In a fast-paced city like London, unexpected financial shortfalls are almost inevitable. whether it’s a surprise medical bill, emergency travel, or simply needing to stretch funds before payday.

That’s where payday advance companies come into play. These lenders offer short-term, high-speed loan solutions designed to bridge the gap between paydays, providing immediate relief when it’s needed most.

While payday loans were once associated with confusing terms and predatory practices, tighter FCA regulations in the UK have reshaped the industry, ensuring transparency, capped interest rates, and ethical lending standards.

Today, borrowers in London have access to a growing number of trustworthy and regulated payday advance companies that put flexibility and customer experience at the forefront.

But with so many options available, choosing the right lender can be overwhelming. That’s why we’ve reviewed and compiled this definitive list of the 10 best payday advance companies in London, based on real customer feedback, service quality, approval speed, and overall reliability.

Whether you’re searching for same-day cash, manageable instalments, or a fully online experience, there’s a lender here tailored to your needs.

What Are Payday Advance Companies and Their Process in London?

Payday advance companies provide short-term lending solutions to individuals in need of immediate financial assistance. In London, where the cost of living continues to rise and unexpected expenses can be difficult to manage, these services have become an essential stopgap for many residents.

Unlike traditional banks, payday lenders often bypass the lengthy credit checks and paperwork. Instead, they offer smaller loans typically ranging from £100 to £1,000 that must be repaid by the borrower’s next payday. This rapid lending process is ideal for emergencies such as car repairs, medical bills, or utility payments.

In the UK, all payday loan providers are regulated by the Financial Conduct Authority (FCA), which ensures they comply with strict rules regarding interest caps, repayment terms, and transparency. This regulation is crucial in protecting consumers from predatory lending practices.

Why Do People in London Choose Payday Loans Over Other Options?

Accessibility and Speed

One of the key reasons people turn to payday loans is the ease and speed of access. Traditional bank loans often involve lengthy applications, strict credit checks, and days of waiting. Payday lenders, on the other hand, typically approve loans within hours and in many cases, transfer funds the same day.

Minimal Credit Requirements

Many payday lenders offer loans without requiring a strong credit history. This opens the door for individuals who may have poor credit scores or limited borrowing history but still have the means to repay on time.

Convenience of Online Applications

With most lenders now operating online, borrowers in London can complete the entire application process from their mobile phones or computers. This makes payday loans not just quick, but incredibly convenient, especially for working professionals or those with limited mobility.

What Makes a Payday Advance Company the Best in London?

Clear and Transparent Loan Terms

The best payday advance companies in London prioritise transparency. They clearly outline interest rates, fees, repayment dates, and penalties with no hidden clauses. This helps borrowers make informed decisions and avoid unexpected financial consequences.

FCA Registration and Regulation

Any lender worth considering must be registered with the Financial Conduct Authority (FCA). This registration ensures that the company adheres to ethical lending practices, including limits on interest rates and the total amount a borrower can be required to repay.

Positive Customer Experience

Companies with high ratings on Google, Trustpilot, and other review platforms often stand out for good reason. Exceptional customer service, fast response times, and respectful communication are common traits of London’s top payday lenders.

Which Are the Top 10 Payday Advance Companies in London Right Now?

