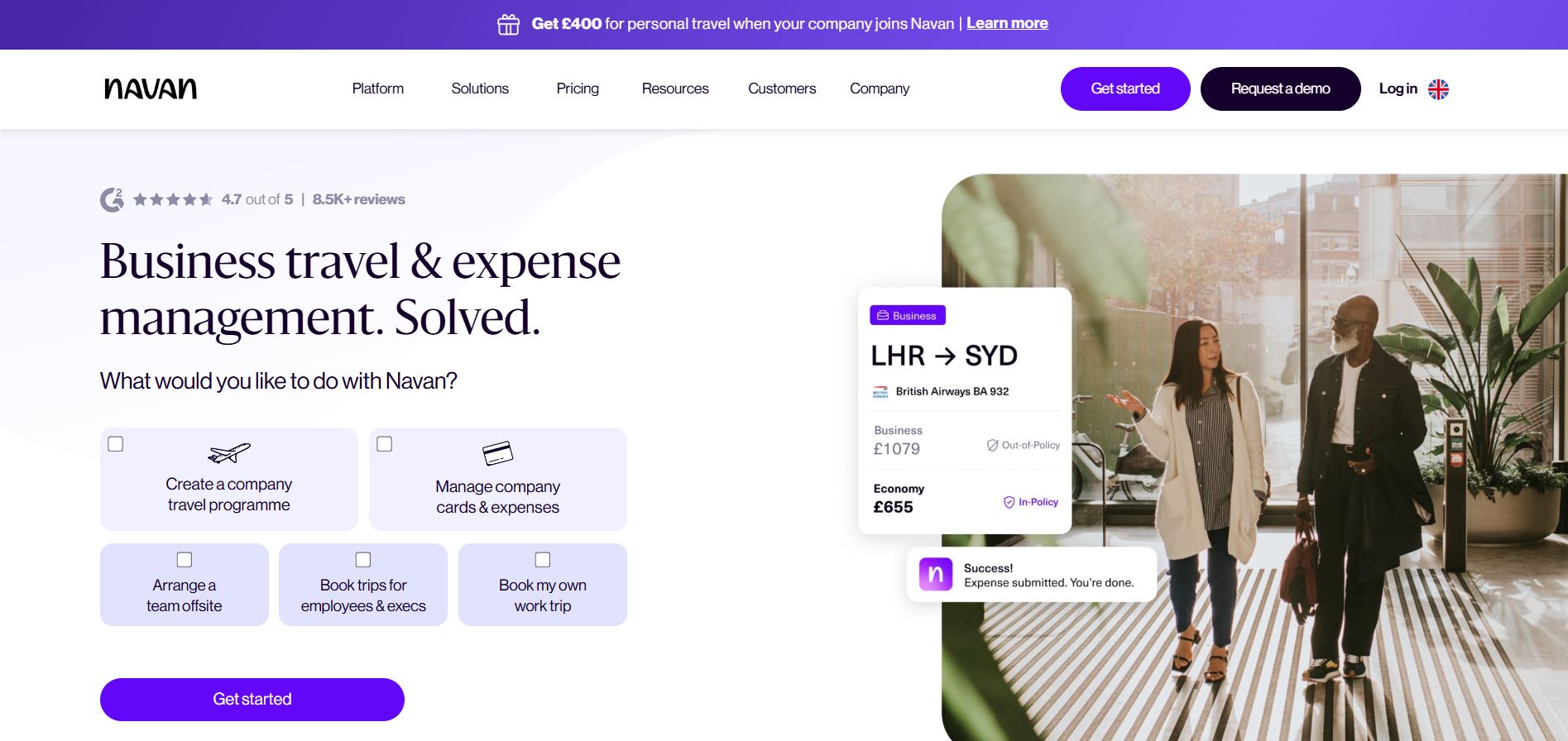

5. Navan – “All-in-One Travel and Expense Intelligence”

Navan offers an integrated approach to travel and expense management for London businesses. The platform combines travel booking with automated expense reporting. Expenses related to travel are captured instantly without manual input. Navan provides real-time analytics that help businesses optimise spending.

Policy enforcement is built directly into the booking and expense process. This reduces out-of-policy spend and improves compliance. Navan is particularly effective for companies with frequent business travel.

