In a bustling city like London, owning a vehicle often becomes more of a necessity than a luxury. But for many, the upfront cost of purchasing a car can be a significant hurdle. That’s where auto finance companies come into play.

With the demand for flexible and accessible car financing options on the rise, it’s more important than ever to choose a provider that not only offers competitive rates but also aligns with your financial situation and lifestyle.

This blog takes a closer look at the top 10 best auto finance companies in London, based on public reviews, reputation, customer service, and overall accessibility. Whether you’re a first-time car buyer or looking to upgrade your vehicle, this guide will help you make an informed decision.

What Makes an Auto Finance Company the Best in London?

Auto finance is not just about getting a loan. it’s about choosing a reliable partner who understands your financial goals. The best car finance companies in London stand out because they offer more than just loans. They provide personalised guidance, flexible repayment terms, and a transparent approval process that considers more than just your credit score.

These companies are also known for their responsiveness, digital accessibility, and ability to cater to different customer profiles, including those with less-than-perfect credit histories. Ultimately, what makes an auto finance provider the best is not just the rate they offer, but how they treat their customers throughout the financing journey.

Which Are the Top 10 Auto Finance Companies in London?

1. CarFinance 247 – Driving Finance Forward

CarFinance 247 is one of the UK’s most recognised auto finance brokers, offering a smooth online experience and access to a wide panel of lenders. Their platform allows customers to get pre-approved before shopping, and each applicant is assigned a dedicated account manager who handles every part of the process.

The company also enables customers to browse car listings directly, simplifying the experience. CarFinance 247 appeals to buyers with all types of credit histories and offers flexible repayment terms. Its digital-first model is well suited for the fast-paced lifestyle of Londoners.

Applicants appreciate the clear terms and quick turnaround. This makes it one of the best choices for people seeking full control over the finance journey.

Area of Expertise

Combines digital technology with personalised human support for efficient financing.

Ideal For

Customers seeking a quick, fully online finance and vehicle selection process.

Pricing: Rates from 6.9% APR, depending on credit profile

- Website: carfinance247.co.uk

- Phone: +44 333 247 1247

- Address: Universal square, Devonshire St N, Manchester M12 6JH, UK

- Email: info@carfinance247.co.uk

Review: ★★★★☆

“Excellent service and a very quick process from start to finish.”

2. Zuto – Car Finance, Made Clear

Zuto simplifies the car finance process by helping applicants compare tailored loan options from a large network of lenders. The company positions itself as a broker, guiding customers through the complexities of applying and securing vehicle finance. What makes Zuto unique is its focus on customer education and clear communication throughout.

They work directly with trusted dealerships, providing added assurance during the purchase. Whether you’re buying your first car or upgrading, Zuto makes the process easy. Their London customers often praise them for reliability and transparency. For those who value informed decision-making, Zuto is an ideal choice.

Primary Strength

Offers tailored loan comparisons with excellent support from start to finish.

Suitable For

Buyers wanting assistance from brokers and access to dealership partnerships.

Pricing: APR ranges from 7.9% to 24.9%, based on applicant criteria

- Website: zuto.com

- Phone: +44 1625 619944

- Address: Winterton House, Winterton Way, Macclesfield,SK11 0LP

- Email: info@zuto.com

Review: ★★★★★

“Great communication and smooth experience highly recommended.”