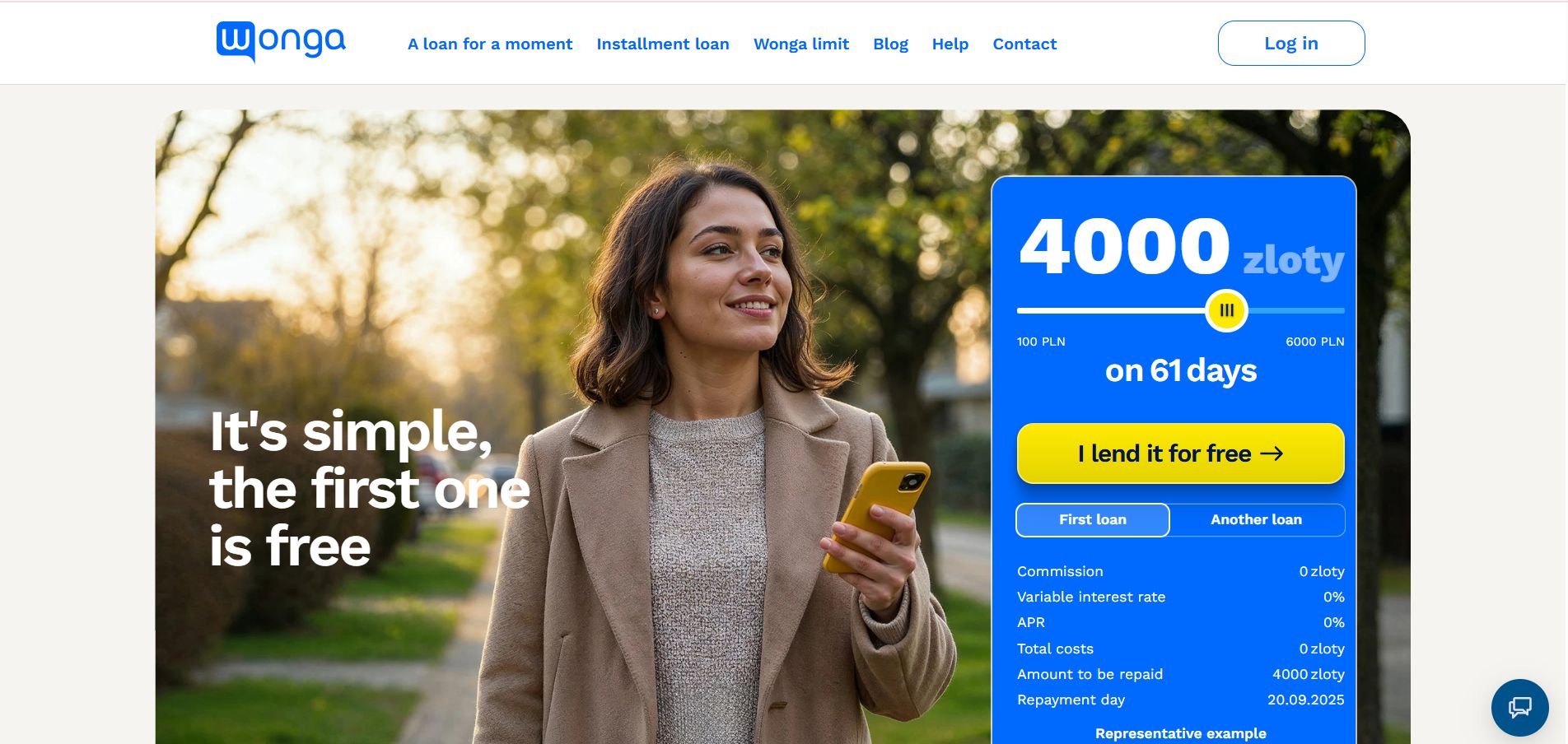

1. Wonga – “Fast Cash for Fast Lives”

Wonga is one of the UK’s most recognised names in short-term lending. Originally known for its ultra-fast payday loans, Wonga has evolved into a more responsible lender with transparent practices and a user-first online experience.

With revamped lending policies post-regulation, the company now focuses on affordability, allowing users to tailor loan terms to their needs. Its sleek digital interface ensures applicants can apply, get approved, and receive funds in as little as 15 minutes.

Lending Focus

Ideal for tech-savvy users seeking ultra-fast funding.

Perfect Fit

Great for those who want flexible repayments.

Pricing: Varies based on loan amount, capped by FCA regulations. No hidden fees.

- Website: www.wonga.com

- Phone: 020 7138 8330

- Address: 3 Prince Albert Rd, London NW1 7SN

- Email: kontakt@wonga.pl

Review: ★★★★☆

“I applied over lunch and had the money before dinner genuinely impressed with how seamless it was!”