Integrated Capability

Unified travel and expense management.

Suitable For

Travel-heavy organisations.

- Website: https://navan.com/uk

- Address: 81-87 High Holborn, London WC1V 6DF, United Kingdom

- Email: Contact Form

Review: ★★★★☆

“Navan has made managing travel expenses far more efficient and transparent.”

6. Goodwille – “Finance and Expense Expertise for Growing Businesses”

Goodwille provides expense management as part of a wider financial services offering. The company supports businesses with expense processes, accounting, and compliance. It takes a consultative approach rather than offering software alone. London-based companies benefit from tailored financial guidance.

Goodwille helps structure expense policies aligned with business growth. Its services are especially useful for international companies entering the UK market. Goodwille combines technology with hands-on financial expertise.

Service Approach

Advisory-led expense management.

Best Use Case

International and expanding businesses.

- Website: https://goodwille.com/finance/expense-management/

- Phone: +44 20 7795 8100

- Address: c/o Work.Life, 20 Red Lion St, London WC1R 4PS, United Kingdom

- Email: hello@goodwille.com

Review: ★★★★☆

“Professional and reliable support that goes beyond standard expense software.”

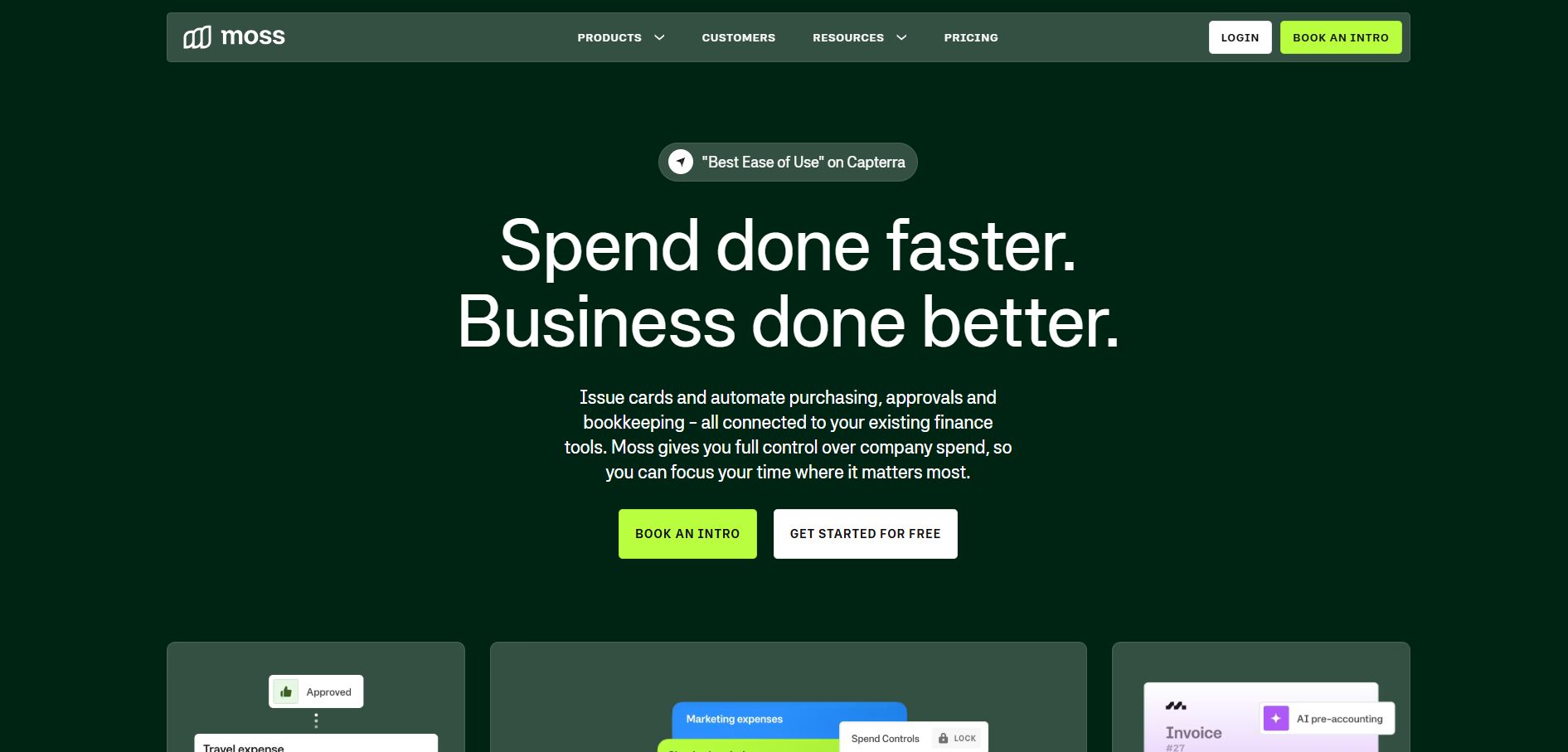

7. Moss – “Corporate Cards with Built-In Expense Control”

Moss is a modern expense management platform focused on corporate cards and automation. It allows businesses to issue cards instantly with defined spending limits. All transactions are tracked in real time through a central dashboard.

Moss simplifies month-end closing by automating reconciliation. The platform provides clear audit trails for compliance purposes. Finance teams gain improved visibility into cash flow and spending patterns. Moss is widely used by fast-growing UK companies.

Product Focus

Card-based expense automation.

Recommended For

Finance-driven SMEs.

- Website: https://www.getmoss.com/

- Phone: +49 30 31196512

- Address: 128 Albert Street, London, NW1 7NE

- Email: join@getmoss.com

Review: ★★★★★

“Moss has significantly improved our expense visibility and reporting accuracy.”

