As the cost of living in London continues to rise, more people are turning to digital financial solutions for short-term borrowing. The demand for fast, flexible, and secure loans has given rise to a competitive market of online loan companies. These lenders offer Londoners a convenient way to access credit without the lengthy paperwork or waiting times associated with traditional banks.

But not all online lenders are created equal. With so many options available, finding a trusted, FCA-authorised provider that offers fair rates and flexible repayment terms can be challenging. In this guide, we explore the top 10 online loan companies in London, helping you make an informed decision when you need it most.

What Makes an Online Loan Company Stand Out in London?

A standout online lender in London is one that combines convenience with trust. In a market where speed is everything, the ability to offer quick loan approvals through a streamlined digital process sets certain companies apart. However, speed alone isn’t enough.

Reputable lenders are transparent about their fees, interest rates, and repayment terms. They are also registered with the Financial Conduct Authority (FCA), ensuring they operate within strict regulatory guidelines. Customer service also plays a crucial role borrowers should have access to support if any issues arise, especially when repayments become challenging.

Perhaps most importantly, standout companies provide flexible options that serve a broad range of borrowers, including those with limited or poor credit histories.

Which Are the Top 10 Online Loan Companies in London?

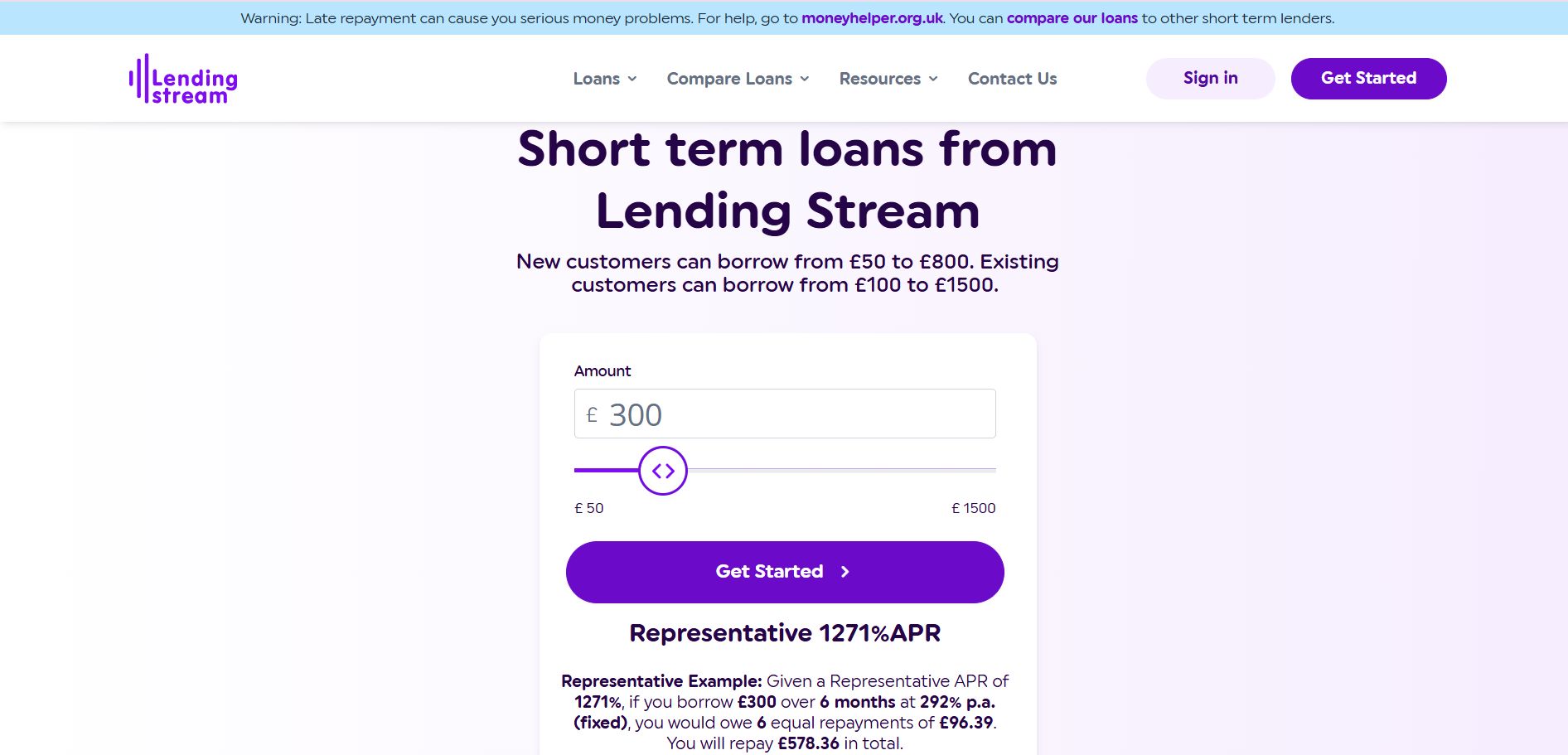

1. Lending Stream – “Loans in Minutes, Not Days”

Lending Stream is one of the fastest online lenders in the UK, offering loans around the clock through a simple digital platform. It allows users to borrow up to £800 and repay in six monthly instalments. Known for its near-instant approval process, many customers receive their funds within 90 minutes.

The service is ideal for emergencies and short-term cash needs. Lending Stream operates transparently, showing total repayment costs upfront before agreement. It’s FCA-authorised and reports to credit bureaus, supporting credit score improvement if repayments are made on time. With its responsive customer support, it continues to be a favourite among Londoners.

Strength

Rapid digital loan processing

Recommended For

Quick, short-term financial fixes

- Website: https://www.lendingstream.co.uk/

- Phone: 0203 808 4440

- Address: 8th Floor, 1 Westferry Circus, London E14 4HD

- Email: support@lendingstream.co.uk

Review: ★★★★☆

“Very fast service when I needed it most—money was in my account within the hour.”

