In a city where your postcode may change faster than your bank balance, your credit score remains one constant that can open or close financial doors. From securing a flat in Zone 1 to qualifying for a business loan in Shoreditch, having a strong credit profile is no longer a luxury. it’s a necessity. But how do you know which credit score company to trust with your most personal financial data?

London is home to some of the UK’s most trusted and forward-thinking credit reference agencies. Whether you’re rebuilding credit, applying for your first mortgage, or just curious where you stand, choosing the right platform makes all the difference.

In this guide, we spotlight the top 10 credit score companies in London breaking down their services, special features, and who they’re best suited for. Quick comparisons, honest reviews, and all the essentials so you can make smarter credit decisions without the guesswork.

What Are Credit Score Companies in London?

Credit score companies are financial service providers that compile, analyse, and deliver reports about the creditworthiness of individuals and businesses. In London a city known as a global financial hub credit scores play a pivotal role in almost every aspect of financial life. From applying for a mortgage in Westminster to securing a business loan in Canary Wharf, your credit score can be the determining factor.

These companies don’t just hand out a number. They help create transparency between lenders and borrowers. By offering a standardised method of assessing credit behaviour, they ensure that both parties can make informed decisions, reducing financial risk and increasing accountability.

Credit Scores and the London Financial Landscape

In a city like London, where the cost of living is high and access to credit is often essential, having an accurate and up-to-date credit score is invaluable. Residents frequently rely on credit to fund everything from travel and home improvements to education and business investments. With so many financial products available, lenders depend on credit score companies to gauge how risky it is to lend to someone.

Whether you’re opening a new mobile phone contract in Shoreditch or applying for a buy-to-let mortgage in Clapham, your credit score is your silent financial résumé.

How Do Credit Score Companies in London Work?

Credit score companies operate by collecting a wide range of financial data related to an individual or business. They then use proprietary algorithms to analyse this data and generate a credit report and a score usually between 300 and 999 in the UK.

Data Sources and Collection Process

The information used to generate a credit report comes from several key sources:

- Banks and Credit Card Issuers: Reports on payment behaviour, credit limits, and balances.

- Utility Providers: Details on whether utility bills are paid on time.

- Public Records: Includes county court judgments (CCJs), bankruptcies, and electoral roll entries.

- Mobile Phone Providers: Monthly contract payments are considered a form of credit.

This data is refreshed regularly sometimes weekly to ensure up-to-date reporting.

Scoring Algorithms and Models

Each credit score company uses a slightly different scoring model. Some focus more heavily on your credit utilisation ratio, while others may emphasise the age of your credit history. This is why your score may differ slightly across agencies like Experian, Equifax, and TransUnion.

Credit scores are typically calculated using the following criteria:

- Payment history (35%)

- Credit utilisation (30%)

- Length of credit history (15%)

- Types of credit in use (10%)

- Recent applications (10%)

Insights for Lenders and Individuals

Credit score companies serve two main clients:

- Lenders: Banks, credit card providers, mortgage lenders, and car finance companies use credit reports to assess the creditworthiness of potential borrowers.

- Consumers: Individuals can access their reports to understand their financial standing, spot potential errors, and take proactive steps to improve their credit scores.

What Should You Look for in a Reliable Credit Score Company?

Choosing the right credit score company can significantly impact your financial planning and decision-making. Here are several key features to consider when evaluating your options.

Reporting Frequency and Data Freshness

Credit scores change over time. A good credit score company provides regular updates, allowing users to track progress and spot discrepancies early. Weekly or real-time updates offer greater accuracy, especially if you’re actively applying for credit.

Report Detail and Transparency

Comprehensive reports will give insights into:

- Account balances and limits

- Payment history

- Hard and soft credit searches

- Public records like CCJs or bankruptcies

- Linked financial accounts (joint credit)

More detailed reports can help users better understand what is influencing their score and what actions they can take to improve it.

Mobile Access and User Experience

Most of the leading companies now offer mobile apps that allow users to check their credit scores on the go. Look for platforms that are easy to navigate, secure, and offer real-time alerts.

Data Privacy and Security

Always confirm that the company follows GDPR (General Data Protection Regulation) and is regulated by the Financial Conduct Authority (FCA). Trusted companies will clearly state how your data is used and offer options to delete or restrict access to your personal information.