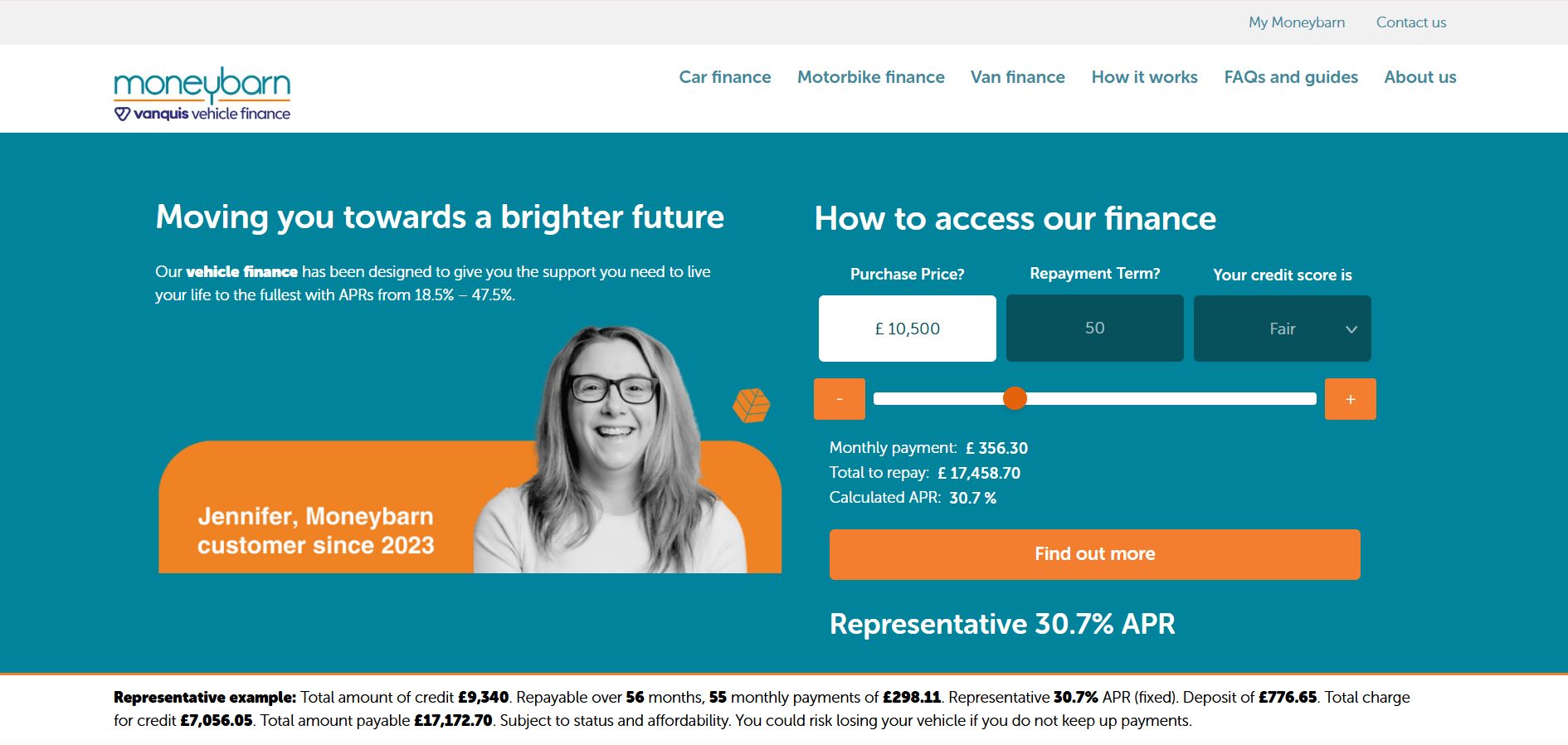

3. Moneybarn – Finance for Real People

Moneybarn has built a solid reputation for offering finance solutions to people who may be overlooked by mainstream lenders. As a specialist in non-prime lending, they provide options for customers with poor or limited credit histories. The application process is straightforward, and approvals are often based on affordability rather than just credit score.

The company is part of the Provident Financial Group and is authorised by the FCA. Their experience in subprime lending makes them a trusted option in London, especially for those who need a second chance. Customers appreciate their fairness and willingness to listen. It’s a dependable choice for anyone rebuilding their credit profile.

Competitive Edge

Flexible car finance designed specifically for people with adverse credit histories.

Best Suited To

Applicants who have been previously declined by traditional lenders.

Pricing: APR typically between 9.9% and 29.9%

- Website: moneybarn.com

- Phone: 0330 555 1230

- Address: Athene House, Basing View, Basingstoke, RG21 4DZ

- Email: contact@moneybarn.com

Review: ★★★★☆

“Moneybarn helped me when no one else would – forever grateful.”

4. Oodle Car Finance – Smarter Car Finance

Oodle Car Finance brings together fintech efficiency with car dealership partnerships to offer a fully digital finance journey. Their platform allows you to apply, get approved, and manage your loan entirely online. Oodle also helps you source a vehicle, combining finance and purchase in one seamless process.