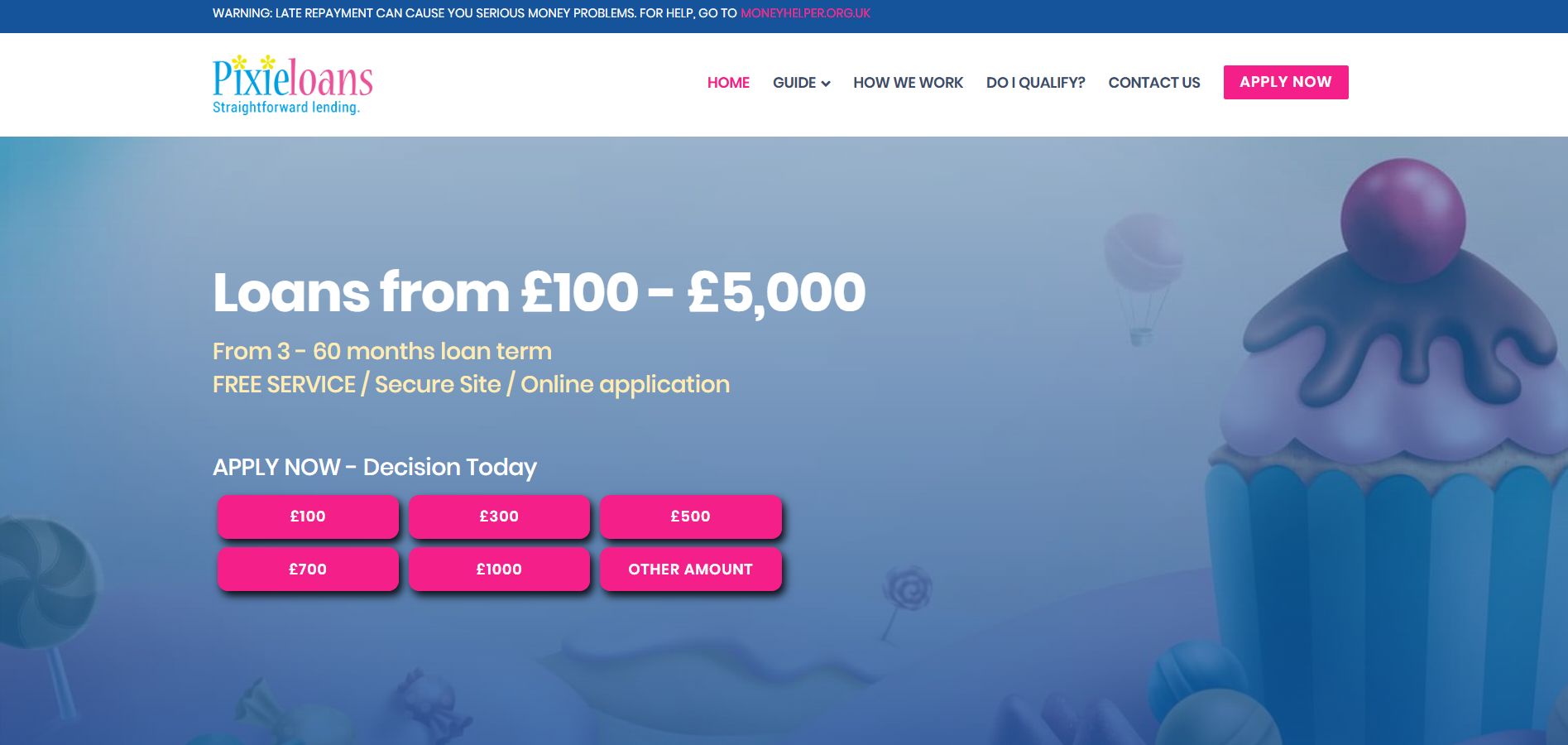

2. Pixiel Loans – “Affordable Loans, Made Simple”

Pixiel Loans has carved out a reputation for straightforward lending and excellent customer service. Known for offering instalment loans with flexible payment schedules, Peachy is popular among first-time borrowers.

Their site is clean, easy to navigate, and includes a pre-application eligibility checker to avoid unnecessary credit checks. Peachy focuses on educating borrowers and preventing debt spirals, setting them apart in the industry.

Lending Angle

Perfect for users wanting guided, step-by-step borrowing.

Borrower Match

Best for people new to payday lending.

Pricing: Representative APR 1,230%, detailed cost calculator on site.

- Website: www.peachy.co.uk

- Phone: 0161 667 4416.

- Address: Adamson House Didsbury, Manchester M20 2YY

- Email: customerservice@maxedupmedia.com

Review: ★★★★☆

“They actually explained everything — no jargon, no tricks. I felt in control the whole time.”