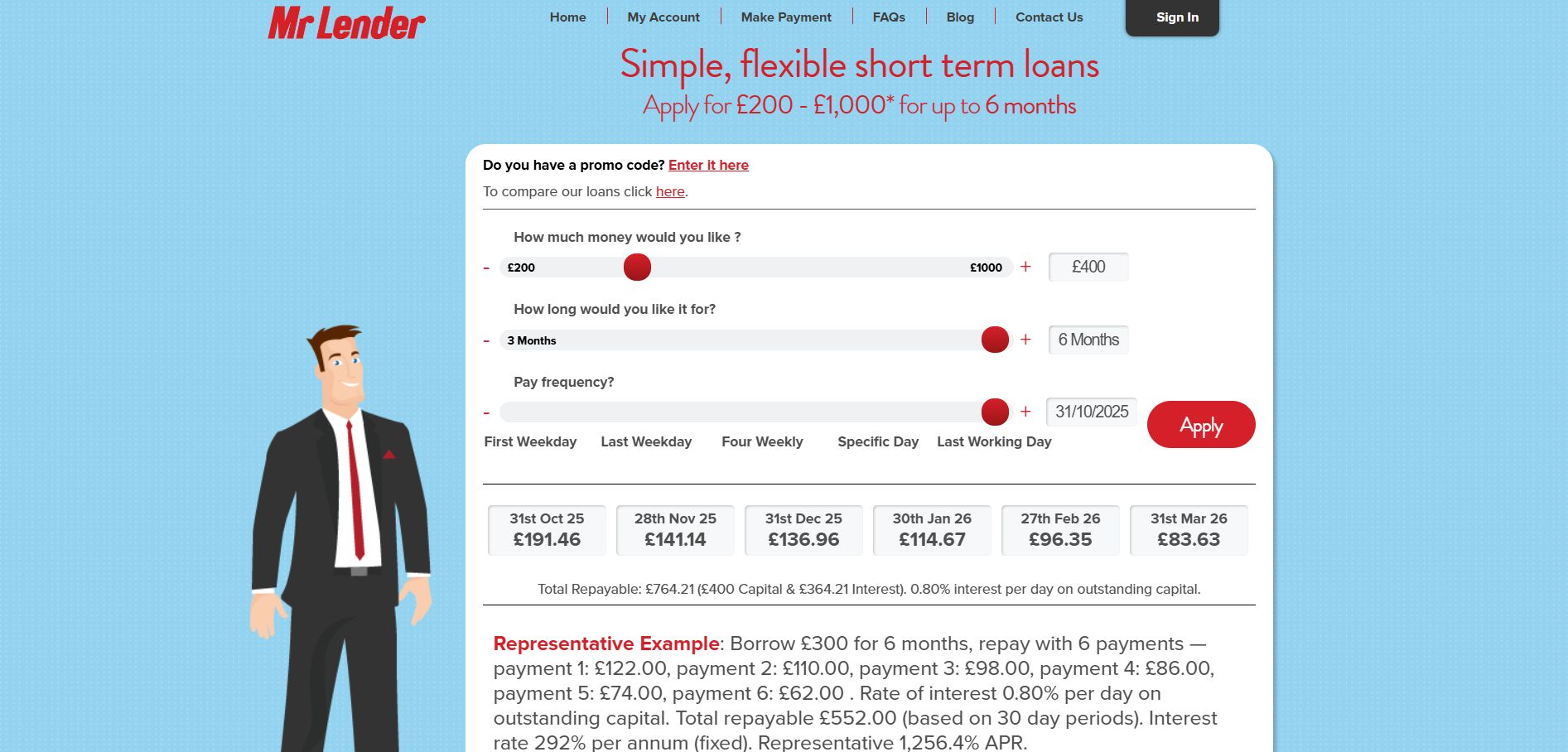

2. Mr Lender – “Your Trusted Short-Term Loan Provider”

Mr Lender is a well-established UK lender focused on short-term personal loans with a customer-first approach. Borrowers can access amounts ranging from £200 to £1,000 over 3 to 6 months.

The lender is known for working with customers who have limited or poor credit history. Their UK-based support team offers a high level of service and clarity throughout the borrowing process. Mr Lender does not charge hidden fees and provides flexible repayment dates.

Every application is assessed individually, with affordability and transparency in focus. It’s one of the most accessible options for Londoners with less-than-perfect credit.

Advantage

Ethical, customer-first lending model

Ideal For

Applicants with limited or poor credit history

- Website: https://www.mrlender.com/

- Phone: 0208-532-1969

- Address: Mr Lender, PO Box 366, Loughton, Essex, IG10 9EW

- Email: Contact form

Review: ★★★★☆

“Really helpful staff and a smooth process—I got a loan even with a low credit score.”

3. Oakam – “Community Lending with a Personal Touch”

Oakam is a digital-first lender offering inclusive credit services to underserved communities in London. The company’s mobile app enables full loan management, including applying, tracking, and repaying. It caters especially to new immigrants and individuals rebuilding their credit history. Oakam also provides a reward programme for on-time repayments, supporting financial growth.

Multilingual support makes the service accessible to a wide range of borrowers. The application process is simple, and the loan terms are tailored to affordability. Oakam is FCA-regulated and well-regarded for its ethical approach to lending.

Focus Area

Financial inclusion for underserved communities

Most Suitable For

New immigrants and those rebuilding financial history

- Website: https://www.oakam.com/

- Phone: 0203 917 37 37

- Address: 483 Green Lanes, London N13 4BS

- Email: support@oakam.com

Review: ★★★★☆

“They gave me a chance when no one else would. App is very easy to use and payments are clear.”