Customers love the intuitive interface and app-based loan management. Oodle is a strong choice for London drivers who prefer modern tools and quick decisions. Their support team is also noted for being helpful and responsive. It’s a convenient and forward-thinking option for today’s tech-driven consumers.

Notable Speciality

Delivers a tech-focused loan experience through innovative mobile features.

Best Matched For

Tech-savvy individuals seeking speed, efficiency, and real-time updates.

Pricing: APR from 6.5%, varies with credit and vehicle

- Website: oodlecarfinance.com

- Phone: +44 1865 477826

- Address: 2 New Bailey, 6 Stanley Street, Salford, Greater Manchester, M3 5GS

- Email: info@oodlecarfinance.com

Review: ★★★★☆

“Easy app, no paperwork, and fast approval — everything worked perfectly.”

5. Blue Motor Finance – Fast, Flexible Finance

Blue Motor Finance is known for its lightning-fast approval process and its commitment to dealer-backed finance. The company works with a vast network of car dealerships across the UK, making it easy for customers to find and finance a car all in one place.

Their modern systems evaluate applications within seconds, and they cater to a wide range of credit profiles. Blue is especially efficient for used car buyers looking to complete a purchase quickly. Customers in London have praised them for professionalism and speed. For straightforward, dealership-integrated finance, Blue is hard to beat.

Defining Feature

Offers high-speed approvals and robust dealership connectivity.

Good Fit For

People who want a quick, dealership-supported finance solution.

Pricing: APR typically from 7.5%, subject to credit

- Website: bluemotorfinance.co.uk

- Phone: 0203 005 9330

- Address: Darenth House, 84 Main Road, Sundridge, Kent TN14 6ER, United Kingdom

- Email: customerservices@bluemotorfinance.co.uk

Review: ★★★★☆

“Super-fast turnaround drove off with my car the same day.”

6. First Response Finance – Finance with a Human Touch

First Response Finance is a customer-focused company offering vehicle finance for individuals with varied financial backgrounds. They place a strong emphasis on customer care and are widely recognised for respectful treatment of applicants, regardless of their credit history.

The approval process is simple and flexible, with clear explanations at every stage. First Response stands out for its ethical approach and long-term customer support.

Buyers across London consistently highlight their transparency and approachability. For those seeking support and understanding during a challenging financial time, this provider is an excellent option.

Major Attribute

Known for empathetic lending and customer-first communication style.

Well-Matched To

Drivers who value ongoing support and ethical business practices.

Pricing: APR between 10.9% and 29.5%, based on credit

- Website: firstresponsefinance.co.uk

- Phone: +44 115 946 6260

- Address: 2 Sir John Robinson Way, Arnold, Nottingham, NG5 8NS

- Email: marketing@frfl.co.uk

Review: ★★★★★

“Finally a finance company that actually listens and understands.”

7. Close Brothers Motor Finance – Trusted Lending Since 1878

Close Brothers Motor Finance brings decades of industry experience and an unwavering commitment to responsible lending. The company operates through a wide dealership network, offering flexible finance packages for both new and used cars. Their reputation is built on trust, making them a favourite among drivers looking for stability and professionalism.

The application process is handled via approved dealers, and their service is known for its clarity and structure. Many London customers appreciate the face-to-face component and the support of a familiar banking brand. For traditional finance with a modern twist, Close Brothers is a top contender.

Recognised Expertise

Specialises in structured car loans through dealership collaboration.

Great For

Buyers who want personal interaction and a well-established finance provider.

Pricing: Varies depending on dealer and applicant profile

- Website: www.closebrotherspf.com

- Phone: +44 333 321 8566

- Address: 10 Crown Pl, London EC2A 4FT, UK

- Email: customer.services@closemotorfinance.co.uk

Review: ★★★★☆

“Straightforward process with excellent support from the dealership.”

8. Advantage Finance – Simple, Fair Car Finance

Advantage Finance offers straightforward car financing focused on hire purchase agreements. With a strong emphasis on clear communication and competitive rates, they make car finance accessible without overwhelming customers with jargon.