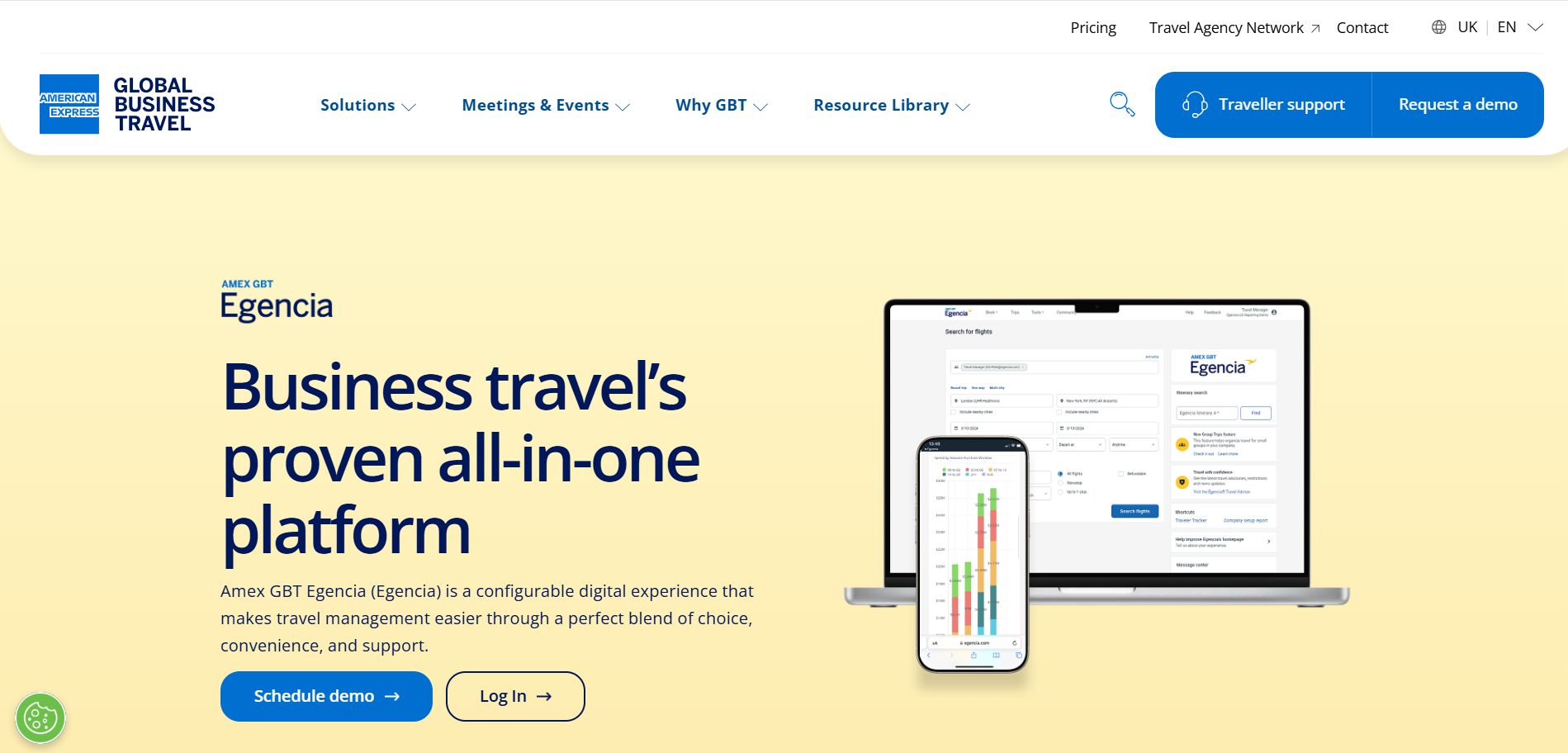

8. Egencia – “Business Travel Meets Expense Control”

Egencia is a well-established travel and expense management provider in London. It specialises in corporate travel booking combined with expense tracking. The platform ensures travel expenses comply with company policies.

Egencia provides reporting tools that offer insight into travel-related spend. It also includes traveller support and risk management features. Finance teams benefit from consolidated travel expense data. Egencia is ideal for organisations with structured travel programmes.

Travel Expertise

Policy-driven travel expense management.

Ideal Clients

Corporates with frequent travel needs.

- Website: https://www.egencia.co.uk/en/travel-expense-management

- Phone: +44 20 7447 7200

- Address: 5 Churchill Pl, London E14 5HU, UK.

- Email: FLast@egencia.com

Review: ★★★★☆

“A strong solution for managing corporate travel and related expenses efficiently.”

9. Emburse – “Advanced Expense Automation for Global Teams”

Emburse offers a suite of expense management solutions tailored to different business needs. The platform supports receipt capture, approvals, and analytics. It is designed to scale with growing organisations. Emburse provides tools suitable for both SMEs and enterprises. Its reporting features offer detailed insights into spending behaviour.

The platform supports international operations and compliance. Emburse is trusted by London businesses with complex expense requirements.

Platform Flexibility

Modular expense management solutions.

Best Application

Mid-sized to enterprise organisations.

- Website: https://www.emburse.com/uk/solutions/expense-management

- Phone: +44 (0) 20 7846 0166