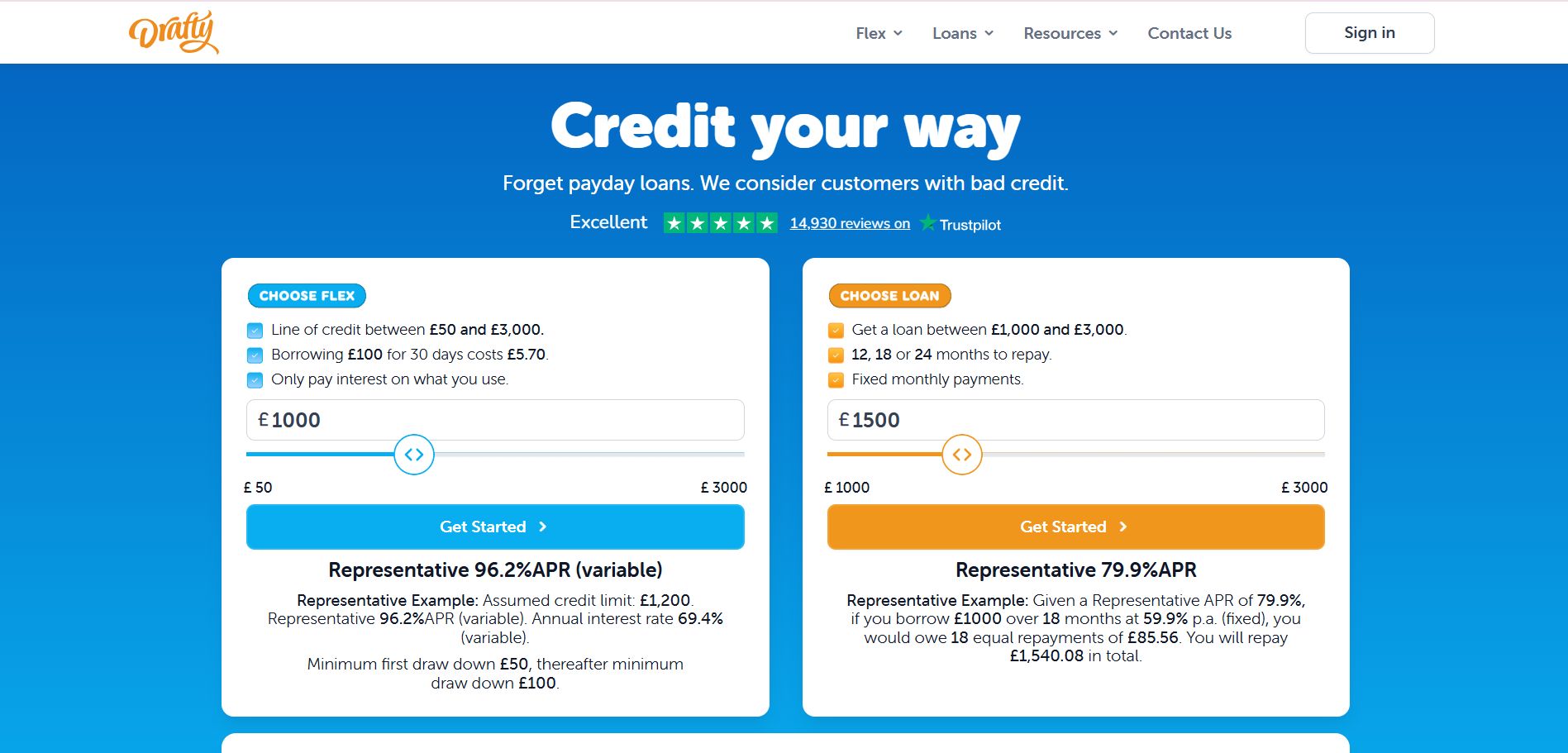

4. Drafty – “A Smarter Alternative to Payday Loans”

Drafty offers an on-demand credit line rather than a traditional loan, perfect for managing flexible or unpredictable cash flow. Once approved, customers can withdraw funds as needed and repay only what they use. Interest is charged daily, but only on the balance withdrawn.

There are no application or maintenance fees, making it more economical for short-term use. The platform is optimised for mobile users and provides instant access to funds. Borrowers can repay early without penalties. Drafty’s model gives users complete control over borrowing frequency and amounts.

Unique Selling Point

Revolving credit access without rigid repayment dates

Preferred User

People who need occasional top-ups rather than fixed-term loans

- Website: https://www.drafty.co.uk/

- Phone: 0203 695 8072

- Address: 8th Floor, 1 Westferry Circus, London E14 4HD

- Email: support@drafty.co.uk

Review: ★★★★☆

“Really convenient when I need a quick boost only pay interest on what I actually use.”