Their approval process is quick, and they are known for working with both first-time buyers and repeat clients. Many London-based applicants appreciate the company’s no-nonsense attitude and fast decisions. It’s a particularly strong option for customers who already know the car they want and need financing to complete the deal.

Unique Capability

Streamlined hire purchase lending with a focus on user clarity.

Most Beneficial For

Buyers wanting fast funding with minimal fuss and strong transparency.

Pricing: Rates usually start from 9.9% APR

- Website: advantage-finance.co.uk

- Phone: 01472 233200

- Address: 11 Ironmonger Lane. London. EC2V 8EY

- Email: enquiries@advantagefinance.co.uk

Review: ★★★★☆

“No confusion, no stress — funds were approved right away.”

9. AA Car Finance – Backed by Britain’s Most Trusted Motoring Brand

AA Car Finance is part of the AA Group, one of the UK’s most recognised motoring organisations. Leveraging its legacy of trust and service, AA Car Finance offers personal car loans through a panel of reputable lenders. Applicants can get a quote without affecting their credit score and receive funds quickly once approved.

The platform caters to both new and used vehicle purchases, and their partnership with highly rated lenders ensures competitive rates for those with good to fair credit. What sets them apart is their reputation for reliability, customer care, and strong after-sales support.

With an easy-to-navigate website and AA-level credibility, it’s a solid choice for London drivers looking for assurance and support throughout the financing process.

Trusted Advantage

Combines the AA’s motoring expertise with handpicked lending partners.

Best Option For

Drivers who want the backing of a trusted national brand with transparent financing.

Pricing: APR from 6.1%, depending on credit and loan type

-

Website: theaa.com/car-finance

-

Phone: 0330 053 0221

-

Address: Fanum House, Basing View, Basingstoke, Hampshire, RG21 4EA

-

Email: carfinance@theaa.com

Review: ★★★★☆

“Smooth experience with a trusted brand. Got a better rate than expected.”

10. Metro Bank Car Loans – Banking on Your Terms

Metro Bank provides simple and transparent personal loans, which many use for car purchases. With fixed monthly payments and no early repayment charges, it’s a flexible solution for customers who value control over their borrowing.

Applications can be completed online or in-branch, and decisions are usually made within 24 hours. The bank is widely appreciated for its customer service and approachable staff. For Londoners already banking with Metro or looking for a recognisable name, this is a practical route to auto finance.

Strong Point

Delivers personal loan options with fixed terms and transparent rates.

Best Fit

Ideal for customers who want traditional bank support with modern convenience.

Pricing: APR from 7.9%, varies with loan size and credit

- Website: metrobankonline.co.uk

- Phone: 0345 08 08 500

- Address: One Southampton Row, London WC1B 5HA

- Email: contact@metrobank.plc.uk

Review: ★★★★☆

“Simple loan setup and great service from the local branch staff.”

How Do Interest Rates Compare Among Top Auto Finance Providers?

Interest rates in the London car finance market can vary widely depending on the provider, your credit profile, and the vehicle being financed. Companies like CarFinance 247 and Oodle tend to offer a range of rates that adjust based on your eligibility. Meanwhile, providers such as Hitachi and Metro Bank usually offer lower fixed rates for those with strong credit histories.

For those with a poor credit score, rates tend to be higher, often starting from around 9% and going up to 30% in some cases. However, many providers mitigate this by offering smaller loan amounts or longer repayment terms, helping borrowers manage affordability. It’s essential to get pre-approved or request a quote before committing, as this gives a clearer picture of the total cost over the loan term.

Are There Auto Finance Companies in London That Accept Bad Credit?

Yes, London has several auto finance providers that cater specifically to customers with bad or limited credit. Moneybarn, First Response Finance, and Advantage Finance all specialise in subprime lending, offering car finance to individuals who may have previously faced rejections.

These companies assess more than just your credit score. Factors such as employment status, current income, and past financial behaviour are taken into account. This holistic approach allows for more inclusive lending, giving people a second chance to rebuild their financial standing while accessing essential transport.

What Are the Differences Between Auto Financing and Car Leasing?

Although both options allow drivers to get behind the wheel without paying the full price upfront, the financial implications are quite different. Auto financing involves borrowing money to purchase a vehicle. Once the loan is paid off, you own the car outright. It’s ideal for those who want long-term ownership and don’t mind higher monthly payments in exchange for future equity.