Which Are the Top 10 Credit Score Companies in London?

1. Experian – “Know More. Live More.”

Experian is one of the most trusted credit score companies in London and globally recognised as a leader in consumer and business credit data. It offers a wide range of services including detailed credit reports, identity theft protection, and real-time alerts for changes in your credit profile.

Their credit score system ranges from 0 to 999, used widely by banks and lenders across the UK. With its headquarters in London, Experian has invested heavily in user-friendly tools that make understanding your credit status easy. It also provides simulations that allow users to see how financial decisions could impact their credit scores in the future.

Whether you’re planning to apply for a mortgage or a business loan, Experian offers in-depth data to help you plan better. The platform also provides specialised services for businesses, including risk assessments and portfolio management.

Area of Expertise

Comprehensive credit analytics and identity protection

Ideal For

Those looking for an all-in-one credit monitoring and fraud alert system

Pricing: Free basic plan; Premium starts from £14.99/month

- Website: www.experian.co.uk

- Phone: +44 344 481 0800

- Address: 80 Victoria St, London SW1E 5JL, UK

- Email: consumer.helpservice@uk.experian.com

Review: ★★★★★

“Experian’s tools helped me spot fraudulent activity quickly worth every penny for peace of mind.”

2. Equifax – “Powering Better Credit Decisions”

Equifax is a top-tier credit score company based in London, providing credit reporting services for both individuals and businesses. Its detailed reports cover personal information, borrowing history, payment reliability, and public records such as County Court Judgments. The company is known for its accuracy and attention to detail, which makes it highly favoured by lenders.

Equifax is also one of the three major credit reference agencies in the UK and is often used for mortgage and loan evaluations. Their platform provides free basic credit scores, while premium users can access alerts, score tracking tools, and ID protection.

They also support businesses in making better lending and investment decisions with advanced credit risk models. Equifax operates with high standards of data privacy and is FCA-regulated, ensuring consumer protection.

Core Strength

In-depth consumer and business credit profiles

Recommended For

Individuals wanting high-accuracy reports or applying for loans

Pricing: Free basic plan; Premium from £7.95/month

- Website: www.equifax.co.uk

- Phone: 0800 014 2955

- Address: 1 Angel Court, London EC2R 7HJ

- Email: Contact form

Review: ★★★★☆

“Very detailed reports but takes some time to navigate their dashboard.”

3. TransUnion UK – “Smarter Decisions for a Better Tomorrow”

TransUnion UK, formerly Callcredit, is one of the three main credit reference agencies in the UK, with strong operations in London. Known for its robust and technology-driven credit evaluation tools, TransUnion powers several third-party apps like Credit Karma and TotallyMoney. It provides consumer and business credit reports, credit risk models, and fraud detection solutions.

Their data is trusted by lenders, insurers, and landlords across the UK. TransUnion’s platform is built with behavioural analytics to help predict future credit behaviour, which is especially useful in today’s dynamic financial climate.

Users typically access their TransUnion data through partner apps, but the quality of the information remains consistent and comprehensive. It’s a preferred choice for businesses that need advanced scoring models and automation features.

Special Focus

Innovative credit insights using behavioural analytics

Perfect Choice For

Tech-savvy users and app-based credit monitoring

Pricing: Free via partners like Credit Karma and TotallyMoney

- Website: www.transunion.co.uk

- Phone: +44 113 538 0016

- Address: 280 High Holborn, London WC1V 7EE

Review: ★★★★☆

“Accessed via other apps, but the data is always timely and well-presented.”

4. Credit Karma UK – “Your Credit Scores Should Be Free. And Easy to Understand.”

Credit Karma UK is a highly popular platform that offers free credit scores powered by TransUnion. With its head office in London, it’s designed to be simple and accessible to the everyday user. The platform offers weekly credit score updates, alerts, and personalised credit card or loan recommendations based on your score.

One of its standout features is that it’s entirely free with no hidden charges, relying on partnerships with financial providers to generate revenue. Credit Karma also offers financial education resources to help users understand the factors influencing their credit rating.

Its mobile app is highly rated for user experience, making it a practical choice for those who prefer managing finances digitally. The dashboard is clear, straightforward, and beginner-friendly, making it ideal for anyone just starting their credit journey.