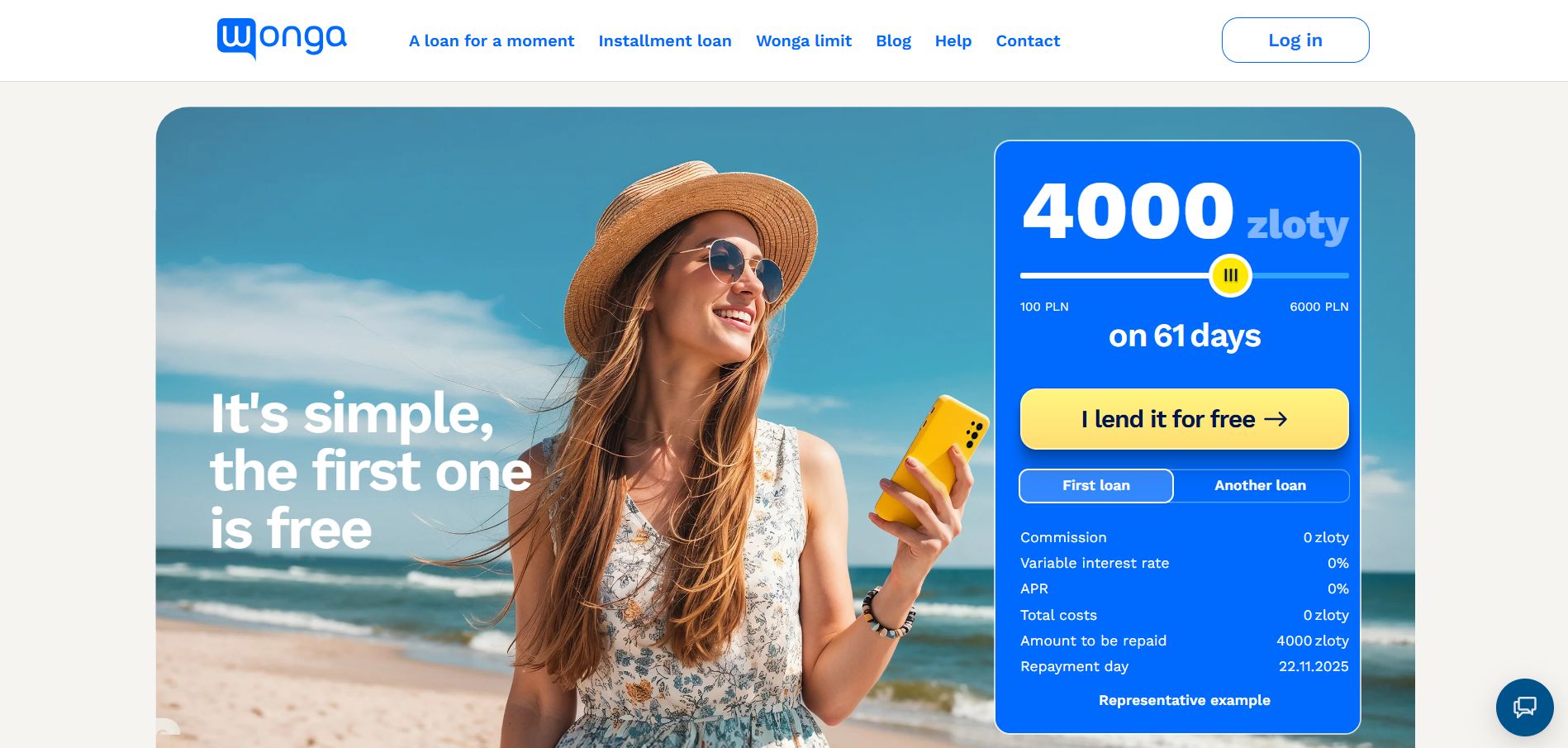

5. Wonga – “Fast Loans, Clear Costs”

Wonga has returned to the lending market with a new commitment to responsible, transparent lending. It allows users to borrow smaller amounts for short terms, usually up to 3 months. The loan calculator shows total repayment before applying, helping borrowers understand the full cost.

Wonga is now stricter with affordability checks, ensuring customers don’t borrow more than they can repay. Their application and approval process is entirely online and designed for speed. Despite its controversial past, the new Wonga operates within FCA guidelines. It’s suitable for emergency expenses with a focus on clarity and control.

Edge

Highly visual, user-friendly application interface

Target Audience

Borrowers looking for clarity and short-term borrowing

- Website: https://www.wonga.pl/

- Phone: 22 388 88 88

- Address: 88 Crawford Street, London W1H 2EJ

- Email: kontakt@wonga.pl

Review: ★★★☆☆

“Easy to apply and quick payout. Just wish the APR wasn’t so high.”

