In a global financial hub like London, the demand for efficient, affordable, and secure money transfer services continues to grow. Whether it’s individuals supporting family abroad, freelancers working with international clients, or businesses handling global transactions, the right money transfer company can make a significant difference.

With so many providers operating in the city, choosing the best option can feel overwhelming. This guide explores what makes a transfer service reliable and cost-effective, and highlights the top 10 rated money transfer companies currently operating in London.

Which Money Transfer Services in London Are the Most Trusted?

Trust remains the cornerstone of any financial transaction especially when it involves sending money overseas. In London, reputable money transfer companies are those authorised and regulated by the Financial Conduct Authority (FCA). Regulation ensures customer protection and sets standards for transparency and anti-fraud measures.

A trusted provider typically offers clear terms, visible fee structures, and secure platforms. Many of London’s leading companies also invest in modern encryption technologies and fraud prevention systems, giving users confidence when transferring funds internationally.

Customer reviews on platforms like Trustpilot or Google Business often reflect the reliability of these services, making them a useful tool for gauging a company’s reputation.

Who Offers the Fastest International Transfers from London?

In a fast-paced city like London, time is money quite literally when it comes to sending funds abroad. The speed of a transfer can vary based on factors like destination country, currency, and method of delivery. Digital-first companies have revolutionised this aspect of the industry by enabling near-instant transfers in many cases.

Londoners can now send money across continents in a matter of minutes using app-based services. These platforms often connect directly to local banks or mobile wallets in the receiving countries, allowing the process to bypass traditional banking delays. For users who prioritise speed, choosing a provider known for efficient processing times is essential.

Looking for the Cheapest Transfer Fees in the UK Capital?

Cost is often the deciding factor when selecting a money transfer service. In London, options range from high street providers with legacy overhead costs to lean digital platforms offering near-zero fees.

However, lower fees don’t always mean better value. Some companies advertise zero fees but include hidden charges in the exchange rate.

Understanding the full cost of a transfer means looking beyond upfront charges. Digital money transfer companies typically offer more competitive pricing by eliminating physical locations and streamlining operations.

While legacy providers still have a strong presence, cost-conscious users increasingly turn to online services that offer transparent pricing and real-time quotes.

Which Providers Give You the Best Currency Exchange Rates?

When sending money abroad, the exchange rate has a direct impact on how much the recipient receives. In London, many consumers are now aware that small fluctuations in currency conversion can significantly affect their transfer value. That’s why comparing providers on the basis of exchange rate not just transfer fee is essential.

Some platforms offer real mid-market rates, while others add a margin that can be difficult to detect unless you’re paying close attention. The best services let you lock in rates, track fluctuations, or even receive alerts when favourable rates are available.

London-based users who frequently send money abroad are encouraged to select companies that offer clear and fair currency conversions.

What Are the Top 10 Money Transfer Companies in London?