Leading Feature

Free access to weekly credit scores with zero hassle

Most Useful For

Everyday consumers who want free credit score tracking

Pricing: Always free

- Website: www.creditkarma.co.uk

- Address: 4th Floor, One New Oxford Street, London WC1A 1NU

Review: ★★★★★

“I love how simple it is to track my score every week for free—no gimmicks!”

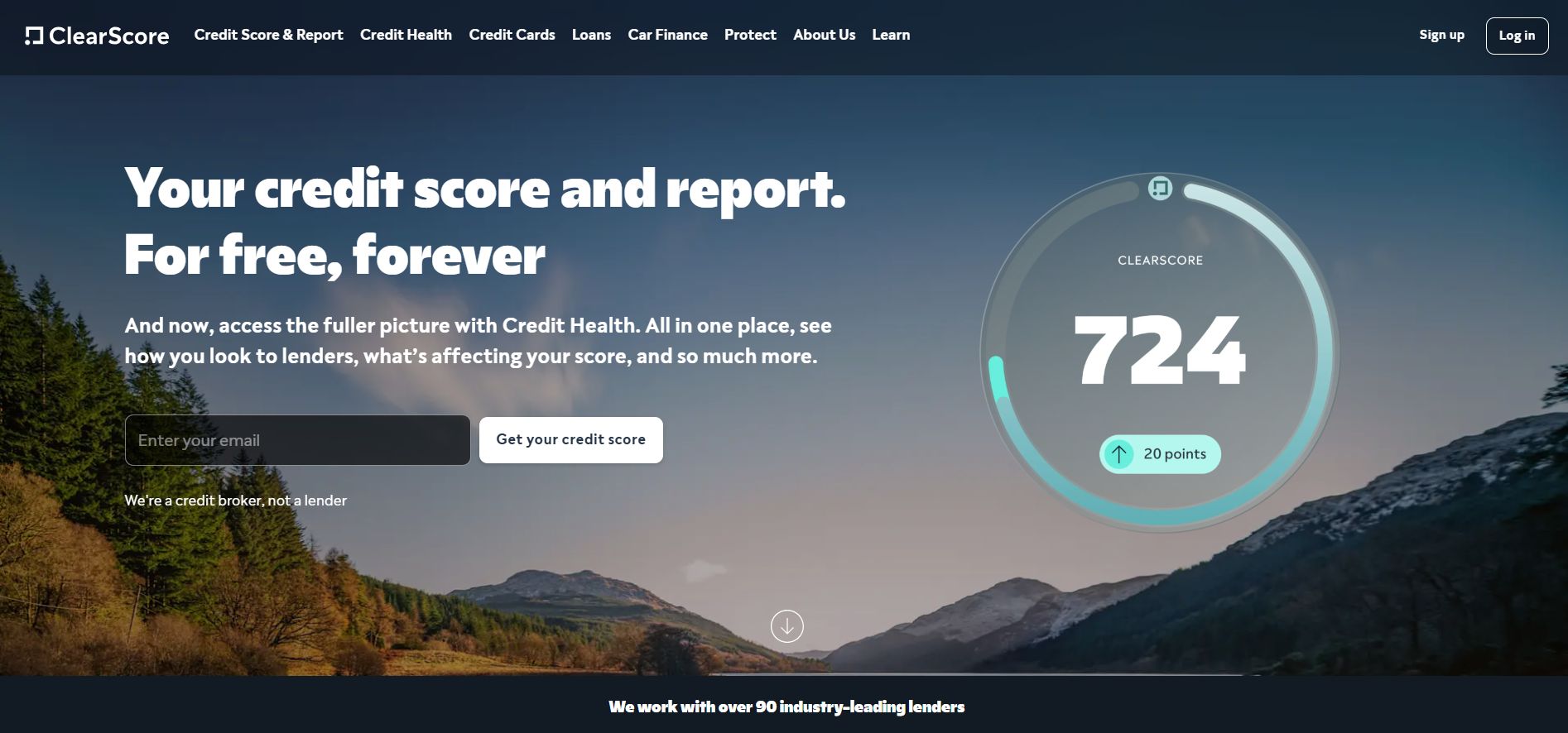

5. ClearScore – “Your Credit Score, Made Clear”

ClearScore is a London-based credit score platform offering Equifax-powered reports and financial insights. It’s well-known for its elegant user interface and clear presentation of credit data. The platform provides free weekly score updates, detailed credit reports, and recommendations for financial products like loans, mortgages, and credit cards.