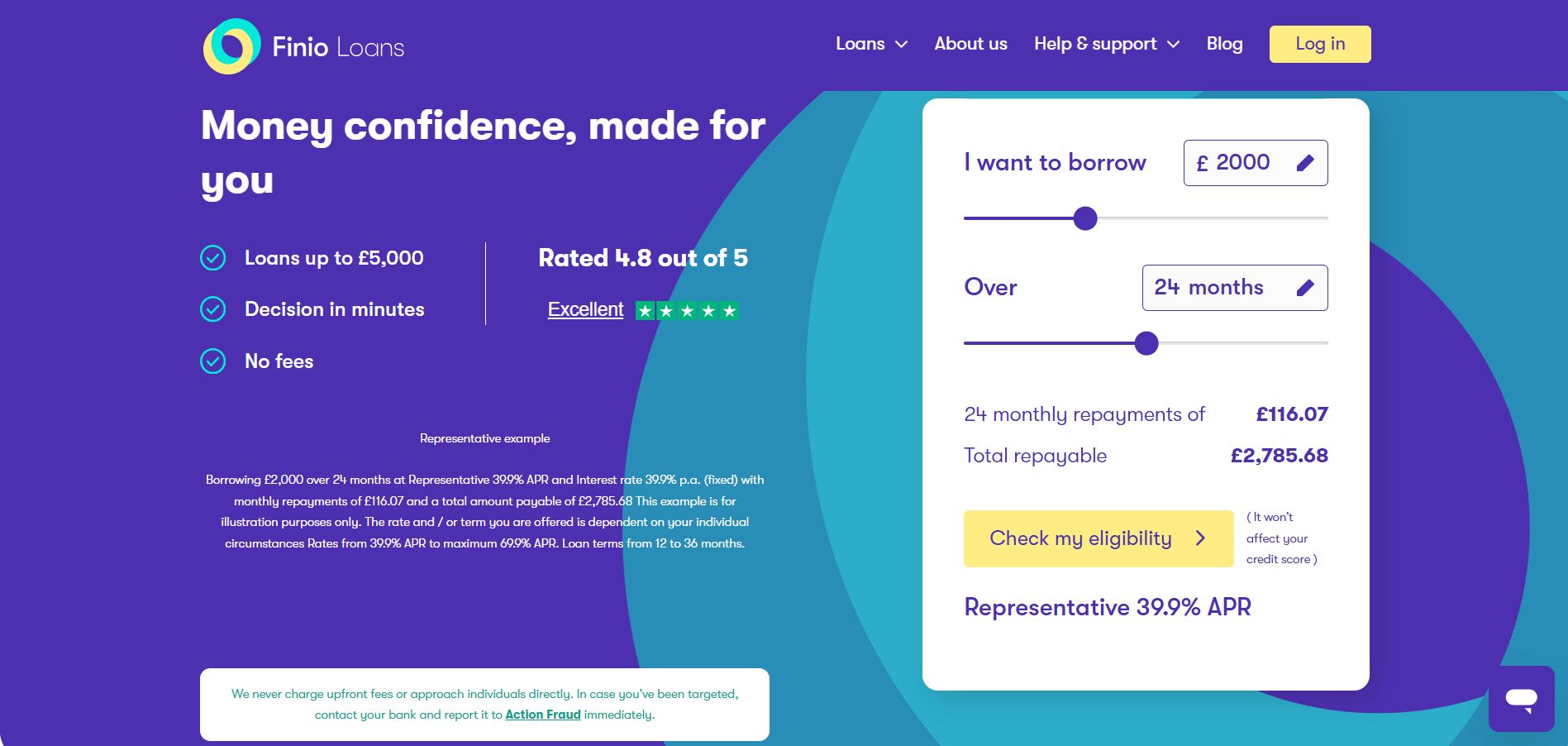

6. FiniO Loans – “Fast, Fair, and Flexible Lending”

FiniO Loans is a UK-based direct lender providing short-term loans with a strong focus on affordability and responsible lending. Customers can borrow from £100 to £1,000, repaid over 3 to 6 months, with transparent pricing and no hidden fees.

The application is fully online and typically takes just minutes to complete. FiniO performs thorough affordability checks and offers decisions quickly, making it suitable for urgent financial needs.

They also offer clear repayment schedules and FCA compliance for added trust. Customers can manage their loans through a user-friendly online account portal. FiniO is committed to lending that works for real people in real situations.

Edge

Short-term credit with no hidden surprises

Great Option For

Borrowers seeking simple, quick loans with flexible terms

- Website: https://finioloans.com/

- Phone: 0333 577 1230

- Address: FiniO Loans, PO Box 13242, Harlow, CM20 9BY

- Email: customerservice@finioloans.com

Review: ★★★★☆

“Really fast application and approval. Everything was explained clearly from start to finish.”