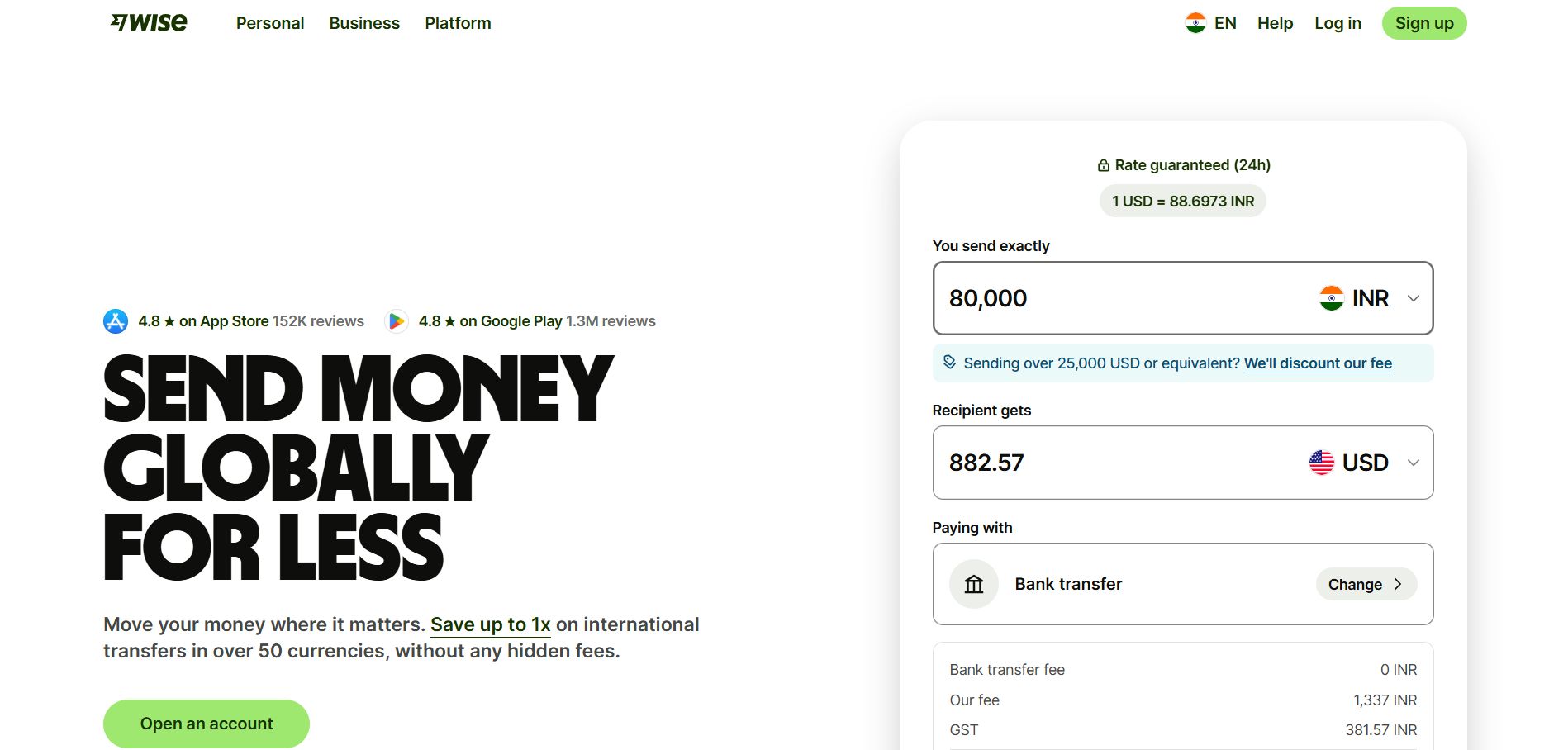

1. Wise – “Money without borders”

Wise, previously known as TransferWise, offers an honest and transparent approach to international money transfers. The company uses real mid-market exchange rates without hidden markups, making it one of the most cost-effective platforms available.

Wise supports over 50 currencies and enables transfers directly into local bank accounts around the world. Users can also hold, manage, and convert multiple currencies in their multi-currency account.

With fast processing times and low fees ranging from 0.35% to 1%, it’s ideal for frequent senders and businesses. The mobile app enhances accessibility, allowing easy money management on the go. FCA regulation and advanced encryption guarantee a high level of trust and security.

Core Feature

Real-time currency conversion with no exchange rate markups.

Perfect Match

A go-to solution for freelancers and international business users.

Pricing: Low fees, typically between 0.35%–1% per transfer.

- Website: wise.com

- Phone: +44 203 695 0990

- Address: 6th Floor, Tea Building, 56 Shoreditch High St, London E1 6JJ

- Email: support@wise.com

Review: ★★★★★ “Fast, fair, and easy to use. I saved hundreds compared to my bank.”