In addition to standard credit reporting, ClearScore includes credit coaching through its “Learn” feature helping users improve their score over time. They also offer dark web monitoring for added security.

The platform is especially attractive to those new to credit reports thanks to its intuitive dashboard. ClearScore is committed to making credit data more accessible and easier to understand without any associated fees.

Known For

User-friendly credit reports and financial coaching

Most Beneficial For

First-time users looking to understand and improve their credit

Pricing: Free

- Website: www.clearscore.com

- Address: Vox Studios, VG 203 1-45 Durham Street London, SE11 5JH, UK

- Email: query@clearscore.com

Review: ★★★★☆

“The app’s design makes understanding your score so easy—perfect for beginners.”

6. TotallyMoney – “Helping Everyone Move Up the Credit Ladder”

TotallyMoney is a credit platform designed to empower users with free weekly credit reports and a unique “Borrowing Power” score. Using data from TransUnion, the platform provides personalised recommendations and alerts for any changes in your credit profile.

Its affordability score helps consumers gauge how much credit they can reasonably afford, making it one of the most practical tools for real-world financial planning. With a strong focus on responsible borrowing, TotallyMoney is aimed at people who are actively working to improve their financial standing.

Their tools are updated regularly, and users can view their full credit history, monitor applications, and get matched with pre-approved credit products. The website and app both offer excellent user experiences.

Area of Advantage

Real-time affordability scoring and loan matching

Best Fit For

Those actively seeking loans or credit cards

Pricing: Free

- Website: www.totallymoney.com

- Address: white collar factory, 1 Old Street Yard, London EC1Y 2AS

- Email: help@totallymoney.com

Review: ★★★★☆

“It helped me find a credit card I was pre-approved for—super helpful!”