- Address: 51 Eastcheap, London EC3M 1DT

- Email: contact@emburse.com

Review: ★★★★☆

“Robust reporting and flexible features make Emburse a strong enterprise option.”

10. Rydoo – “Fast, Compliant, and Global Expense Management”

Rydoo is a mobile-first expense management platform used by many London-based businesses. It enables employees to submit expenses instantly from anywhere. The platform automates approvals and policy checks.

Rydoo supports multiple currencies and VAT handling. Finance teams benefit from real-time reporting and compliance tools. The system reduces administrative workload significantly. Rydoo is ideal for international and fast-moving organisations.

Operational Speed

Rapid expense submission and approvals.

Best Match

International and mobile-first companies.

- Website: https://www.rydoo.com/

- Address: 8 Northumberland Avenue London WC2N 5BY

- Email: hello@rydoo.com

Review: ★★★★★

“Rydoo is fast, intuitive, and saves our finance team hours every month.”

How Do Expense Management Tools Help Businesses Stay HMRC-Compliant?

Staying compliant with HMRC is a non-negotiable requirement for all UK businesses, and expense management plays a major role in achieving that. Digital expense platforms provide an audit trail for every transaction, helping companies meet legal obligations effortlessly.

Instead of relying on physical documents or manual logging, expenses are recorded and stored electronically. Receipts are attached to transactions, mileage is calculated using GPS tracking, and VAT is applied where necessary. Many tools automatically prepare reports in line with HMRC’s digital tax requirements, which simplifies filing and reduces the risk of penalties.