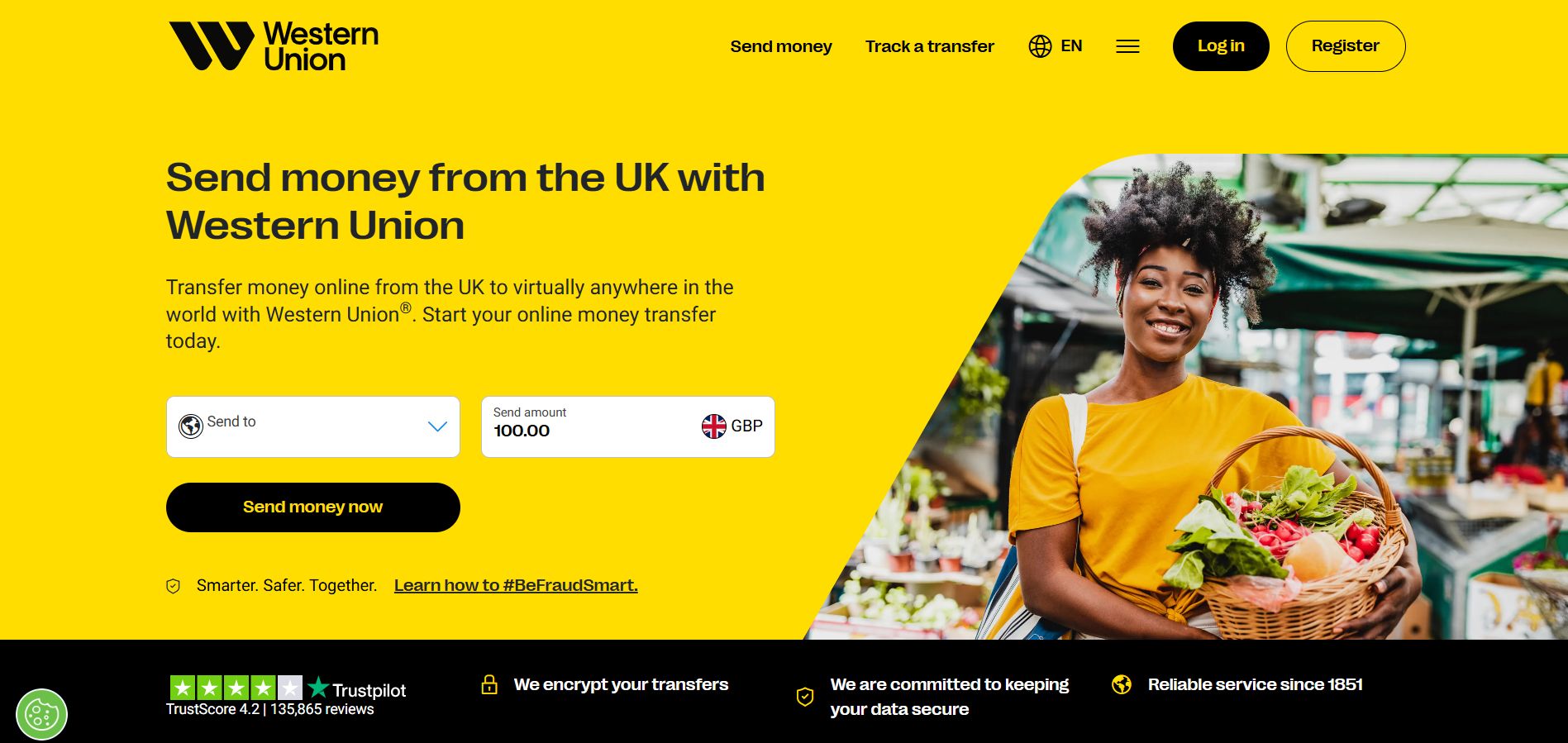

2. Western Union – “Moving money for better”

Western Union has been moving money around the world for over 170 years, making it one of the most trusted names in the business. In London, it boasts dozens of branches and agent locations, providing quick access to both send and receive cash transfers.

The platform supports over 200 countries, and funds can be sent to bank accounts, mobile wallets, or for in-person pickup. Western Union is especially useful for emergency transfers and cash delivery in remote areas.

Its online and app services offer additional flexibility, though fees can be higher than newer fintech alternatives. It’s regulated by the FCA and remains a popular choice for legacy reliability.

Key Strength

Unmatched reach with thousands of global cash pickup locations.

Best Fit

Ideal for urgent, last-minute, or rural destination transfers.

Pricing: Starts around £4.90; varies based on delivery method and location.

- Website: westernunion.com

- Phone: +44 20 7031 6000

- Address: 1st Floor, 200 Hammersmith Rd, London W6 7DL

- Email: uk.customer@westernunion.com

Review: ★★★★☆ “Convenient and everywhere. A bit pricey but reliable in a pinch.”

3. Revolut – “Your money, your way”

Revolut is a digital-first finance app that offers far more than just money transfers. It allows users to send money abroad at near-interbank rates with no hidden costs. The app supports over 30 currencies and features additional tools like budgeting, crypto trading, and even stock investing.

With real-time rate updates and spending analytics, it’s a modern banking solution for the tech-savvy generation. Transfers within the Revolut ecosystem are often instant, and even international transfers are completed within hours or a day.

Revolut is fully regulated in the UK and offers various membership plans, including free and premium tiers. It’s a top choice for digital natives and travellers.

Unique Element

All-in-one mobile banking app with low-cost currency transfers.

Target Audience

Perfect for travellers and mobile-first users.

Pricing: Free standard account; premium starts at £6.99/month.

- Website: revolut.com

- Phone: In-app support only

- Address: 7 Westferry Circus, Canary Wharf, London E14 4HD

- Email: support@revolut.com

Review: ★★★★☆ “Slick app, great rates. Perfect for travel and everyday use.”