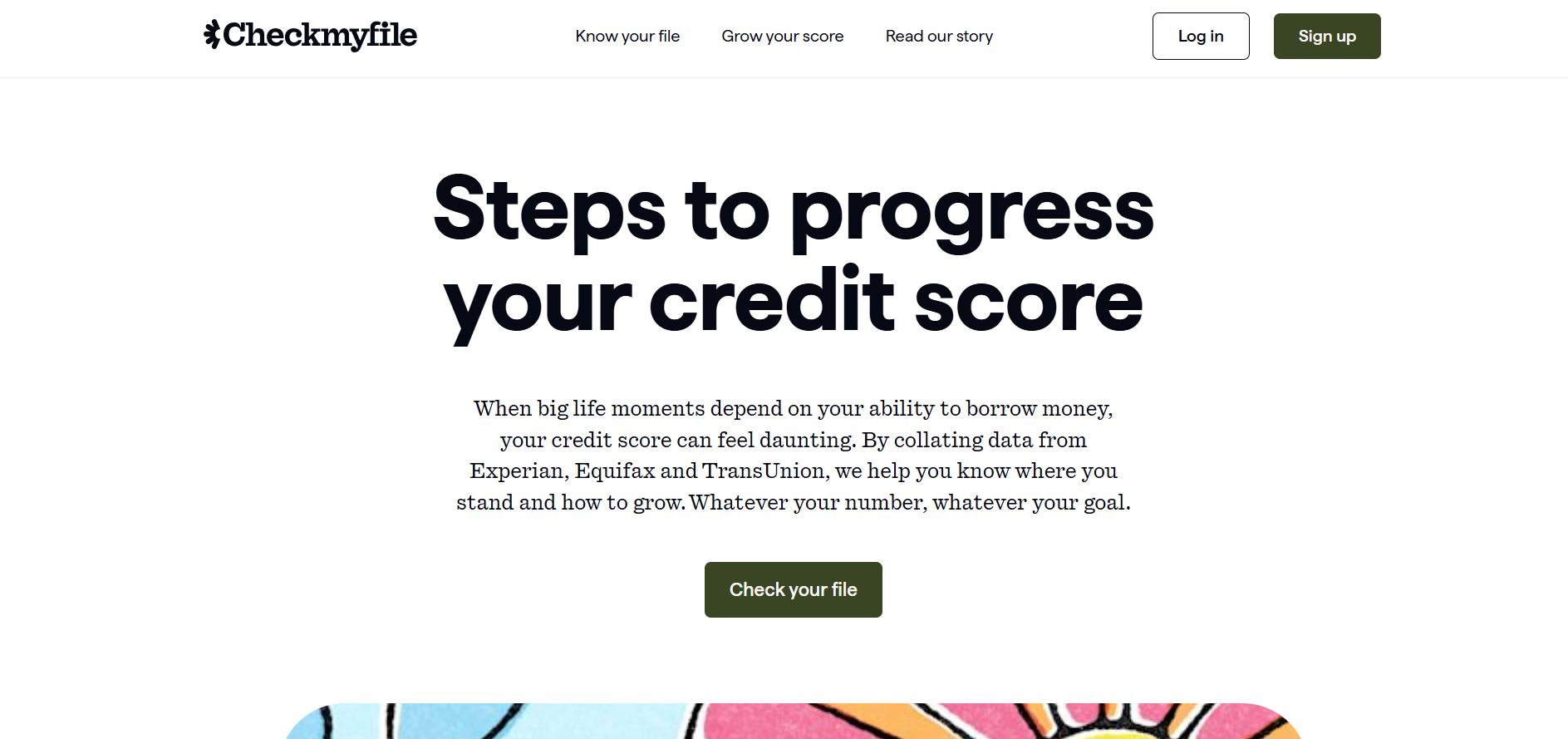

7. Checkmyfile – “The UK’s Most Detailed Credit Report”

Checkmyfile stands apart in the UK credit space by offering multi-agency credit reports combining data from Experian, Equifax, TransUnion, and Crediva. Based near London, it’s the only credit reporting tool that allows users to see a complete picture across all major agencies.

The platform is ideal for people preparing to apply for a mortgage or looking to dispute data inconsistencies. While it’s a paid service after the trial period, many users find the investment worthwhile given its level of detail.

The reports are easy to read, colour-coded, and broken down into manageable sections. In addition to personal credit scores, it provides insights into credit utilisation, account age, and financial associations. Checkmyfile is especially useful for those who want maximum transparency.

Notable Offering

Multi-agency reporting for a full financial snapshot

Most Effective For

Mortgage applicants and those disputing data discrepancies

Pricing: Free 30-day trial, then £14.99/month

- Website: www.checkmyfile.com

- Phone: 01872 304050

- Address: The Credit Reporting Agency Ltd, Ferndown BH22 9AG

- Email: help@checkmyfile.com

Review: ★★★★★

“The most detailed report I’ve ever seen—worth it before applying for a mortgage!”

8. My Credit Monitor – “Stay Alert. Stay Ahead.”

My Credit Monitor is a UK-based credit monitoring service that offers consumers access to their credit report and score, with a strong focus on early warning alerts and fraud protection. While not one of the “big three” agencies, it partners with credit bureaus to deliver accurate and timely updates.

The platform is designed to help users monitor any changes in their financial data that could impact their credit score from new account openings to hard enquiries or missed payments. My Credit Monitor also offers tools for understanding your credit health and tracking how it evolves over time.

With a clear, easy-to-use interface and regular email alerts, it’s well-suited for users who prefer staying one step ahead of identity theft or credit mishaps. Based in the UK and compliant with GDPR, it provides reliable data access for peace of mind.

Distinct Benefit

Proactive alerts and fraud detection tools for everyday users

Tailored To

Users focused on credit monitoring and identity protection

Pricing: Free 14-day trial, then £19.95/month

-

Website: www.mycreditmonitor.co.uk

-

Phone: 0344 381 4163

-

Address: 3rd Floor, 6 Ramillies Street, London, W1F 7TY

-

Email: enquiries@MyCreditMonitor.co.uk

Review: ★★★★☆

“Thanks to their alerts, I caught a suspicious credit check right away—saved me from fraud.”