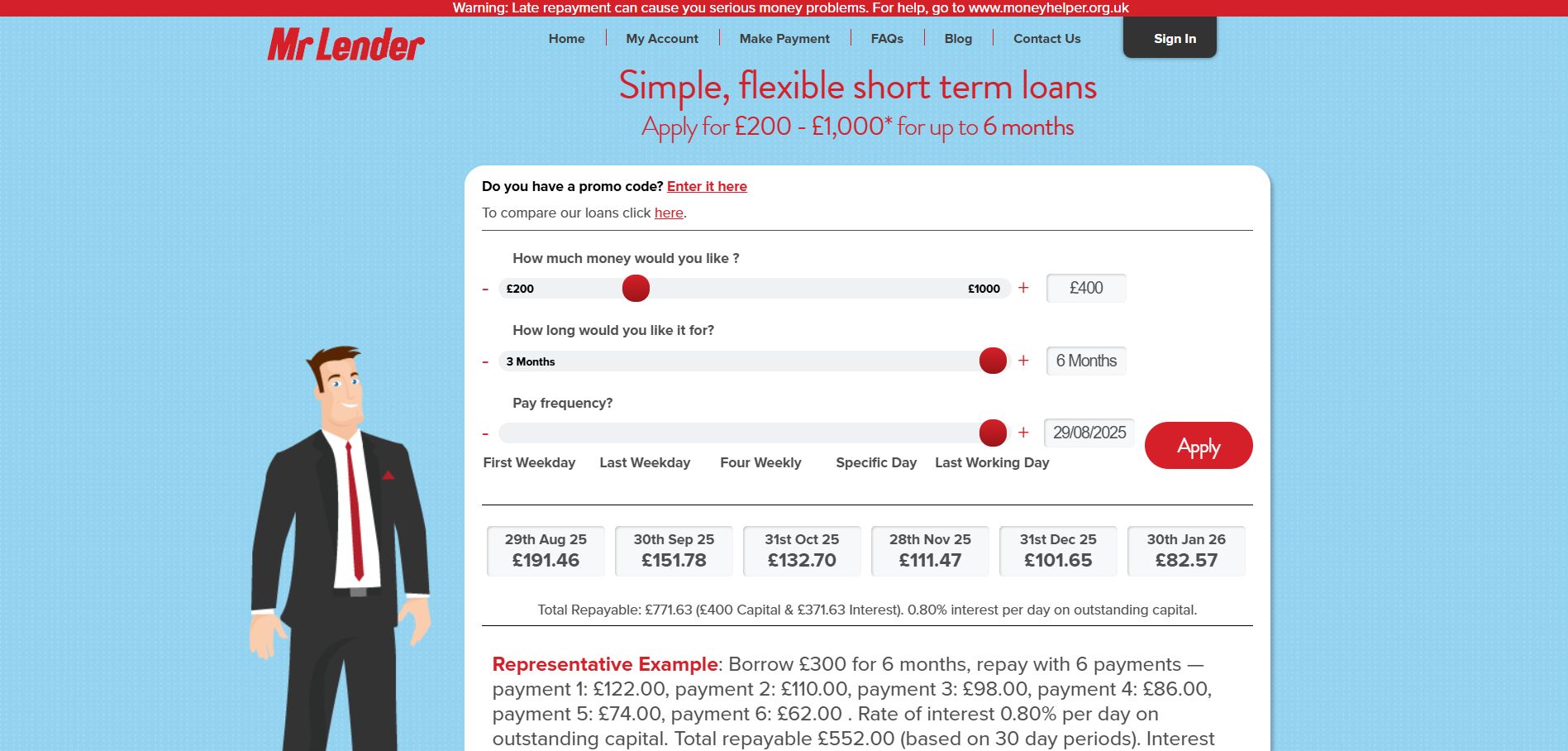

3. Mr Lender – “Short-Term Loans You Can Trust”

Mr Lender has long been a trusted name in London’s payday lending market. Offering loans of up to £1,000 repayable over 3 to 6 months, this Stratford-based lender emphasises responsible borrowing.

Their easy-to-use mobile app and web platform allow customers to manage their repayments and track their borrowing history. Mr Lender is particularly popular for its helpful and responsive customer service team.

Unique Feature

Excellent support for managing loans digitally.

Ideal User

Great for users who prefer human interaction and digital control.

Pricing: Interest capped as per FCA; APR approx. 1,248%.

- Website: www.mrlender.com

- Phone: 0208-532-1969

- Address: 121 Broadway, Stratford, London E15 4BQ

Review: ★★★★★

“The support team called me back in 10 minutes and explained everything — amazing service!”