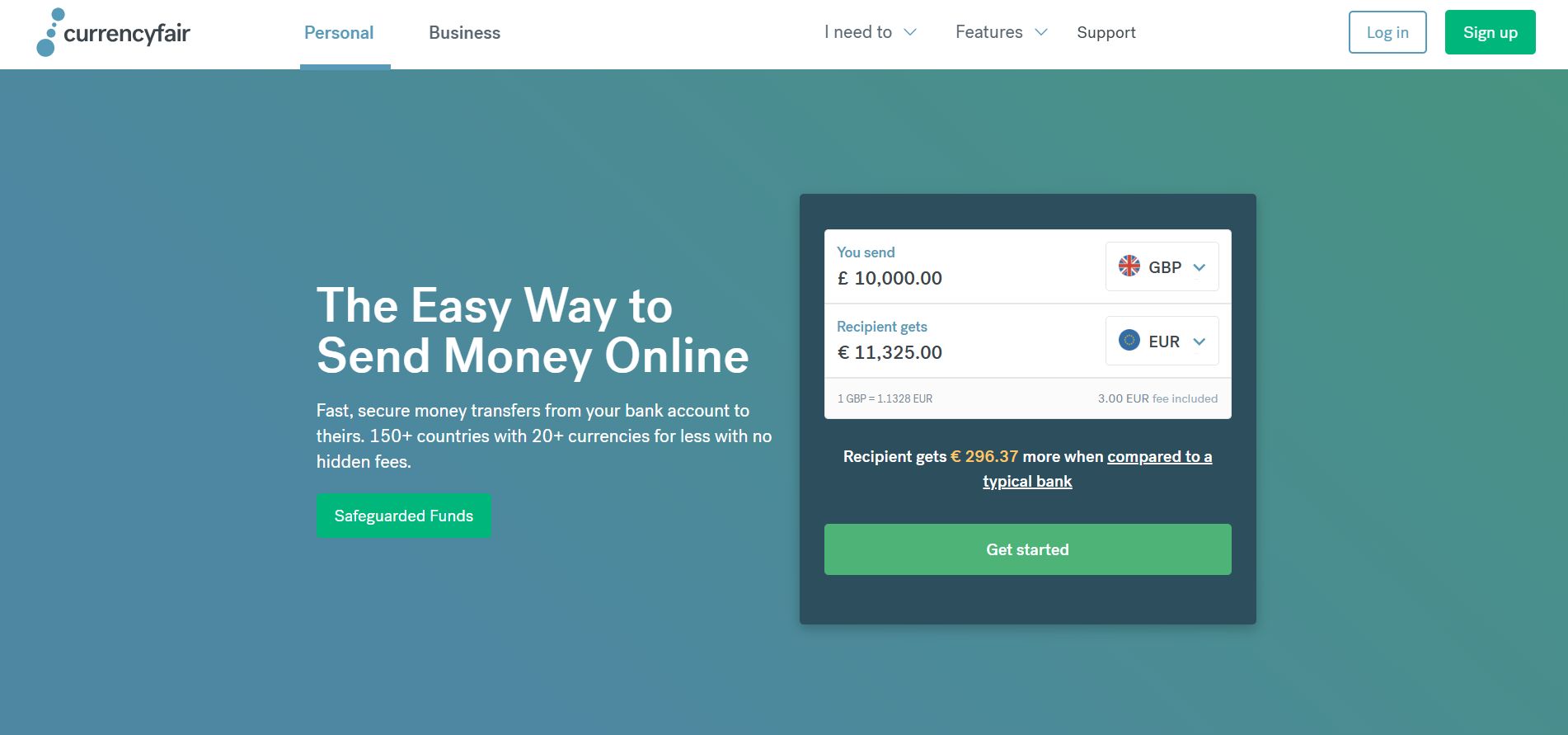

4. CurrencyFair – “Fairer exchange, smarter transfers”

CurrencyFair is unique for its peer-to-peer model, allowing users to exchange currency directly with others at mutually agreed rates. This can result in much better value compared to traditional banking services.

The platform supports transfers to more than 20 countries and is particularly useful for large transactions like property purchases or international payrolls.

Users can set their own exchange rate or opt for immediate transfers using CurrencyFair’s marketplace. The interface is simple, secure, and FCA-approved, making it a safe option for cost-conscious senders. The flat fee and low margin mean predictable and transparent pricing. It’s especially suited to expats and business users.

Signature Offer

Peer-matching for highly competitive exchange rates.

Best-Suited Users

Optimised for large personal and business transfers.

Pricing: €3 flat fee plus 0.45%–0.6% exchange rate margin.

- Website: currencyfair.com

- Phone: +44 20 3637 1300

- Address: 1 Fore Street Ave, London EC2Y 9DT

- Email: support@currencyfair.com

Review: ★★★★☆ “Saved a lot on my property payment abroad. Great support too.”