Car leasing, on the other hand, is more like renting. You pay a monthly fee to use the vehicle for a fixed period, after which the car is returned unless you choose to buy it at a residual value. Leasing often has lower upfront and monthly costs but comes with mileage limits and potential penalties for wear and tear. For drivers who enjoy switching to newer models regularly, leasing can be an attractive option.

Which Auto Finance Providers Offer Online Applications in London?

In today’s digital age, convenience is key. Most of London’s leading auto finance companies now offer fully online applications. Platforms like CarFinance 247, Zuto, and Oodle Car Finance have streamlined their processes to allow users to check eligibility, submit documents, and receive decisions without ever stepping into an office.

This online-first approach not only speeds up the approval process but also improves accessibility for busy Londoners. Even companies that are traditionally more manual, like Close Brothers, have upgraded their digital systems to make remote applications easier.

Are There Special Car Finance Options for Used Vehicles in London?

Used car finance is widely available across London, and many of the city’s top lenders actively promote loans for second-hand vehicles. Providers like Oodle, Blue Motor Finance, and Advantage Finance offer tailored plans for pre-owned cars, often in collaboration with local dealerships.

Financing a used car tends to be more affordable, as the loan amount is lower and depreciation is less of an issue. However, buyers should still conduct due diligence on the vehicle’s condition, and confirm whether the finance company includes any inspections or warranties in their offer.

What Are the Most Trusted Auto Finance Companies Based on Customer Reviews?

Customer feedback plays a vital role in distinguishing top performers in any industry, and auto finance is no exception. First Response Finance consistently receives praise for its supportive staff and fair approach to lending. CarFinance 247 is often highlighted for its smooth application process, while Zuto is recognised for its transparency and efficiency.

These reviews often mention how these companies treat their customers during difficult financial times, which speaks volumes about their service ethics. When a provider balances professionalism with empathy, it earns not just trust but loyalty.

What Documents Do You Need to Apply for Auto Finance in the UK?

Applying for car finance in London is relatively straightforward, but there are some documents you’ll typically need. This includes proof of identity, such as a passport or driving licence, along with proof of income usually recent payslips or bank statements. Lenders also ask for proof of address, such as utility bills or council tax letters.

Having these documents ready in advance can speed up your application. Some providers may also ask for employment details or perform affordability checks to ensure you can manage the monthly payments.

How Is the Future of Auto Financing in London Changing?

The future of auto finance in London is becoming increasingly digital and inclusive. Fintech innovation has allowed companies to improve their credit assessment models, enabling more people to access funding without the long wait times of traditional banks.

At the same time, there’s growing interest in financing electric vehicles (EVs), with some lenders offering lower rates for sustainable options. Expect to see more tailored products, mobile-first experiences, and adaptive lending criteria as the industry continues to evolve.

Conclusion

Choosing the right auto finance provider can make all the difference in how smoothly your vehicle purchase goes. London is home to many reputable lenders, each with its own strengths. Whether you’re looking for a tech-savvy platform, a lender that specialises in bad credit, or a bank with personal loan options, the companies listed above represent the best auto finance companies in London.

FAQs About Best Auto Finance Companies in London

Can I still get car finance in London if I have poor credit?

Yes, several lenders like Moneybarn and First Response Finance specialise in financing for customers with low or bad credit scores.

What’s the typical loan term for car finance in the UK?

Most auto finance terms range from 24 to 60 months, although some companies offer shorter or longer terms depending on your preferences and eligibility.

Do car finance companies require a deposit?

Not always. Many lenders now offer zero-deposit car finance options, especially through online brokers like Zuto and CarFinance 247.

Can I pay off my car loan early?

Yes, but some lenders may charge an early settlement fee. Always read the terms before committing.

Is it better to get car finance from a bank or a specialist lender?

Banks often offer lower rates for those with good credit, while specialist lenders are more flexible for individuals with varied financial situations.

Are online car finance applications safe?

Yes, as long as you’re applying through FCA-regulated platforms with secure encryption, online applications are safe and efficient.

Can I refinance my existing car loan?

Yes, some providers offer refinancing options to help lower your interest rate or extend your loan term for smaller monthly payments.