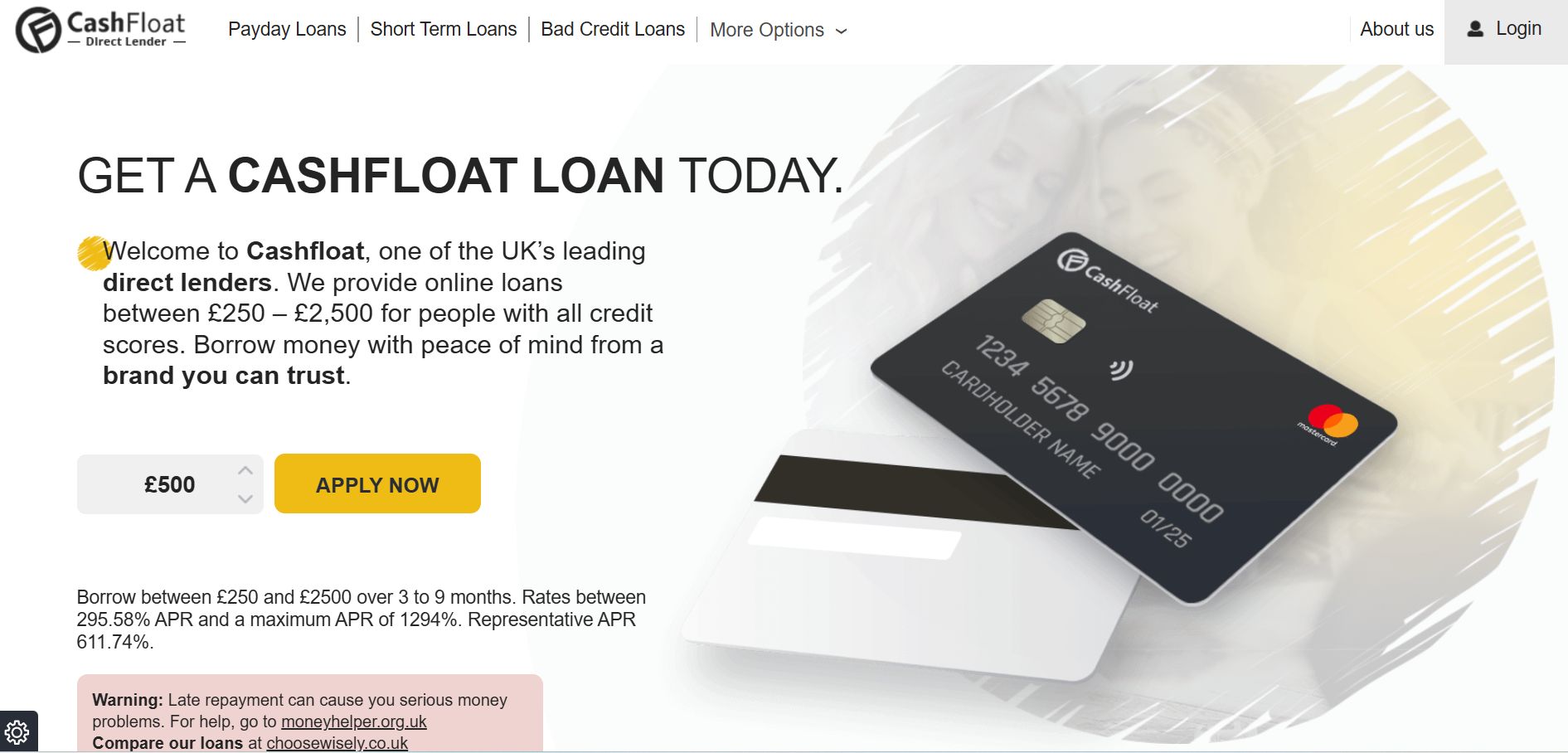

4. Cashfloat – “Smart Loans with a Human Touch”

Cashfloat blends the speed of online lending with a commitment to ethical practices. Their platform offers quick decisions and funding within one business day, while also screening applications carefully to prevent unaffordable lending.

Cashfloat provides a useful blog and budgeting advice a unique touch for a payday lender. They’re FCA-regulated and proud of their reputation for responsible lending.

Advantage

Offers financial advice along with loan services.

Target Borrower

Great for those who need both funding and guidance.

Pricing: APR 1,116.7%; cost examples included on the website.

- Website: www.cashfloat.co.uk

- Phone: 020 3757 1933

- Address: 4th Floor, 18 St Cross St, London EC1N 8UN

- Email: info@cashfloat.co.uk

Review: ★★★★☆

“They care about educating you, not just lending. Very refreshing in this industry!”

5. Sunny Loans – “Bright Ideas for Borrowing”

Although not currently accepting new applications (as of July 2025), Sunny Loans remains a respected brand with a legacy of customer-focused lending. Their website is still active for existing clients, offering flexible repayment and no late fees. Sunny gained a strong following thanks to its no-guarantor policies and interest transparency.