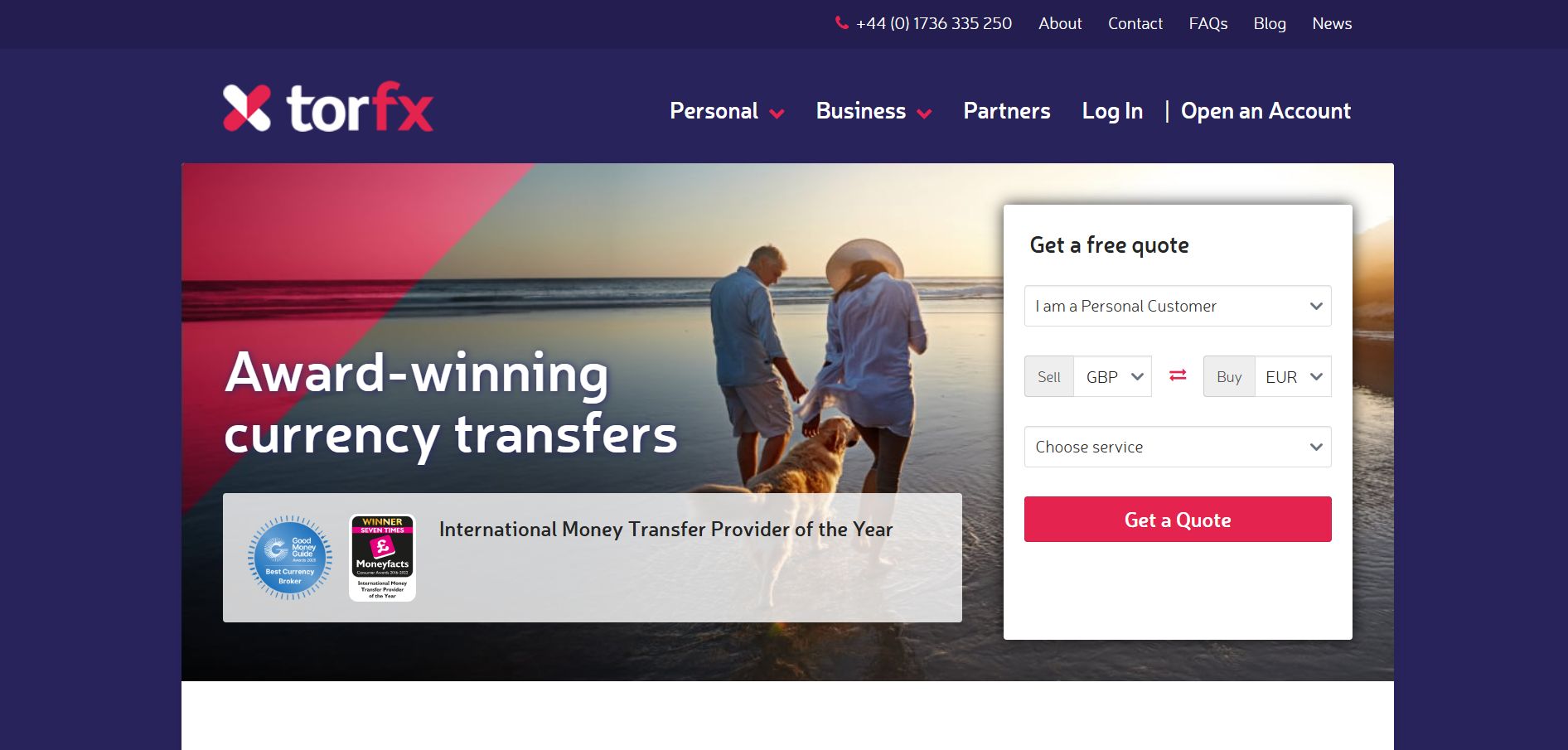

5. TorFX – “Personal service, powerful rates”

TorFX focuses on high-value transfers and offers personalised services through dedicated account managers. Whether you’re buying overseas property or making regular pension transfers, TorFX provides competitive exchange rates with zero transfer fees.

The company handles both personal and business transfers, with guidance and assistance throughout the process. While there’s no option for cash pickup or mobile wallets, it excels in secure bank-to-bank transactions.

Clients benefit from tailored insights and real-time market updates to make informed decisions. Regulated by the FCA, TorFX is widely praised for its hands-on customer support and value-added approach.

Service Highlight

Dedicated personal advisors for complex currency transactions.

Most Effective For

Tailored for expats and clients with large transfer needs.

Pricing: No fees; margin-based pricing with strong exchange rates.

- Website: torfx.com

- Phone: +44 1736 335250

- Address: 3rd Floor, 68 King William St, London EC4N 7DZ

- Email: info@torfx.com

Review: ★★★★★ “My account manager made everything smooth. Great rates and no stress.”

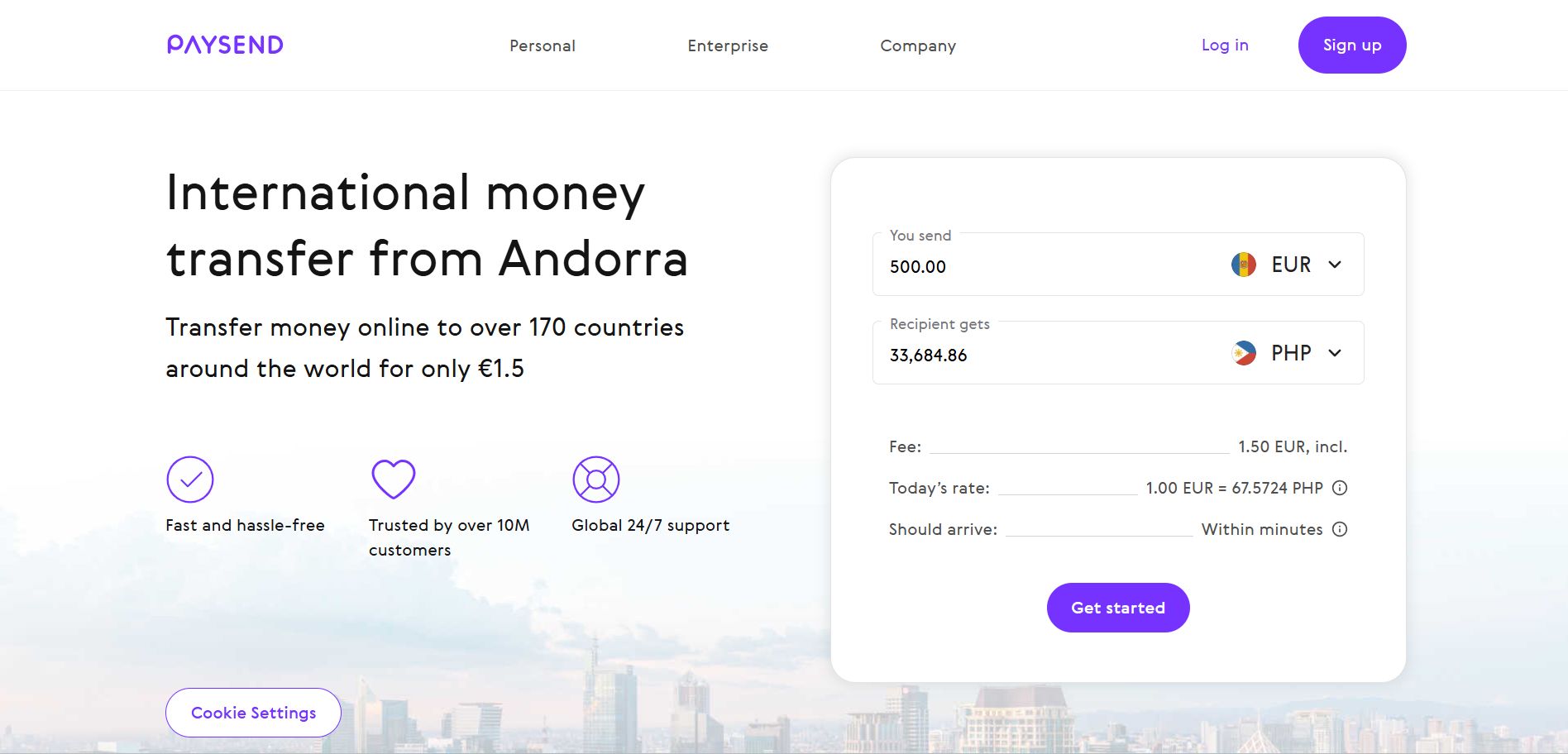

6. Paysend – “Global transfers made simple

Paysend is a modern UK-based money transfer platform that simplifies how users send money across borders. With support for over 170 countries and 40+ currencies, the service enables users to transfer funds directly to bank accounts, cards, or mobile wallets. One of its standout features is card-to-card transfers, where recipients only need a card number or phone number to receive money.