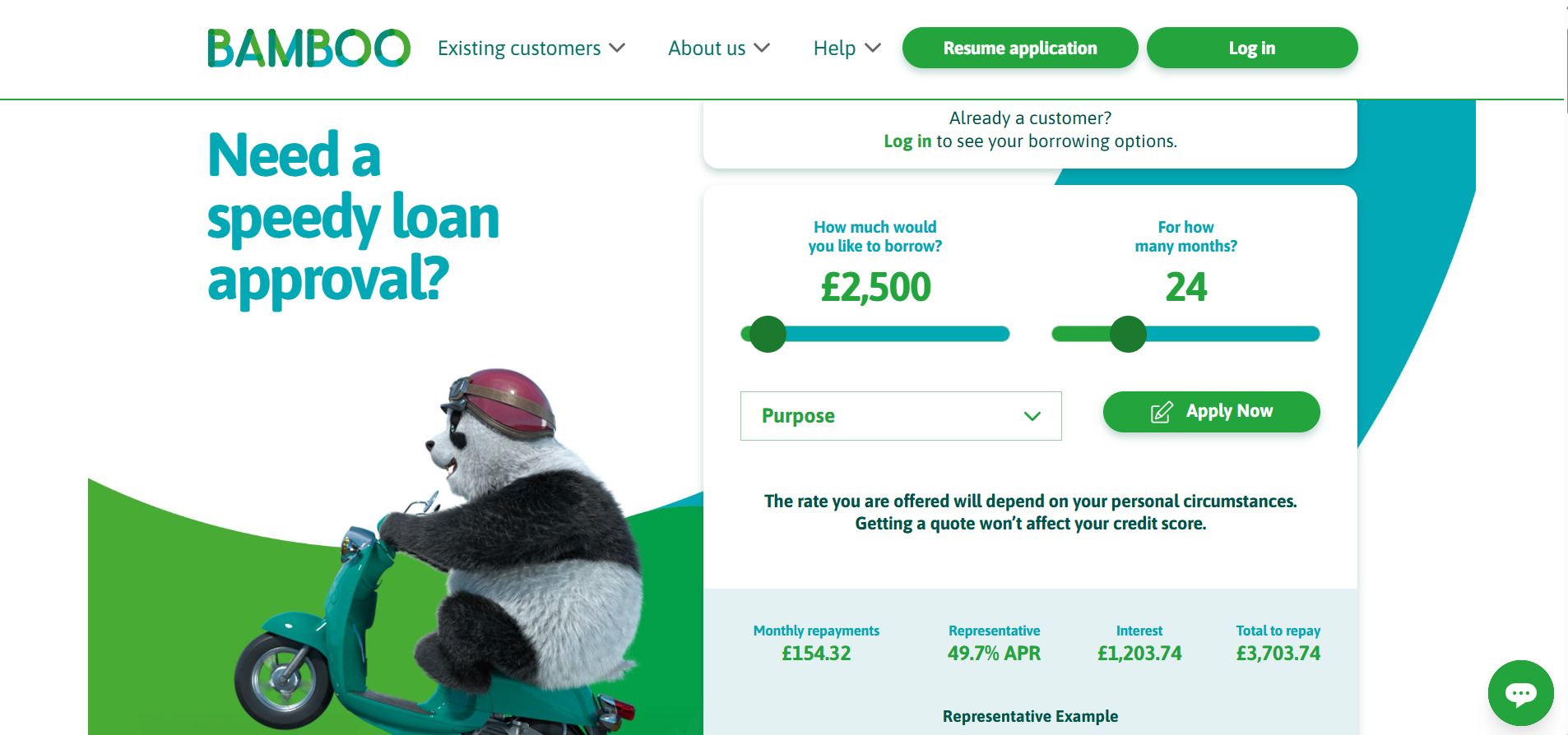

7. Bamboo Loans – “Affordable Loans That Work for You”

Bamboo Loans is an award-winning online lender that specialises in offering personal and guarantor loans to a wide range of UK borrowers. Whether you have an excellent credit score or are trying to rebuild your financial reputation, Bamboo provides borrowing options from £1,000 to £8,000, repayable over 12 to 60 months.

Their process includes a soft credit check during pre-qualification, so applicants can explore options without affecting their credit rating. Bamboo is well-regarded for its customer support, transparent terms, and quick decisions.

The online portal is intuitive, allowing customers to manage their loans easily. With a reputation for fair lending, Bamboo is a smart choice for Londoners seeking flexible mid-size loans.

Standout Feature

Soft check pre-approval with fast decision turnaround

Great Match For

People needing larger loans with flexible credit history requirements

Pricing: Representative APR 59.7%

- Website: https://www.bambooloans.com/

- Phone: +44 330 159 6010

- Address: Bamboo Ltd, Floor 2, Arena Business Centre, Threefield Lane, Southampton, SO14 3LP

- Email: customer@bambooloans.com

Review: ★★★★☆

“Bamboo was clear, fast, and offered me a fair rate even with my credit history. Highly recommend!”

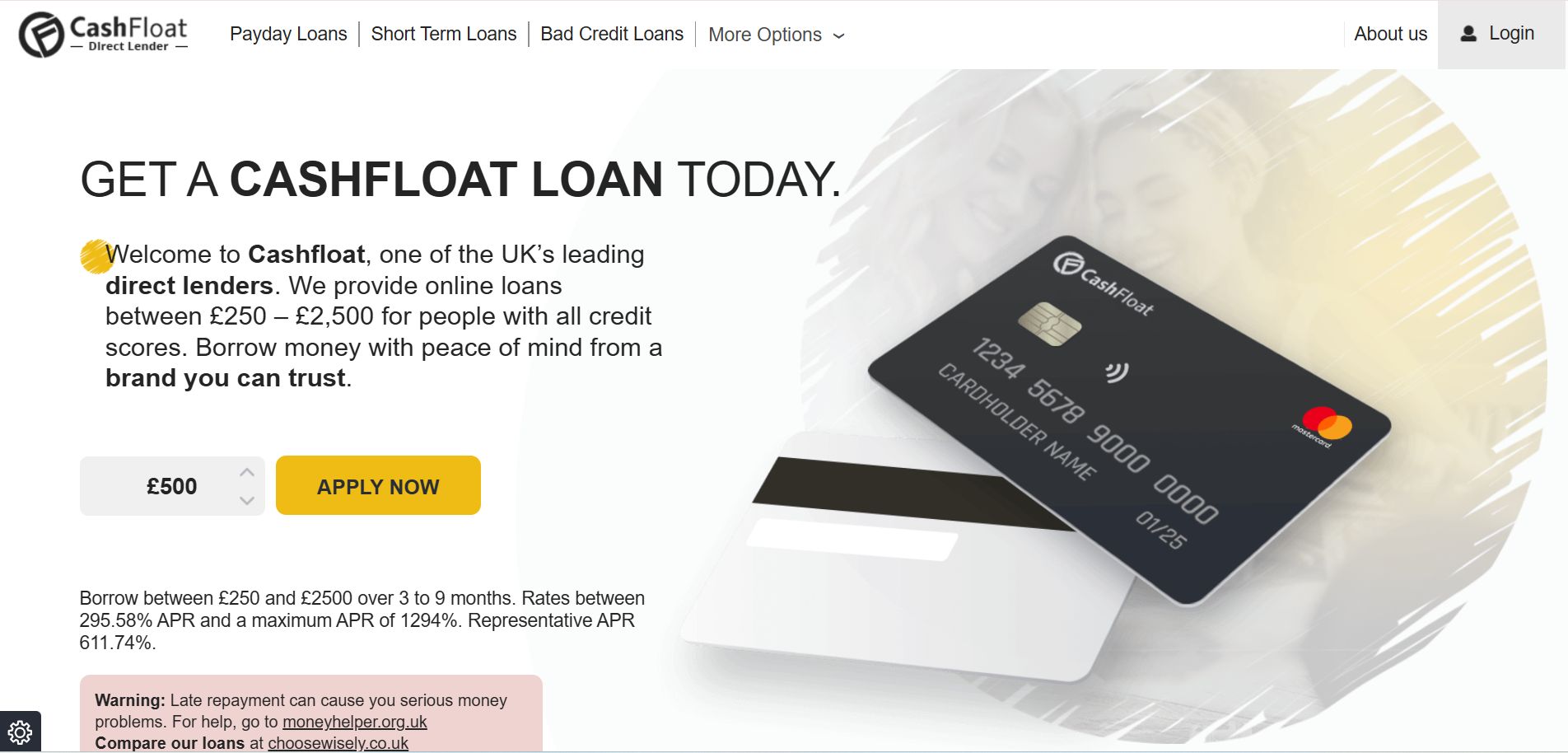

8. Cashfloat – “Emergency Loans Without the Stress”

Cashfloat is an online direct lender offering small loans for unexpected expenses. Borrowers can apply for loans from £300 to £1,100, with repayment periods between 3 and 9 months. The company prides itself on fair lending, clear pricing, and a fully online application process. They also offer educational resources to help users manage debt responsibly.