Service Highlight

Offers flexible repayment plans with zero late fees.

Best Audience

Good for those with irregular income streams.

Pricing: Historical APR 1,267%; contact required for active rates.

- Website: www.sunny.co.uk

- Phone: 0800 7315 444

- Address: 7 Bell Yard, London, England, WC2A 2JR

- Email: customerhelp@sunny.co.uk

Review: ★★★★☆

“They never pushed me for extra fees or extended deadlines really fair.”

6. Drafty – “Credit on Demand, Not Just a Loan”

Drafty isn’t your traditional payday lender. it operates more like a credit line, offering users flexible access to funds up to a preset limit. Once approved, you can withdraw as much or as little as needed, only paying interest on what you use.

This makes it a smart choice for people who face frequent, small cash flow gaps rather than one-off emergencies. Drafty is FCA-authorised and offers a sleek mobile app for managing balances, payments, and withdrawals in real-time.

Loan Flexibility

Offers a revolving credit line instead of fixed-term payday loans.

Ideal For

People who want continuous access to emergency funds.

Pricing: Representative APR 96.2% significantly lower than most payday loans. Interest is charged daily on used amounts only.

-

Website: www.drafty.co.uk

-

Phone: 020 3003 4580

-

Address: 20 Fenchurch St, London EC3M 3BY

-

Email: support@drafty.co.uk

Review: ★★★★★

“I love that I can dip in and out of funds without reapplying every time. It’s like an overdraft without the bank!”

7. MYJAR – “Lending That Respects You”

MYJAR positions itself as a lender with integrity, focusing on responsible credit and user-friendly tools. The platform is easy to use, and they provide detailed payment plans upfront. MYJAR also includes tools to help improve users’ credit profiles over time. They stand out in the market for transparency and loan control.

Loan Benefit

Focuses on helping customers build financial health.

Most Suitable For

Borrowers who value transparency and simplicity.

Pricing: Typical APR is 1,200%; includes full breakdown pre-loan.

- Website: www.myjar.com

- Phone: 02045 254 593

- Address: Exchange Tower London E14 9SR

- Email: contact@myjar.uk

Review: ★★★★☆

“Everything was laid out before I signed no surprises, just straight-up honesty.”

8. QuidMarket – “Short-Term Lending with No Surprises”

QuidMarket is ideal for borrowers seeking clarity and control. This lender operates without broker interference, making the loan process direct and personal. It provides detailed examples of repayments and interest before finalising any application, offering a reassuring level of transparency.

Strong Point

Removes middlemen for faster, more transparent lending.

Best Choice

Great for those who want to avoid brokerage platforms.

Pricing: APR from 1,255%; no early repayment fees.

- Website: www.quidmarketloans.com

- Phone: 0115 8456434

- Address: 8th Floor, Waterfront House, 35 Station Street, Nottingham, NG2 3DQ

- Email: help@quidmarket.com

Review: ★★★★☆

“Applied directly no junk emails or hidden steps. Super clean process.”

9. OMACL Loans – “Your Money, When You Need It Most”

OMACL Loans has made a name for itself with its fast application system and discreet service. Operating fully online, the lender provides quick decisions and even weekend approvals. With a straightforward cost calculator and same-day transfers, it’s popular among shift workers and freelancers.

Standout Feature

24/7 availability with weekend approvals.

Ideal Match

Perfect for gig workers and freelancers.

Pricing: APR up to 1,292%; calculator available on site.

- Website: www.swiftsterling.co.uk

- Phone: 020 3322 9103

- Address: 50 Liverpool St, London EC2M 7PY

- Email: info@swiftsterling.co.uk

Review: ★★★★☆

“They approved my loan at 10pm on a Saturday absolute lifesaver!”