The mobile app is intuitive, making it easy for first-time users and regular senders alike. FCA-regulated and protected by bank-grade encryption, Paysend provides peace of mind for its growing global user base. Its fixed low transfer fee and real exchange rate policy ensure predictability and affordability. Available 24/7, Paysend is rapidly becoming a preferred option for both personal and small-scale business transactions.

Top Functionality

Seamless global card transfers powered by a simple mobile interface.

Best Choice For

Cost-conscious users who need easy, on-the-go transfer solutions.

Pricing: Fixed fee of £1 per transfer; competitive FX rates.

- Website: paysend.com

- Phone: +44 800 051 7305

- Address: 1 Angel Court, London EC2R 7HJ

- Email: help@paysend.com

Review: ★★★★☆ “Super easy to use and cheap. Sending money to my family abroad has never been simpler.”

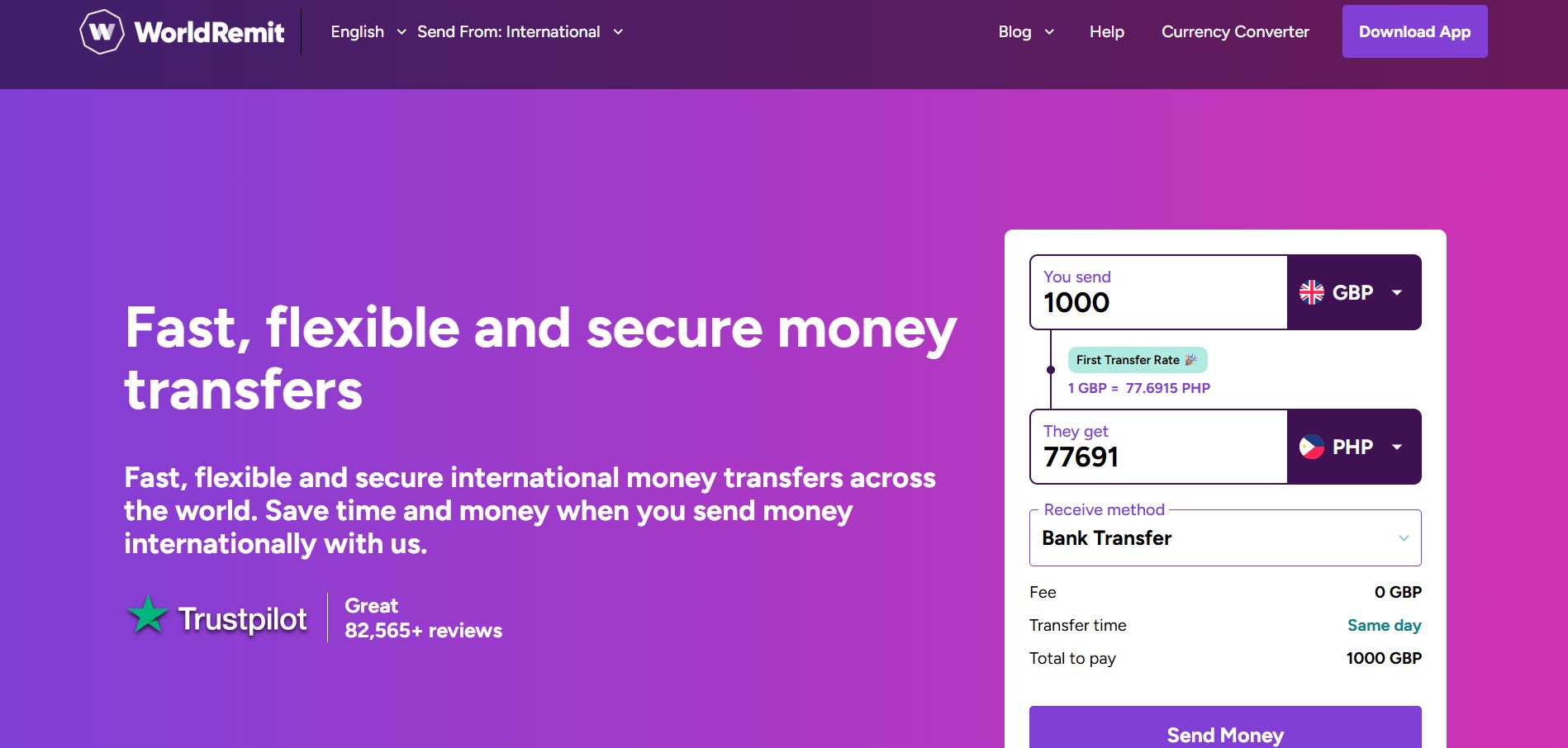

7. WorldRemit – “Send money with a smile”

WorldRemit is a digital-first platform that provides fast, affordable transfers to more than 130 countries. It supports various payout methods like bank transfers, mobile wallets, and even airtime top-ups. Particularly popular among African and Asian diasporas in London, the app offers real-time updates and a user-friendly interface.