Cashfloat performs a soft credit check during pre-qualification, making it safer to explore without affecting your credit score. Customer reviews praise their honesty and easy-to-understand terms. They are regulated by the FCA and operate a secure digital platform.

Special Attribute

Transparent borrowing backed by educational resources

Recommended Customer

Borrowers seeking fair, no-surprise short-term loans

- Website: https://www.cashfloat.co.uk/

- Phone: 0203 757 1933

- Address: 2a Highfield Avenue, London NW11 9ET

- Email: info@cashfloat.co.uk

Review: ★★★★☆

“One of the few lenders that actually explains everything in plain English felt confident borrowing.”

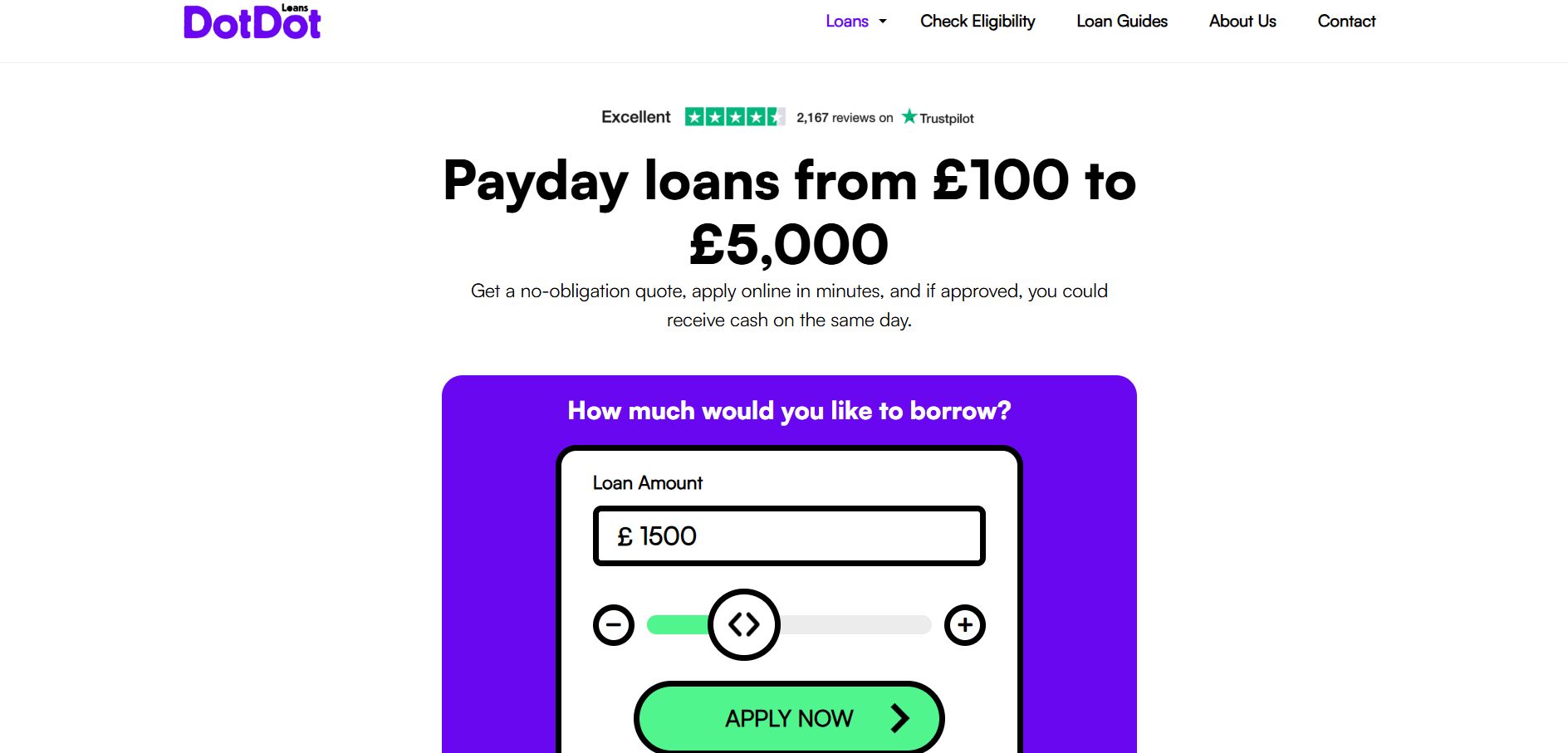

9. Dot Dot Loans – “Borrowing Made Straightforward”

Dot Dot Loans is part of the Provident Financial Group and focuses on straightforward lending with fixed monthly repayments. Borrowers can choose loan amounts from £100 to £5,000, with terms ranging from 3 months to 48 months. Everything is explained upfront—no surprises or hidden charges.

Their customer portal makes it easy to manage payments and view schedules. The lender caters to both short-term and long-term needs. They offer a responsible, fair, and regulated lending process, and their UK-based customer service receives strong feedback.

Key Feature

Structured repayments with full cost transparency

Good Match For

Those who want predictability in loan terms and budget planning

Pricing: Short-term APR: 939.5%, Long-term APR: 89.9%

- Website: https://www.dotdotloans.co.uk/

- Phone: 0333 240 6215

- Address: Dot Dot Loans, Provident Financial, No. 1 Godwin Street, Bradford BD1 2SU

- Email: hello@dotdotloans.co.uk

Review: ★★★★☆

“Clear repayment plan and no surprise fees. Good experience from start to finish.”