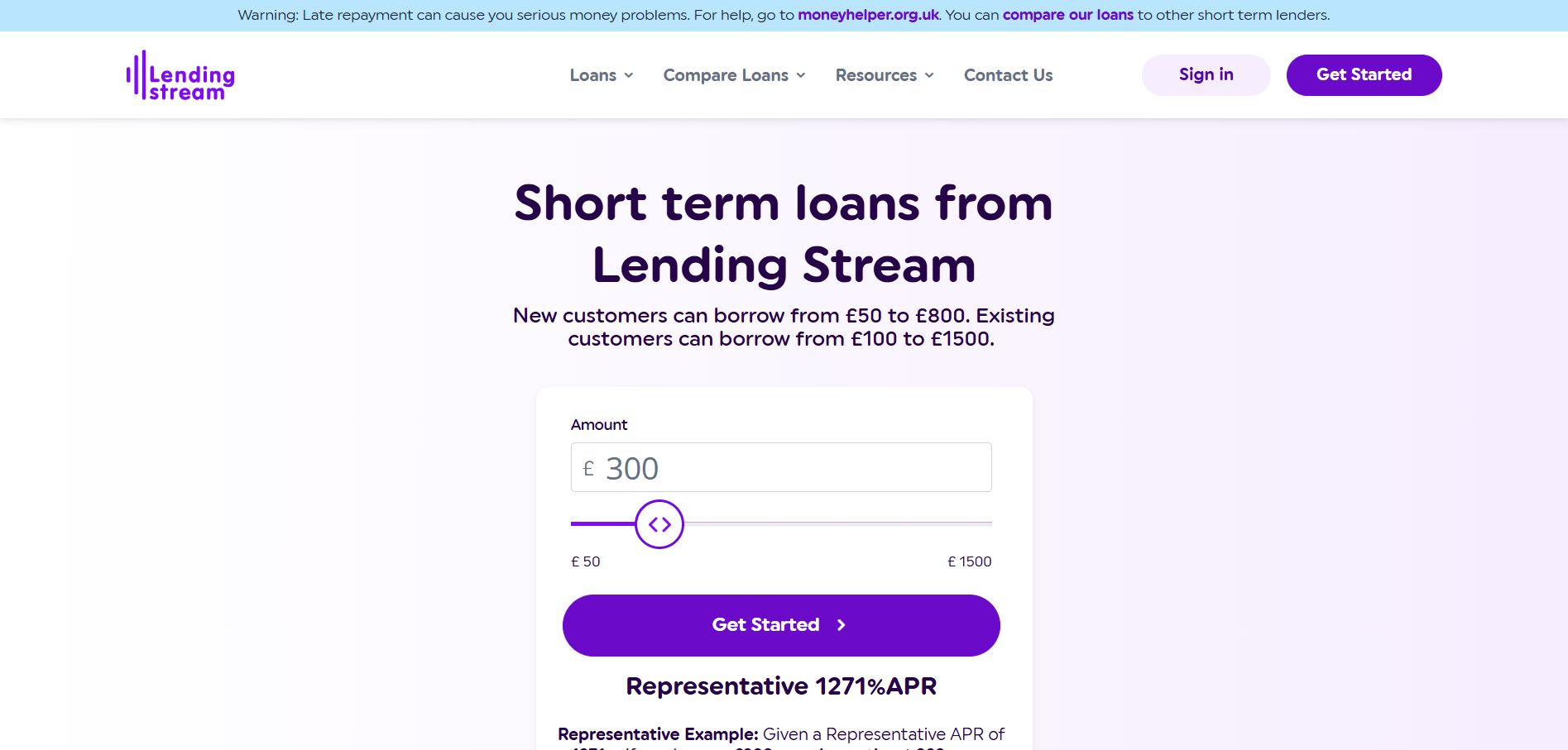

10. Lending Stream – “Streamlined Loans in Minutes”

Lending Stream is one of the fastest-growing payday lenders in the UK, known for its quick and fully digital process. Borrowers can apply in minutes, receive funds the same day, and repay in up to six instalments. Their unique repayment structure offers flexibility without overwhelming users financially.

Primary Strength

Combines speed with structured repayment.

Most Helpful For

Borrowers seeking instalment options over lump-sum repayment.

Pricing: Typical APR around 1,333%; detailed repayment table provided.

- Website: www.lendingstream.co.uk

- Phone: 0203 808 4440

- Address: Unit 320, Metal Box Factory, 30 Great Guildford St, London SE1 0HS

Review: ★★★★☆

“Signed up during a commute loan was approved before I got off the train. Super efficient!”

What Types of Payday Loans Are Available in London?

Single Repayment Loans

These are traditional payday loans that require full repayment on the borrower’s next payday. They’re ideal for individuals who need a small amount of money for a very short period.

Instalment Loans

Instalment loans allow borrowers to repay over several months, typically 3 to 6. These are suitable for larger borrowing amounts or individuals who prefer more manageable monthly payments.

No Credit Check Loans

Some lenders offer payday loans without a hard credit check, instead assessing affordability based on current income. While convenient, they often come with higher interest rates.