Transactions are often completed within minutes depending on the delivery option selected. WorldRemit is FCA-regulated and employs advanced security technologies to protect users. The platform is designed for convenience and transparency, with upfront pricing and no surprise fees. It’s a reliable choice for recurring international remittances.

Core Function

Streamlined digital transfers with wide payout coverage.

Great For

Highly suited to tech-savvy remittance senders.

Pricing: Low, transparent fees that vary by destination.

- Website: worldremit.com

- Phone: +44 20 7148 5800

- Address: 62 Buckingham Gate, London SW1E 6AJ

- Email: customerservice@worldremit.com

Review: ★★★★☆ “I send money to Ghana weekly. It’s fast and always arrives on time.”

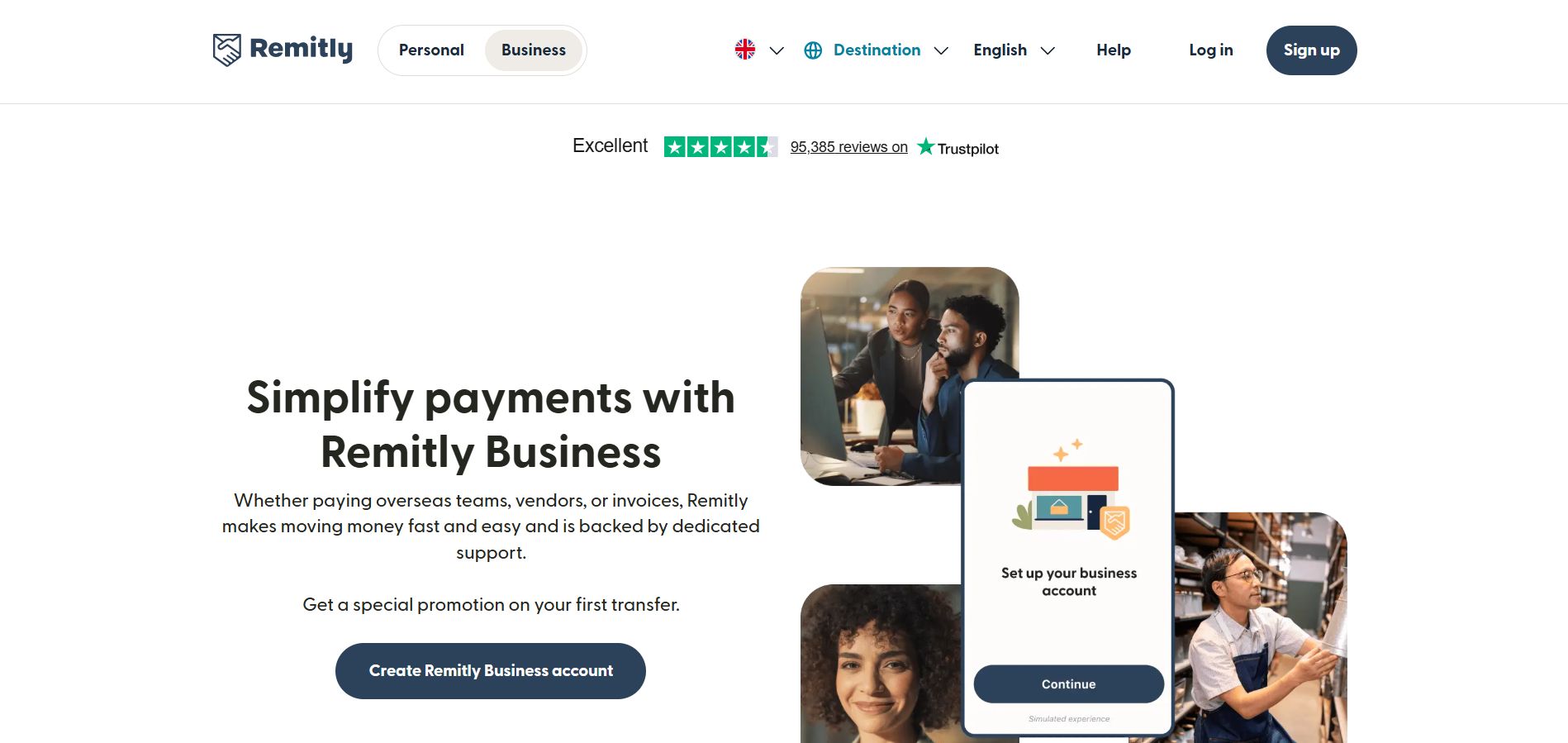

8. Remitly – “Send money with love”

Remitly is known for its focus on family remittances, providing fast and flexible international transfer services. The platform offers two options: Economy for low-cost delivery, and Express for faster processing at a slightly higher fee.

Transfers can be directed to bank accounts, cash pickup locations, or mobile wallets across 100+ countries. The app is simple to use and includes tracking features for peace of mind.

With strong support and reliable service, Remitly has become a favourite among Londoners sending money back home regularly. It’s FCA-approved and uses multi-layered security.

Standout Quality

Speed-tiered delivery to balance urgency and affordability.

Most Appropriate For

Built for families sending remittances consistently.

Pricing: Starts at £2.99; varies by speed and country.