10. Pixie Loans – “Quick Loans with a Touch of Magic”

Pixie Loans is a UK-based short-term credit broker, specialising in helping customers connect with trusted lenders across the country. Rather than lending directly, Pixie Loans works with a panel of FCA-regulated lenders to offer loan options ranging from £100 to £5,000. The application process is fast and completely online, with instant decisions and no paperwork required.

Pixie Loans is particularly helpful for people who have been declined elsewhere, as they match applicants to lenders based on real-time eligibility. The platform uses smart algorithms to assess affordability, ensuring that borrowers only receive offers they’re likely to qualify for. With no fees to apply and no impact on your credit score from the initial search, Pixie Loans offers a stress-free borrowing experience.

Edge

Smart loan-matching service that compares options instantly

Great Option For

Borrowers wanting quick comparisons from multiple FCA-approved lenders

Pricing: Varies by lender; Pixie is a broker, not a direct lender

- Website: https://www.pixieloans.co.uk/

- Phone: 020 8089 3123

- Address: Pixie Loans, Kemp House, 160 City Road, London EC1V 2NX

- Email: support@pixieloans.co.uk

Review: ★★★★☆

“Super fast and no hassle found a lender even though my bank said no. No hidden fees at all.”

How Do Online Loan Companies in London Handle Bad Credit Borrowers?

Many of London’s online lenders are designed to be inclusive, offering loans to those with poor credit or limited financial history. Instead of relying solely on credit scores, these companies look at an applicant’s income, spending habits, and overall affordability.

Some, like Mr Lender and Amigo, specialise in serving this demographic. Guarantor loans, in particular, allow bad credit borrowers to access funds if someone trustworthy agrees to co-sign the loan. These models ensure more people can access financial support when needed, without being penalised for past financial mistakes.

Are These Online Loan Companies FCA Authorised and Legit?

Every lender mentioned in this guide is authorised by the Financial Conduct Authority (FCA). This means they are legally allowed to operate in the UK and must follow regulations that protect borrowers from unfair practices.

To verify a lender’s credentials, you can search the FCA Register online. Avoid any loan provider that asks for upfront fees, has no verifiable business address, or uses pressure tactics. Legitimate lenders are always clear about who they are, what they charge, and how you can contact them.

What Type of Loans Can You Get Online in London Today?

Online lenders in London offer a wide range of products to suit different financial needs. This includes short-term payday loans, personal loans for larger amounts, and instalment loans that let you repay over several months. Some companies also offer revolving credit lines or guarantor loans, catering to borrowers with more complex credit situations.

Whether you’re dealing with an unexpected expense or planning a significant purchase, there’s likely an online loan product that can help.

How Fast Can You Get Approved by an Online Lender in London?

Speed is one of the biggest advantages of borrowing online. Most of the top lenders in London offer near-instant decisions after you complete your application. If approved, funds can be transferred within a couple of hours, depending on your bank.

Lenders like Lending Stream and Wonga are known for their ultra-fast payout times, while others, such as Oakam or Amigo, may take a bit longer depending on verification or guarantor approval.

What Are the Common Eligibility Criteria to Apply Online?

To apply for a loan online, you typically need to be at least 18 years old and a resident of the UK. A regular source of income is also required, although self-employment or benefits may be considered depending on the lender.

You’ll need a UK bank account, a valid mobile number, and an email address. Some lenders run a soft credit check initially, so applying won’t affect your credit score unless you proceed.

How Do Interest Rates Compare Among Online Loan Companies?

Interest rates vary significantly depending on the lender and the type of loan. Short-term loans often come with higher APRs due to the increased risk and short repayment windows. However, many companies now offer transparent pricing structures that help borrowers see the total cost of the loan upfront.

For example, guarantor loans such as those from Amigo have lower APRs compared to payday loans but require another person to co-sign. Meanwhile, Drafty and Dot Dot Loans offer moderate rates with flexible borrowing terms.

What Should You Watch Out for When Choosing an Online Lender?

When selecting a lender, it’s crucial to look beyond just the approval speed. Always check for hidden fees, such as early repayment penalties or setup charges. Make sure the lender is FCA-authorised and read the terms and conditions carefully.

It’s also a good idea to read customer reviews on independent platforms like Trustpilot. These insights can help you avoid scams and identify any issues other borrowers have faced.

Conclusion

Finding a reliable online loan company in London doesn’t have to be overwhelming. The top 10 lenders listed above each bring something unique whether it’s fast approval, support for bad credit, or flexible repayment options.

With FCA regulation and a focus on transparency, these companies offer a secure way to borrow when life throws you the unexpected. Always compare your options carefully and borrow responsibly to protect your financial well-being.

FAQs About Online Loan Companies in London

What is the minimum credit score needed for an online loan in the UK?

Many lenders don’t set a specific minimum score. Instead, they assess your affordability, income, and past borrowing behaviour to make a decision.

Are online loans safe and secure in London?

Yes, as long as you choose a provider that is FCA-authorised. These companies are required to follow data protection and responsible lending rules.

Can you get a loan without a guarantor online?

Absolutely. Most online lenders in London offer unsecured loans that don’t require a guarantor, especially for lower loan amounts.

What documents are required to apply for a loan online in the UK?

You’ll typically need proof of ID, income verification (such as payslips or bank statements), and a valid UK bank account.

How soon can funds be transferred after loan approval?

In many cases, funds are transferred within 15 minutes to 2 hours. This varies depending on the lender and your bank.

Are there online lenders that work with freelancers or self-employed?

Yes, some lenders consider self-employed income, although you may need to provide additional documents to prove earnings.

What’s the best way to compare online loan rates in London?

Using comparison tools or reviewing APRs directly on lender websites is effective. Always calculate the total cost of repayment before committing.