Are Same-Day Payday Advance Services in London Reliable?

How Same-Day Loans Work

Same-day payday loans are designed to provide funds within hours of approval. Applications are usually submitted online, verified electronically, and funds are disbursed directly to the borrower’s bank account.

Trusting Reputable Lenders

Reliability depends largely on the lender’s reputation. FCA-authorised companies like Mr Lender, Cashfloat, and Satsuma Loans have consistently delivered quick funding and transparent terms.

Factors That Impact Approval Time

Factors such as time of application, verification document readiness, and bank processing speed can all affect how quickly the funds are received.

What Should You Consider Before Choosing a Payday Loan Provider?

The Real Cost of the Loan

Always review the APR, total repayment amount, and any fees associated with late payments or early settlement. Even if a lender advertises low daily rates, the total cost can be significant over time.

Customer Reviews and Testimonials

Reading customer reviews provides insight into how the company operates in real-life situations. Look for consistent feedback regarding responsiveness, clarity, and customer support.

Repayment Support Options

The best companies offer flexible repayment terms or assistance for those who may struggle. Having these support systems in place can make a big difference if financial situations change unexpectedly.

What Are the FCA Rules on Payday Lending in London?

Interest Rate and Fee Caps

The FCA limits interest to 0.8% per day, capping total repayment at no more than twice the borrowed amount. Default charges are also capped at £15.

Transparency and Fairness

Lenders must provide clear explanations of repayment schedules, interest rates, and any associated fees. Any deviation can lead to sanctions or licence revocation.

Cooling-Off Period and Complaints

Borrowers have a 14-day cooling-off period to cancel a loan without penalties. If issues arise, consumers can file complaints directly with the lender or escalate to the Financial Ombudsman Service.

What Are the Risks of Using Payday Advance Services in London?

The Debt Cycle Risk

Failing to repay on time can lead to a cycle of re-borrowing, where new loans are taken to repay previous ones. This is a common issue among borrowers who lack a repayment plan.

Potential Damage to Credit Scores

Late or missed payments can be reported to credit bureaus, impacting the borrower’s credit profile and reducing future access to more affordable loan options.

High Interest in the Long-Term

Even with FCA rules, payday loans remain an expensive form of credit. Borrowers should always explore alternatives before committing.

What Alternatives Exist to Payday Advance Companies in London?

Credit Unions

Credit unions offer small loans at lower interest rates and may provide financial counselling. They’re a community-focused alternative to payday lenders.

Budgeting Loans from the Government

Those on benefits may qualify for interest-free Budgeting Loans from the Department for Work and Pensions (DWP), which are designed to cover essential or unexpected costs.

Employer-Sponsored Advance Schemes

Some employers now offer salary advances as part of financial wellness programmes. These are often interest-free and deducted from future wages.

Overdraft Extensions

Bank overdraft facilities, while also subject to interest, often come at a lower cost and may offer more flexibility than payday loans.

Conclusion

The payday lending industry in London has evolved significantly under FCA regulation. While still a high-cost credit option, payday loans are now more transparent and better regulated than ever before.

Choosing the best payday advance company means focusing on FCA compliance, transparent terms, good customer feedback, and speed of service.

Whether you’re considering Wonga, Cashfloat, or Mr Lender, ensure that the lender matches your financial needs and offers fair terms. And always consider alternative financial solutions before turning to high-interest borrowing.

FAQs About Best Payday Advance Companies in London

Can I get a payday loan in London if I have poor credit?

Yes, many payday lenders offer loans to individuals with poor credit histories. They often assess affordability more than traditional creditworthiness.

How much can I borrow from a payday advance company in London?

First-time borrowers may be limited to £100–£300, while returning customers can borrow up to £1,000 depending on the lender’s policies.

Are payday loans legal and regulated in London?

Yes, all payday lenders must be registered with the Financial Conduct Authority (FCA) and adhere to UK lending laws.

Is it safe to apply for a payday loan online?

Yes, but only if you’re dealing with an FCA-authorised lender. Always verify their credentials before sharing personal or banking information.

What happens if I miss a repayment?

You may be charged a default fee (maximum £15) and the missed payment may be reported to credit agencies, affecting your credit score.

Can I repay my payday loan early?

Yes, most lenders allow early repayment and may reduce interest charges as a result. Always check terms in your loan agreement.

What’s the best way to compare payday lenders in London?

Look at interest rates, customer reviews, and FCA registration status. Comparing these factors can help you choose a safe and affordable lender.