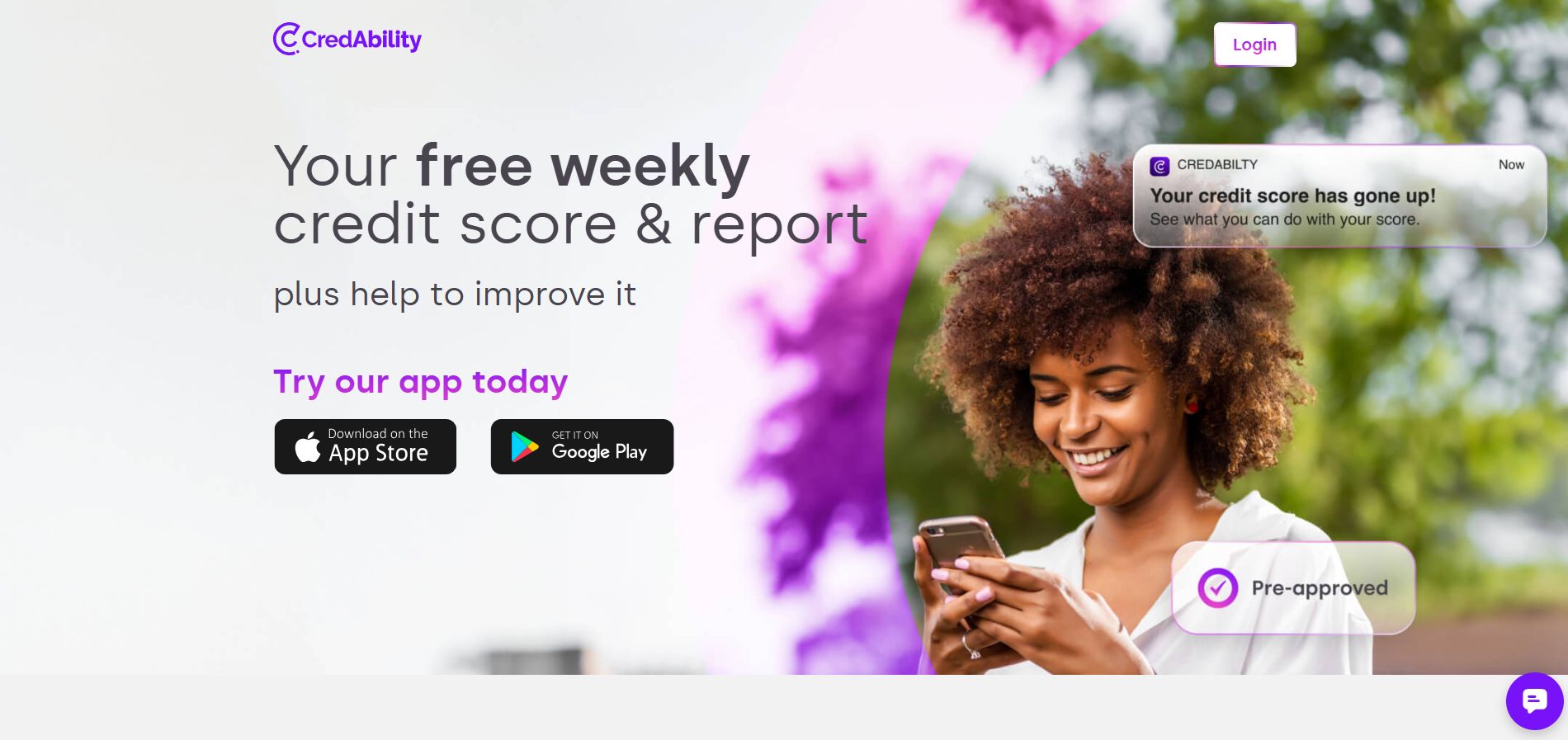

9. CredAbility – “Your Credit. Your Control.”

CredAbility is a user-focused credit score platform based in the UK, offering completely free access to your credit score and report powered by Equifax. What sets CredAbility apart is its commitment to full transparency with no trial periods or hidden charges. Users receive regular updates, financial tips, and personalised credit product recommendations all without needing to upgrade or subscribe.

The dashboard is sleek and beginner-friendly, making it an ideal entry point for those new to credit tracking. CredAbility also provides goal-setting features, allowing users to track their journey towards improving their credit score over time.

The service is FCA regulated and GDPR-compliant, offering peace of mind while helping you stay on top of your credit health. It’s becoming increasingly popular among digital-first consumers who want straightforward, no-strings credit insights.

Standout Feature

Free Equifax-powered credit reports with no upsell

Recommended For

People who want no-hassle, 100% free credit score access

Pricing: Always free

-

Website: www.credability.co.uk

-

Address: White Collar Factory, 1 Old Street Yard, London, EC1Y 2AS

-

Email: hello@credability.co.uk

Review: ★★★★☆

“I didn’t have to enter card details or worry about trials—it’s truly free and super easy to use.”