- Website: remitly.com

- Phone: +44 20 3695 9380

- Address: 1 Poultry, London EC2R 8EJ

- Email: service@remitly.com

Review: ★★★★☆ “Express delivery is a lifesaver. My family gets the money in minutes.”

9. Azimo – “Smarter money transfers”

Azimo provides a smart, low-cost way to send money to over 200 countries from London. The service is entirely online and offers a clean app interface. Transfers can be sent to banks, mobile wallets, or picked up as cash in various global locations. Azimo also supports business payments and bulk transfers, making it suitable for small enterprises.

Its pricing is among the most competitive, and the company boasts high transfer speeds. Security is top-notch with full UK regulation. It’s an ideal platform for budget-conscious individuals and companies that need reliable transfer solutions.

Key Benefit

Multi-method transfers at low cost with fast turnaround.

Most Helpful For

Practical for both personal and small business transactions.

Pricing: Starts at £1; additional margin on exchange rate.

- Website: azimo.com

- Phone: +44 20 3510 4915

- Address: 9th Floor, 107 Cheapside, London EC2V 6DN

- Email: support@azimo.com

Review: ★★★★☆ “Great rates and fast service. I use it for both personal and business transfers.”

10. MoneyGram – “Bringing you closer”

MoneyGram is a global name in the remittance world, offering wide access through both digital channels and physical locations. In London, it has an extensive network of agent locations where cash can be sent or received within minutes. It also provides app-based transfers and mobile wallet support.

The service supports over 200 countries, making it ideal for cash pickups in areas where banking infrastructure is limited. It is regulated, trusted, and widely used by people needing flexible and fast transfer solutions. Though slightly costlier than some fintech options, its reach is unmatched.

Signature Feature

Global reach and fast cash availability for underserved areas.

Ideal Scenario

Best choice for recipients without banking access.

Pricing: Starts around £3.99; varies with destination and payment type.

- Website: moneygram.com

- Phone: +44 800 026 0535

- Address: 1st Floor, 1 Canada Square, London E14 5AB

- Email: uk.support@moneygram.com

Review: ★★★★☆ “Reliable and fast. My relatives in rural areas can always pick up cash easily.”

How Secure Are London’s Money Transfer Options?

Security is non-negotiable when dealing with financial data and cross-border payments. Fortunately, most reputable money transfer companies in London operate under strict UK and EU data protection laws. Those registered with the FCA must meet compliance standards for anti-money laundering (AML), customer due diligence, and fraud prevention.

Top-tier companies also implement features like two-factor authentication, biometric logins, and real-time alerts. For London users, choosing a secure platform means protecting both their money and their personal information.

Are App-Based Money Transfers the Future in London?

The shift to mobile apps and online platforms has been swift and decisive. In a city as digitally integrated as London, the convenience of app-based money transfers is hard to ignore. These apps allow users to send, track, and manage transactions from their phones often with better rates and faster service than traditional channels.

With younger generations preferring digital finance tools, and the post-pandemic era normalising remote transactions, app-based money transfer services are becoming the standard. Features like automatic top-ups, real-time notifications, and mobile wallet integration are now expected by users across the city.

Can You Still Send Money In-Person Across London?

Yes, despite the popularity of digital transfers, physical locations are still in demand across London. Areas with large international communities, such as Croydon, East Ham, or Southall, continue to rely on high street transfer agents. These locations offer services in multiple languages and provide assistance to those who may not be comfortable using digital platforms.

Companies like Western Union, MoneyGram, and Small World maintain an active presence with in-person counters across the capital, offering flexible payment and pickup options for those who prefer a more traditional approach.

What Should You Always Check Before Using a Transfer Service?

Before committing to any money transfer provider, it’s important to review a few key factors. First, ensure the company is regulated by the FCA and has a strong user rating. Then examine the total cost of the transfer, including both the fee and the currency exchange margin.

Also, assess how long the transfer will take and whether customer support is available should anything go wrong. For London residents dealing with international transactions regularly, these checks can prevent unwanted surprises and ensure a smooth experience every time.

Conclusion

The financial landscape of London offers a wide array of money transfer options for residents and businesses alike. From agile digital platforms to reliable high street brands, users can choose services based on what matters most be it speed, cost, convenience, or security.

With the right knowledge and a bit of comparison, anyone can find a provider that fits their specific transfer needs. As technology continues to evolve, so too does the way Londoners send and receive money across borders.

FAQs About Money Transfer Companies in London

Are all money transfer companies in London regulated by the FCA?

No. Always verify a company’s FCA registration online to ensure your transactions are protected by UK regulations.

How long does it typically take to transfer money from the UK to another country?

It can take anywhere from a few minutes to three business days, depending on the company, destination, and payment method.

Can I cancel a transfer once it’s initiated?

In most cases, transfers can only be cancelled before they are processed or collected. Always check the cancellation terms before confirming a transaction.

What is the safest way to send money abroad from London?

The safest methods involve using FCA-regulated companies that offer secure encryption and fraud protection features.

Do digital-only services offer better rates than high street providers?

Generally, yes. They often operate on lower margins and pass savings on to the user through better exchange rates and lower fees.

What’s the difference between money transfer and remittance?

Money transfer is a broad term for sending funds, while remittance typically refers to money sent home by workers to family abroad.

Are there any hidden charges when sending money internationally?

Some companies may advertise zero fees but include charges in their exchange rates. It’s important to compare both fee and rate together.