Moreover, with audit-friendly reporting and secure data storage, finance teams can retrieve expense data instantly during inspections or reviews. This not only saves time but also provides confidence that every financial action is accounted for and defensible.

Which Expense Platforms Work Best for Small to Mid-Sized Enterprises in the UK?

Small and medium-sized enterprises (SMEs) in London often operate with lean finance teams and limited resources. Therefore, the ideal expense management solution for these organisations should be easy to implement, cost-effective, and scalable.

Platforms like Pleo and Zoho Expense stand out for SMEs due to their user-friendly design, mobile capabilities, and flexible pricing. They eliminate the need for complex training and provide quick onboarding, allowing smaller teams to start managing expenses immediately. Soldo also offers great value for SMEs, combining spend control with robust reporting tools.

These platforms grow with the business, offering advanced features such as analytics, integration with payroll, and budgeting tools as needs evolve. For businesses aiming to modernise their financial processes without the overhead of enterprise systems, these tools strike the perfect balance.

What Common Expense Challenges Can These Platforms Solve?

Expense management tools are designed to address some of the most persistent challenges businesses face. One of the primary issues is the lack of visibility into where and how money is spent. Without proper tools, it’s easy for businesses to exceed budgets, reimburse out-of-policy expenses, or misclassify costs.

These platforms provide real-time dashboards and categorisation features that help finance teams monitor spending by department, employee, or project. They also streamline the approval process, replacing email chains and paper forms with automated workflows that notify the right people at the right time.

Another common issue is delayed reimbursements. With digital submission and approvals, employees get reimbursed faster, which improves satisfaction and reduces backlogs. Finally, by automating VAT calculations and storing digital receipts, these platforms support better reporting and reduce the risk of errors during audits or tax submissions.

How Should You Evaluate and Choose a Corporate Expense Management Company in London?

Selecting the right provider involves a thorough evaluation of business needs, team size, and long-term goals. While flashy features can be attractive, it’s important to choose a solution that aligns with your company’s structure and financial priorities.

Here’s a table to help compare key factors when evaluating platforms:

| Evaluation Criteria | Questions to Consider |

| Pricing and Affordability | Does the platform offer transparent pricing and plans suitable for your size? |

| Ease of Use | Can your team learn and adopt it quickly without technical training? |

| Software Integrations | Does it integrate with your accounting, HR, and banking systems? |

| Mobile Access | Is there a fully functional mobile app for on-the-go use? |

| Policy Management | Can you set and enforce expense policies easily? |

| Customer Support | Is support available in UK hours with helpful onboarding? |

| Security & Compliance | Does it meet GDPR and HMRC data protection standards? |

Doing a free trial or demo is also a smart move it allows teams to explore the interface, test integrations, and see how it fits into daily workflows.

Conclusion

London businesses are embracing digital transformation across all departments, and finance is no exception. Corporate expense management companies offer tools that not only make life easier for employees and finance teams but also ensure financial data is accurate, compliant, and actionable.

Whether you’re a growing startup or an established enterprise, choosing the right expense platform is a strategic move that can lead to improved control, cost savings, and better decision-making. The companies listed in this guide represent some of the best options available, catering to diverse business sizes and industries across the UK.

FAQs About Corporate Expense Management Companies in London

What does a corporate expense management platform do?

It automates the process of submitting, approving, and tracking business-related expenses, replacing manual methods like spreadsheets or paper forms.

Are expense platforms useful for businesses with remote teams?

Yes, they are ideal for remote teams. Employees can submit expenses via mobile apps, and managers can approve them from anywhere.

How long does it take to implement an expense management system?

Most modern platforms can be implemented within a few days. Some even offer same-day onboarding for small teams.

Can expense tools help with VAT reclaim?

Absolutely. Many platforms are HMRC-compliant and include features to calculate and reclaim VAT on eligible expenses.

What’s the typical cost of using an expense management tool in the UK?

Prices vary but generally range from £5 to £15 per user per month. Some providers offer custom pricing for larger teams.

Do these systems support multiple currencies?

Yes, especially those built for global teams. Multi-currency support is standard in platforms like SAP Concur and Rydoo.

How do these tools ensure data security?

They follow strict security protocols including encryption, role-based access, and GDPR compliance to protect financial data.