10. UK Credit Ratings – “Track. Improve. Succeed.”

UK Credit Ratings is a user-focused credit score platform designed to support those who want to monitor and improve their credit over time. It offers regular credit updates, alerts on profile changes, and step-by-step guidance for improving credit scores.

The interface is simple to use and designed with financial education in mind. While the service starts with a free trial, users can access more tools and insights through a monthly subscription.

It’s ideal for consumers who want proactive help rather than just data. The company is based in London and focuses on making credit improvement accessible to all.

Signature Offering

Step-by-step credit improvement guidance

Most Suitable For

People working to repair or build their credit

Pricing: Free 14-day trial, then £19.95/month

- Website: www.ukcreditratings.com

- Phone: 0161 250 7700

- Address: 14 – 16 Caxton Street, London, SW1H 0QY

- Email: info@ukcreditratings.com

Review: ★★★★☆

“The daily tips helped me go from poor to fair in 6 months very motivating!”

What Services Do Credit Reference Agencies Offer Beyond Credit Scores?

Modern credit reference agencies are much more than score calculators. They act as full-scale financial wellness platforms.

Real-Time Credit Monitoring

This feature keeps you updated about any changes in your report. Alerts can notify you of new credit applications, missed payments, or account changes vital in preventing identity theft or fraud.

Financial Education and Score-Building Tips

Some companies, like Credit Karma and ClearScore, provide detailed advice and simulations to help users understand the impact of their financial decisions.

Loan and Card Recommendations

Using your credit profile, these platforms match you with financial products you’re more likely to be approved for improving your chances and reducing hard inquiries.

Dispute Resolution Support

Most providers now help users challenge and correct errors directly through the platform, significantly speeding up the resolution process.

Is It Possible to Get a Free Credit Score in the UK?

Yes, multiple platforms based in London offer completely free access to your credit score and report without hidden fees or trial traps.

Free Credit Providers You Can Trust

- ClearScore (Equifax data)

- Credit Karma UK (TransUnion data)

- TotallyMoney (TransUnion data)

These platforms are entirely free and provide users with unlimited access to their scores, often updating weekly.

Limitations of Free Services

While free credit reports are helpful, they often come with limited historical data and fewer monitoring features. For more comprehensive tools like credit score simulators or identity theft insurance a paid subscription may be necessary.

How Do Credit Reports Impact Business Lending in London?

For entrepreneurs and business owners in London, credit reports are vital. A business’s credit score can influence its ability to secure funding, negotiate better trade terms, and build credibility with suppliers and partners.

Business Credit Profiles

Companies like Experian and TransUnion provide separate business credit profiles that include:

- Payment history to vendors

- Loan obligations

- Business registration data

- Public filings such as tax liens or CCJs

Strategic Impact

A good credit report not only increases access to funding but also helps establish trust with investors, clients, and banks. In competitive markets like central London, this can make or break a startup’s early momentum.

Conclusion

The best credit score company for you depends on your goals:

- For free, user-friendly access: Choose ClearScore or Credit Karma UK.

- For comprehensive, multi-agency reports: Opt for Checkmyfile.

- For business credit evaluations: Consider Experian, Equifax, or Credit Kudos.

- For those concerned with identity theft and fraud protection, a paid subscription with Experian or Equifax might be worth the investment.

Ultimately, the London credit score market is robust and varied making it easy for both consumers and businesses to make informed financial decisions.

FAQs About Credit Score Companies in London

What is the safest way to check your credit score in the UK?

Use platforms regulated by the Financial Conduct Authority, such as Experian or Credit Karma.

Can checking my own credit score harm it?

No. Self-checks are soft searches and do not affect your score.

Are all credit reference agencies regulated?

Yes, reputable credit score companies in the UK are regulated by the FCA and follow GDPR standards.

How often should I monitor my credit score?

Ideally, you should check your credit score at least once a month to catch any discrepancies early.

Do lenders use the same credit score I see?

Not always. Lenders may use different scoring models or a customised version depending on the product.

Is there a perfect credit score in the UK?

While scores vary by agency, a score of 960 or above (out of 999) is generally considered excellent.

How long does negative information stay on my credit report?

Most negative data remains for six years, including missed payments or CCJs.